Behold the Sahm rule.

It’s perfect.

Going back decades, a simple economic rule was able to indicate when the U.S. economy was in recession. Note that we said “indicate,” not “predict.” Indeed, the Sahm rule is not a forward predictor of the economy but rather an indicator of its current state.

The rule is quite simple. When the three-month average unemployment rate nudges 0.5 percentage points above the 12-month low, the Sahm rule triggers.

The Sahm rule just triggered. According to the economic rule that has never been wrong, the U.S. is currently in a recession.

July’s unemployment report reported an unemployment rate of 4.3%, up from 4.1% in June. The Sahm rule recession indicator currently sits at 0.53 - over the trigger point of 0.5 to indicate a recession.

So what? Isn’t this a newsletter for aviation charts?

That it is. But our research doesn’t end at aviation. It continues through to anything that may affect aviation. A recession in the largest aviation, representing 40% of commercial aviation, would matter. Hence, the Sahm rule.

So the U.S. is in a recession, right? Well, no.

The signal that has fired reliably every time the U.S. has been in recession just fired. The Sahm rule never breaks!

The Sahm rule broke.

How do we know? Because Claudia Sahm said so.

A brilliant economist by any standard, Claudia Sahm made a mistake. No, that mistake was not in creating the Sahm rule. Claudia’s Sahm’s mistake (as noted by her on multiple interviews this week) was in giving an economic model her last name.

No model is perfect.

But why did the Sahm rule break in 2024?

The U.S. unemployment rate has ticked up over the past year. It just did so from very, very low levels. As Claudia Sahm said, her model was never made to consider the impacts of a global pandemic that would have such disruption.

Why, then, is the U.S. unemployment number ticking up? This is where things get interesting.

The total number of hires in the U.S. has been declining since 2022. This chart looks terrifying. New jobs are down. But, consider the red line. The red line is the number of separations. It would make sense the two would move in tandem, particularly since a position is most likely to become open by someone vacating it.

Fewer people are quitting. The Great Resignation is over.

It is the gap between the red and blue that matters. How many more people were hired than separated? Still positive. Still growing, even though the lines are pointed down.

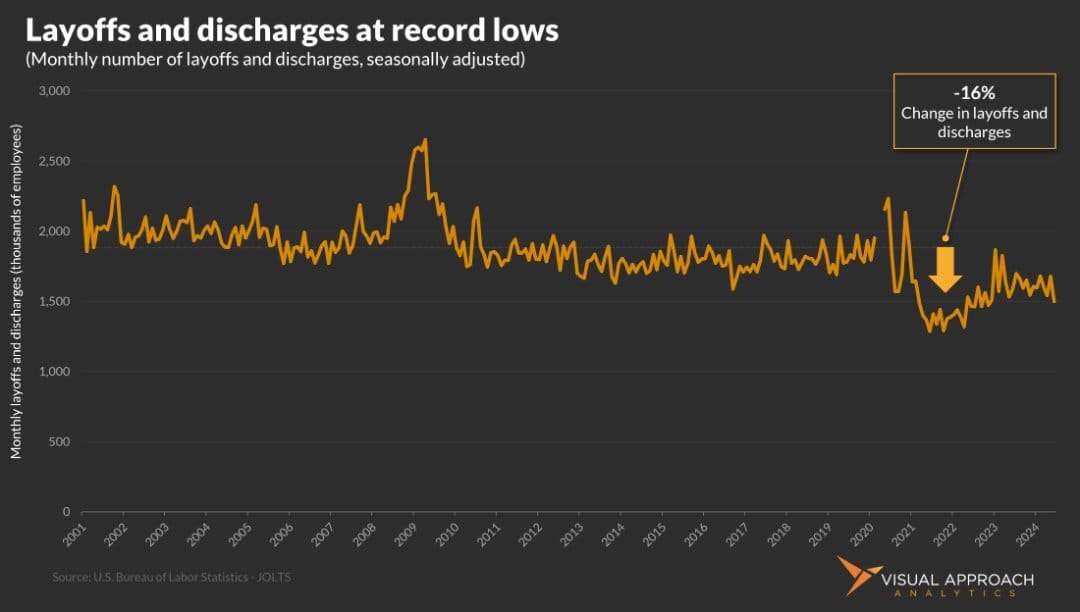

But what about involuntary separations - layoffs, furloughs, etc?

Those are down. Very down. In fact, there has been a step change since the pandemic in the number of layoffs and discharges since the pandemic. Even during the boom times of the 2010s, layoffs are currently 16% lower.

So fewer people are hiring, but its because fewer people are leaving and even fewer are being laid off. Why did the Sahm rule fire?

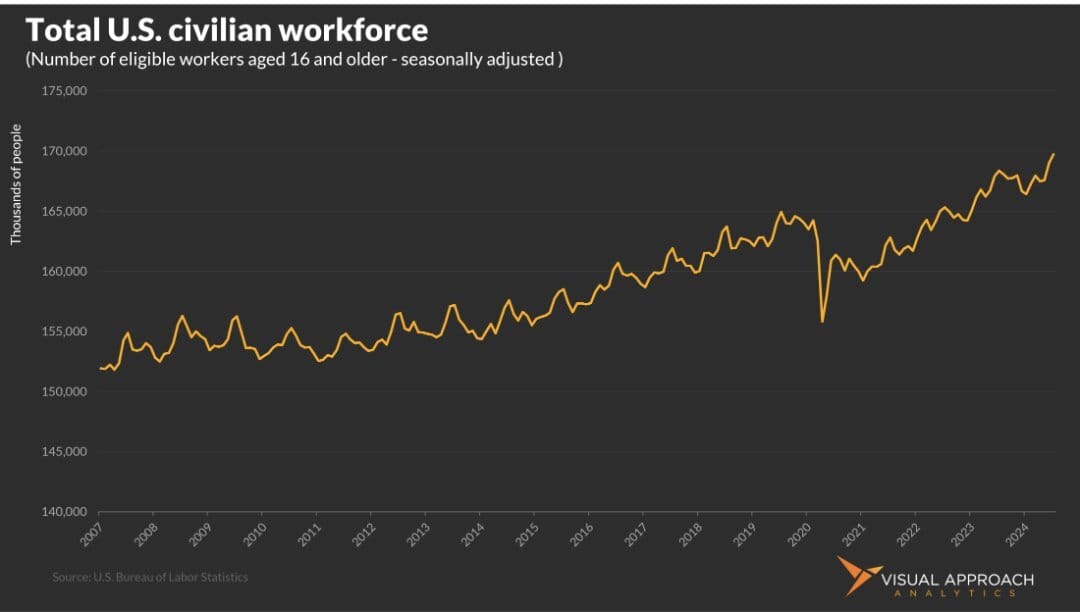

Jobs are being added, but workers are being added faster. Hence, an increase in the unemployment rate while employment continues to increase.

This isn't necessarily a unique event. However, let's consider what it means for the economy that people who have jobs are keeping them while new entrants are arriving faster than job openings.

This gets us to the next topic: how is the workforce population growing? The U.S. does have a bit of a population problem. Not enough babies. But that has long been made up with immigration. Indeed, when we look at the numbers, the domestic-born civilian workforce increased by only 1.5% while the foreign-born workforce increased by 17.3%.

Setting aside the heated political debate of immigration, consider what this means for unemployment. Workers who have jobs are keeping them, yet the overall unemployment rate continues higher. At the same time, nearly all of the workforce growth has come from immigration.

This suggests a very nuanced view of unemployment - and one that showcases the brilliance of Claudia Sahm. The job market - once rock solid in predicting the health of the U.S. economy - is a bit wonky.

For instance, did you notice the drop in civilian workforce after 2020? The great resignation also encompassed the great retirement. A chunk of the workforce retired during COVID. Some have since come back Michael Jordan and Brett Favre-style, but most have not. Growth restarted at those low rates. A labor shortage ensued.

While the triggering of the Sahm rule does not indicate a recession this time (as declared by Claudia Sahm, herself), it does highlight some concerns. Job growth is slowing. In a strange way, this was the goal of the Fed as they raised interest rates to slow inflation (and the economy). Other growth is showing a similarly gradual decline. Inflation still remains above 3%.

But wage growth is still much higher.

In the end, our conclusion is this: Economies are complex. Attempting to apply a single rule to anything will eventually result in it being wrong, no matter how long its been back-tested.

The same applies to the yield curve as a recession predictor. Don't get us started on the yield curve...

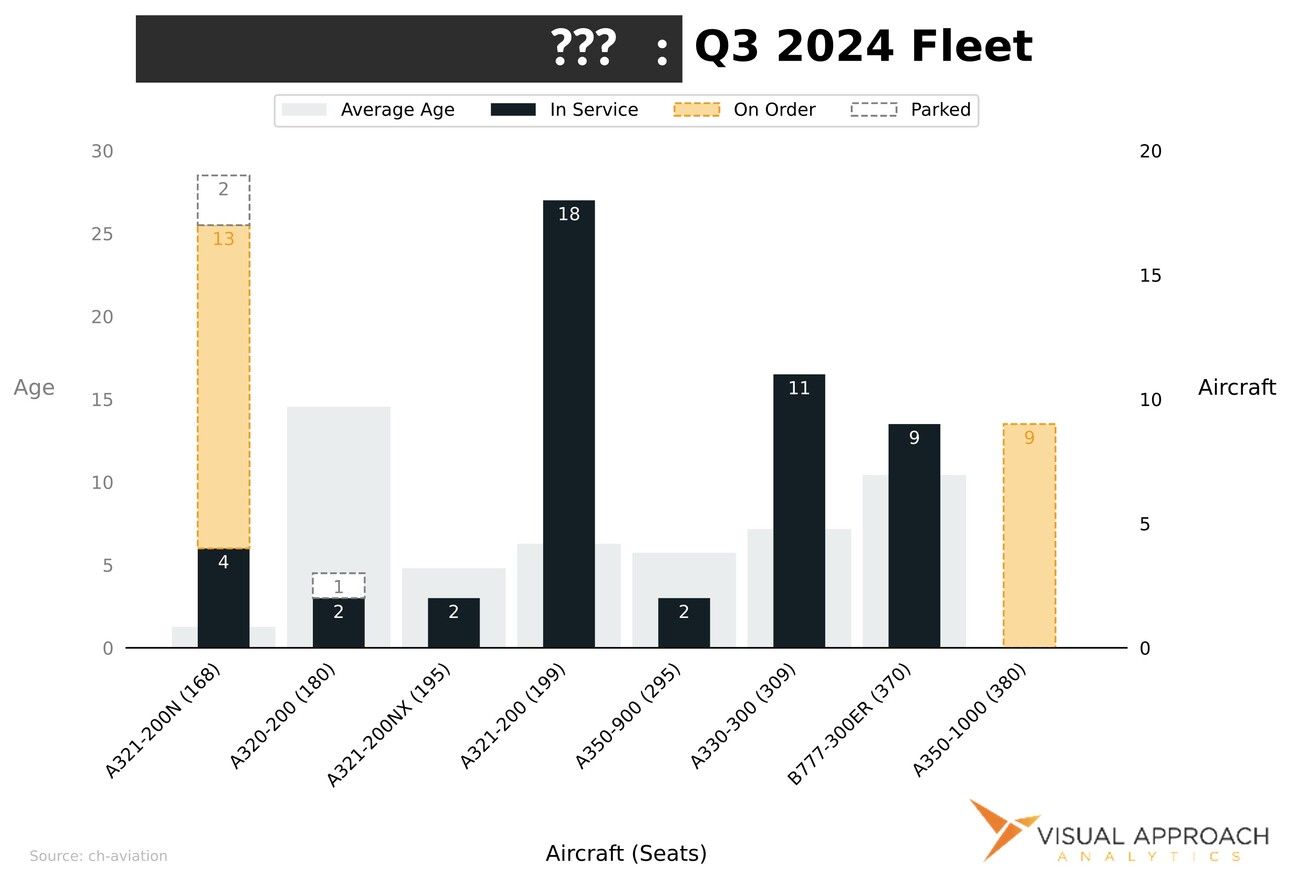

Quiz - Which airline is this?

Remember the website Airliners.net? It's been ages, but I personally found an interesting conversation regarding an airline's fleet management prospects. I spent several hours writing code to compile a bespoke analysis of the airline and its current fleet situation.

It turns out the internet dictators moderators assumed I stole someone else's work and deleted all of it (as well as the two pages of analysis). So, the analysis becomes a newsletter quiz: Which airline was I (trying) to discuss?

You can find the answer here.

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact