After countless requests for an annual letter on what to expect for 2026, I have officially relented.

In the fall of 2021, I delivered a presentation on the anticipated narrowbody shortage. The pushback was what you would expect. My argument was that we were not building sufficient aircraft for the COVID recovery. The pushback was that economies would not continue to grow at the same rate as before the pandemic, so future expectations based on that growth rate were flawed.

It wasn’t necessarily a contentious debate. Visual Approach had existed for barely more than a year, and the claim of a coming shortage in the midst of the most epic oversupply the industry has ever experienced was… bold, to say the least. Seasoned (and actual) economists expected long-term growth to slow, sending a warning to manufacturers that oversupply was a concern.

So, who was right?

We both were - just at different times.

I’m not one to pass up a chance to toot my own horn, but when I look back on 2025, I see a transition from the point I was making to the point they were making. The shift from the tactical to the strategic - from the micro to the macro happened in 2025. If I had to sum 2025 up in one word, it would be “momentum.”

On the economy:

I think 2026 will be a good year for global economies. Now that I’ve laid that out, allow me to contradict myself:

In August 2024, the Sahm Rule signaled an inbound recession. We thought it was a false signal, and we wrote about it: A recessionary head fake. But our take wasn’t novel. Claudia Sahm, the creator of the Sahm Rule herself, thought the Sahm Rule was giving a false signal and that the U.S. was already in a recession.

Sixteen months later, we can safely say Ms. Sahm was right, and her rule was wrong. But what does a false signal in 2024 have to do with 2025 and 2026?

The question I ask myself from time to time is why the rule broke in summer 2024. At the time, the explanation was that it was reacting to backward-looking data still fluctuating from COVID. Much of that was true. Yet, today, we see many of the same fundamentals the Sahm Rule is meant to measure moving in the wrong direction - while economic growth continues.

The global economy is splitting. Sure, this Sahm Rule is a U.S. economic measure, but it is picking up on an economic shift that aligns with the pushback against my 2021 shortage expectation.

The macro outlook for 2025 and 2026 was (and is) decidedly negative. Global demographics are not great. Geopolitical conflict continues to ramp up. Even though we can identify potential resolutions to existing conflicts, the arrival of new conflicts in unrelated areas is driving an overall trend. That overall trend is one of tension.

Economies are becoming even more K-shaped, extending asset prices higher faster than the majority of people can afford. While the past two decades have been about the emergence of the middle class, the 2020s have been more about its bifurcation.

We have seen this play out indirectly with the challenges of the ULCC model. Premium travel demand is hot, hot, hot, while the low-fare-focused ULCC airlines that thrive on stimulating leisure travel are struggling. There are many reasons for this, and we do not believe the threat is existential to the space, but it all points back to the K-ness of the economies.

National debt-to-GDP ratios are rising at a rate faster than last year, when they were labeled as very concerning. Attention in 2025 has been focused on managing the political messaging of spending, all the while continuing at increasing rates.

In the U.S., poor economic data has switched from signs that policy changes should be considered to signs that the people who publish them should be replaced.

And it all worked. Fascinating!

Don’t confuse this with some political commentary. People do what people will do. The economy is little more than collective confidence in a population. The S&P 500 is at record levels, while the reported consumer confidence is at record lows. Which one is right? We can complain all we want about the economy, but the stock market has become a much better indicator of its trajectory than consumers. Wild.

The answer for 2025 was “momentum.” The force of a growing economy is very strong indeed - strong enough to sustain itself. As it turns out, it is very difficult to turn an economy in either direction.

We think momentum will be enough to continue the good times through 2026.

Which leads us to the next issue. What about consumer sentiment, lagging job and wage growth, slow new housing starts, and other signs of a pending recession?

Welcome to the conflicting signs that are dividing the U.S. Federal Reserve. On one hand, inflation is down, but not down to target levels. GDP is robust (despite some odd post-shutdown accounting). On the other hand, unemployment is starting to show concerns, and the pressure to cut rates is building.

We see this as a battery for continued momentum. If warning signs appear, the economy can continue on its own momentum, boosted by rate cuts for quite some time.

I am not bearish on 2026, but I do expect a slowdown to arrive right on the historic schedule, around 2030. I’ve said as much many times. The question better asked is how deep the downturn may be, and how well aviation is poised to deal with it. As it stands at the midpoint of the decade, signs look decent.

Aviation is well-positioned for whatever downturn may arrive. But consider that with the arrival of 2026 comes a transition. We are now closer to the next expected downturn than we are from 2020. I expect 2026 to be an indicative year on what that downturn may look like. 2025 was about momentum. 2026 will continue.

On narrowbodies

I expect production will continue to increase through the year. The market is dominated by the A321neo and the 737-8, despite six other variants sharing the same space (I’m not counting A220 and E2 in this category). I expect the wave of A321neos to start putting strain on future capacity as the production of seats is converging with the slower economic growth.

We should see the material benefit of the back-end of the GTF situation. Things will only get better during the year, likely to conclude in 2027/early 2028. That represents a fair amount of returning capacity at a time when new production is also increasing. It’s not a problem yet, but one to watch for future years.

But old-tech will continue to reign in 2026, just like it has in 2025. Especially the 737-800, which has proven to be an incredibly valuable aircraft for all the right reasons - chief among those, durability. We expect this to continue through 2026, with the aircraft being appropriately priced for the additional years of utilization it’s proving.

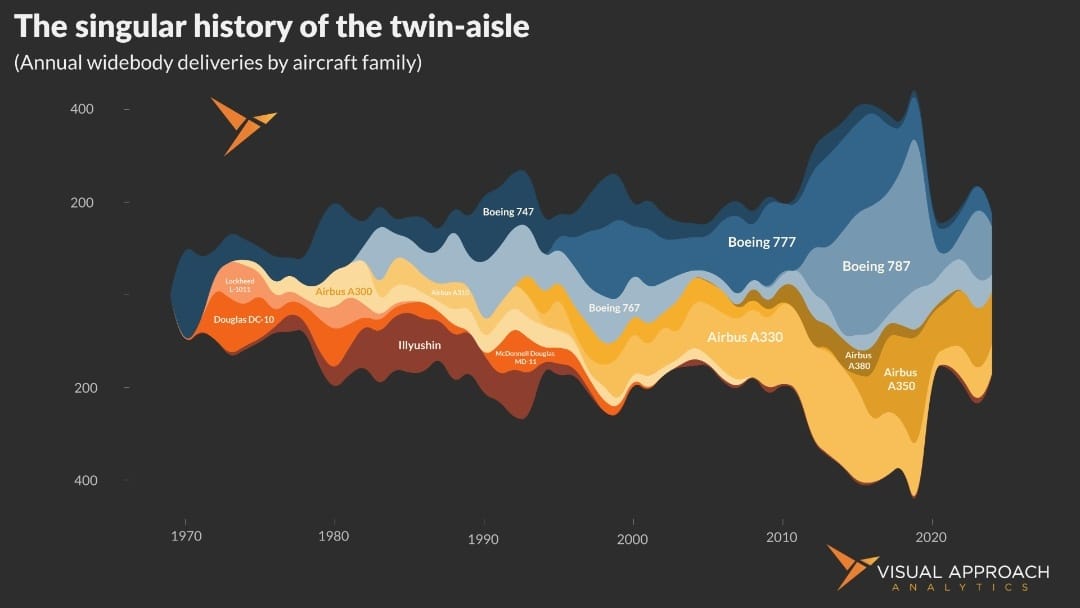

Widebody expectations

We are now in a widebody shortage. 2026 will do little to change that. Production rates can’t increase substantially, meaning the industry largely already has the game pieces. We expect more pressure on widebody freighters, potentially extending the 777F line in lieu of fixing the MD-11 - a solution I really don’t like. I don’t mind the 777F extension, but it is a poor, expensive future solution for a cheap MD-11 problem today. A large gap exists in the low-utilization, high-capacity freighter lift for MD-11 operators with no proposed solution for several years.

On Boeing

Speaking of momentum, Boeing has it. Not that the manufacturer is necessarily killing it, but the starting point was much lower than that of Airbus - 38 vs 57. But 2025 was about Airbus stubbing their toe on deliveries while Boeing increased 737 production. Again, low bar, but the shift is there.

On Airbus

I suspect Airbus will fix many of the production challenges that plagued deliveries in 2025. One of the most interesting aircraft to watch will be the A321XLR, which will begin delivering to the key customers in the U.S. for which it was designed. I suspect the XLR will receive good press through 2026 as it opens new routes across the Atlantic. It won’t be until 2027 that the excitement of new routes will fade to inevitable mediocrity.

On Embraer

Embraer turned the corner in 2025. The E2 has finally sold into the market size it clearly commands. I expect this to continue into 2026, successfully splitting a surprising number of sales between it and the A220. While the two compete against each other directly, I expect the success of both will be dependent upon Embraer's ability to sell the benefits of the small narrowbody space against the allure of the large narrowbody, rather than the OEM’s ability to sell the E2 against the A220. Airbus doesn’t care, especially since it makes more money from the large narrowbody. The larger the market Embrear can split with the A220, the better.

On AI

We couldn’t wrap up a 2026 outlook without talking about AI. There are two spectrums of thought: AI will replace everything we pitiful humans do, or AI will destroy the world. Neither will happen.

2026 will be a year of coming down from the AI hype.

That doesn’t mean an AI bubble popping (see above commentary on momentum), but it does continue a trend that has been strengthening through 2025. There is real AI fatigue. Already, we can reliably detect AI-generated images very quickly - a skill that didn’t even exist in 2023. A shift back to human-generated experience and content is well underway and will be noticeable in 2026. I expect the term “AI Backlash” will become a thing.

Good. This means AI can start getting past its teenage hype and into the mature adulthood of matching expectations with capabilities. Companies will learn how to use AI rather than just rush to use it anywhere. The idea of replacing people with AI will slow sharply, and we will start to see re-hires (in fact, we are already seeing this in the tech space today).

As for us, we’ll continue to use it where it works - and dear lord, can it work well. We will have a great example next week. But 2026 will probably be remembered for slowing AI progress.

Conclusions

Again, I will reiterate the keyword for 2025: momentum. By definition, that continues. Whether it be economic trends, shifts away from low-fare to premium, or production rates. We expect the momentum of 2025 to push us through 2026.

The question for the back half of the decade is what it is pushing us toward.

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact