Airline data in the U.S. always shares some interesting tidbits. Take the DB1B, for instance: A unique dataset that provides great detail to individual itineraries.

Currently, 10% of all tickets sold on U.S. domestic routes are randomly sampled for inclusion in the DB1B database, which is released quarterly (that percentage is set to greatly increase shortly). The Q1 2025 numbers came out this month, and after running through our processes of extracting taxes, cleaning up the non-fare people, etc., we’ve been playing.

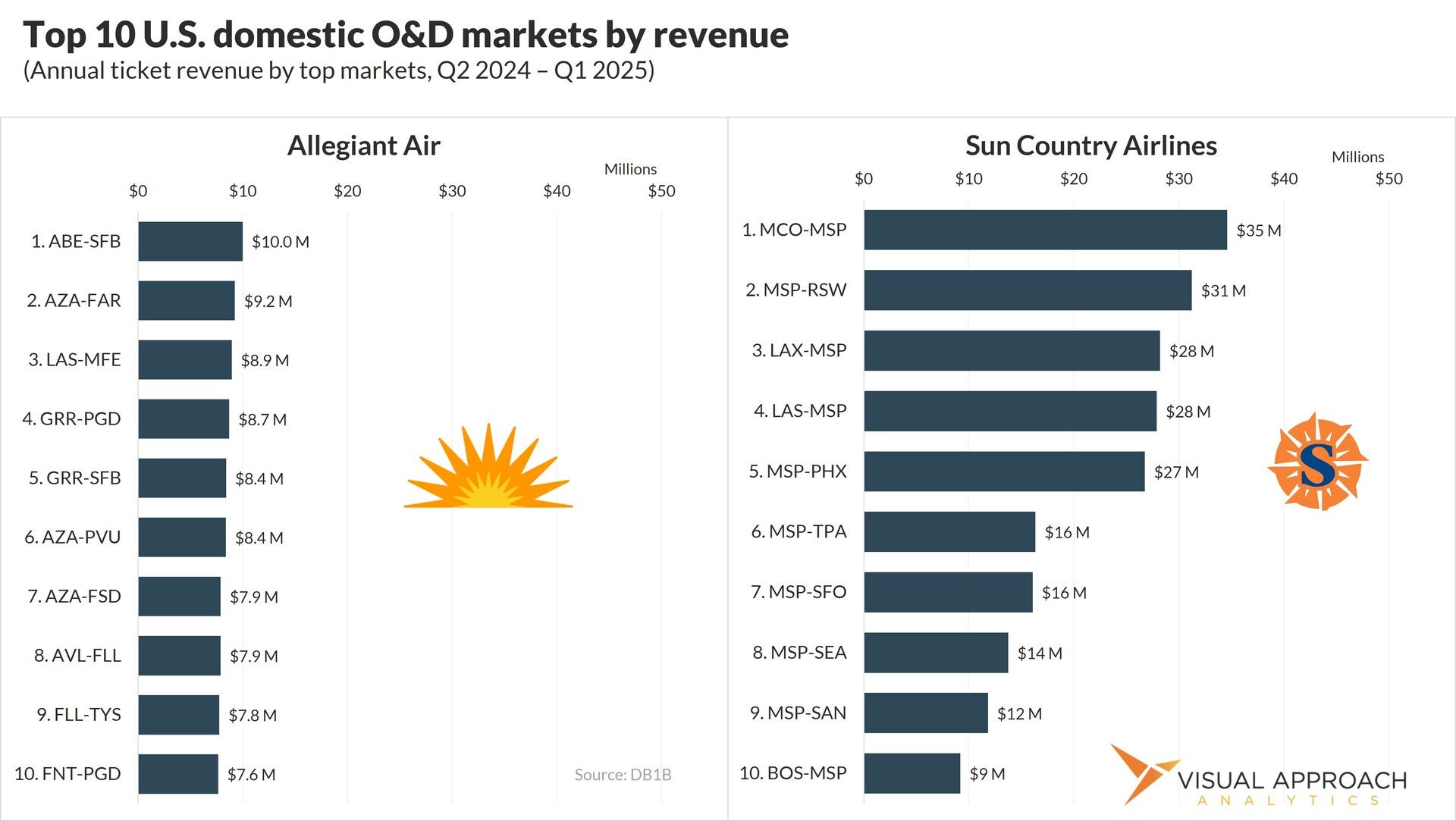

There are a few oddball markets that showed surprising results (BNA-ONT revenues up 89% after New Pacific’s exit?), but we decided to take a step back and look at the top O&D markets for each airline.

It’s a simple look, but we pulled each airline’s top ten O&D markets by ticket revenue over the four quarters. Since this is DB1B, we’re looking at passengers originating and destined on this market route, regardless of whether they are nonstop or connecting. Ticket revenues only, so take your best guess as to the ancillary or loyalty bump-up.

The short answer is, if it’s a legacy airline, it’s probably some version of New York to Los Angeles. The winning by Delta on JFK-LAX is undeniable. United slightly beats top revenue numbers out of EWR, but to SFO - both United fortress hubs.

What interested us more is the markets that pop up earlier than expected. HQ to LGA is very strong, especially considering these are shorter flights to Chicago and Atlanta.

American joins the Delta party in JFK-LAX, but then MIA shows much better than expected. We see the HQ-LGA market perform as well as expected, particularly considering DFW is substantially further from LGA than both ATL and ORD. Notably for AA - no CLT - not even to LAX. Even PHL found itself in the top 10 three times without CLT showing once. Come to think of it, no DEN for UA.

Alaska’s top passenger revenue market has been SEA-PHX. Expected to be in the top 10, but a bit of a surprise at number 1. SEA-SNA at number 5? All of Alaska’s top revenue-producing markets touch SEA except for one. JFK-SFO. Also, no PDX.

As expected, Southwest’s markets are as well distributed as its entire network. I still would not have placed BWI-MCO at the top, let alone the short DEN-PHX at number two or SAN-SMF at three.

JFK is about as expected, though. The results also remind us to never underestimate the SJU market, at least to JFK and MCO.

The Northeast corridor pays dividends for both Frontier and Spirit, showing just how much the two would benefit from becoming one (hypothetically speaking). Still, we would have expected FLL to show better than it did for Spirit. Notable is the old home, DTW. Spirit does well in the Motor City.

PHL and SJU deliver again, this time for Frontier. If any future quiz questions involve the most underrated domestic markets, you’ll know my answer.

Allegiant is a different airline, and they post different results. The only surprise for us on Allegiant’s list is AZA-PVU. Watch PVU. You’ll see it again.

In a complete shocker to nobody, all of Sun Country’s top routes touch MSP. Notable on SY’s chart is the heavy presence of Gulf Coast Florida, and nothing of the Atlantic side. If you drew a line bisecting Florida and continued it north, you’d have a pretty good approximation of who flies where. Northeast travelers love the Atlantic side: PBI, especially. Midwesterners? RSW.

Avelo is interesting to us, even if not very surprising. HVN dominates, but what is notable is not the markets that appear on the list, but those that do not. No west coast routes. That’s particularly interesting since Avelo just announced it would pull out of all west coast flying this fall.

Remember PVU? It’s part of Breeze’s top market, and to SNA no less.

And that’s it. No deep conclusions. Just charts, context, and logos.

Unexpected winners for us on this list are PHL, SJU, DTW, PVU, and SNA… not that you were asking.

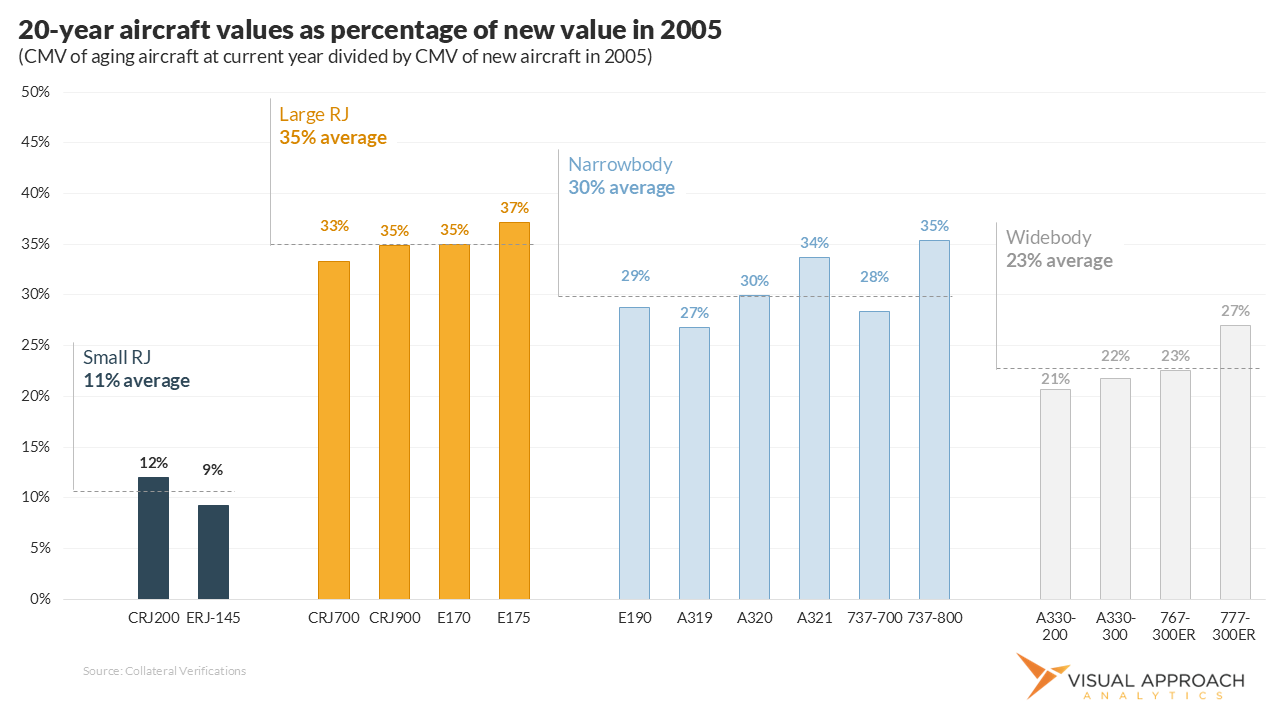

The art of misunderstanding regional jet residual values

This is the story of how the 50-seat jet told the story of all regional jet values – and how it was completely wrong.

Our analysis, published earlier this week, in case you missed it. We focused on how the 50-seat jet market disguised the aircraft segment that best retained its value over the past 20 years. Even more than the narrowbody, the large RJ retains more of its value than any other passenger segment.

You can read the analysis here and download the PDF here: The art of misunderstanding regional jet residual values

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact