Spirit doesn’t need its NEOs.

Sure, the airline could certainly end up with some A320neo and A321neo aircraft, but it doesn’t necessarily need them.

Spirit Airlines entered bankruptcy for the second time in 10 months last Friday, August 29. While little help remained for Spirit to make it through the fall season to the holiday and Spring Break peaks, the lack of cash wasn’t what forced the airline into its second Chapter 11. It was the threat of a lack of cash.

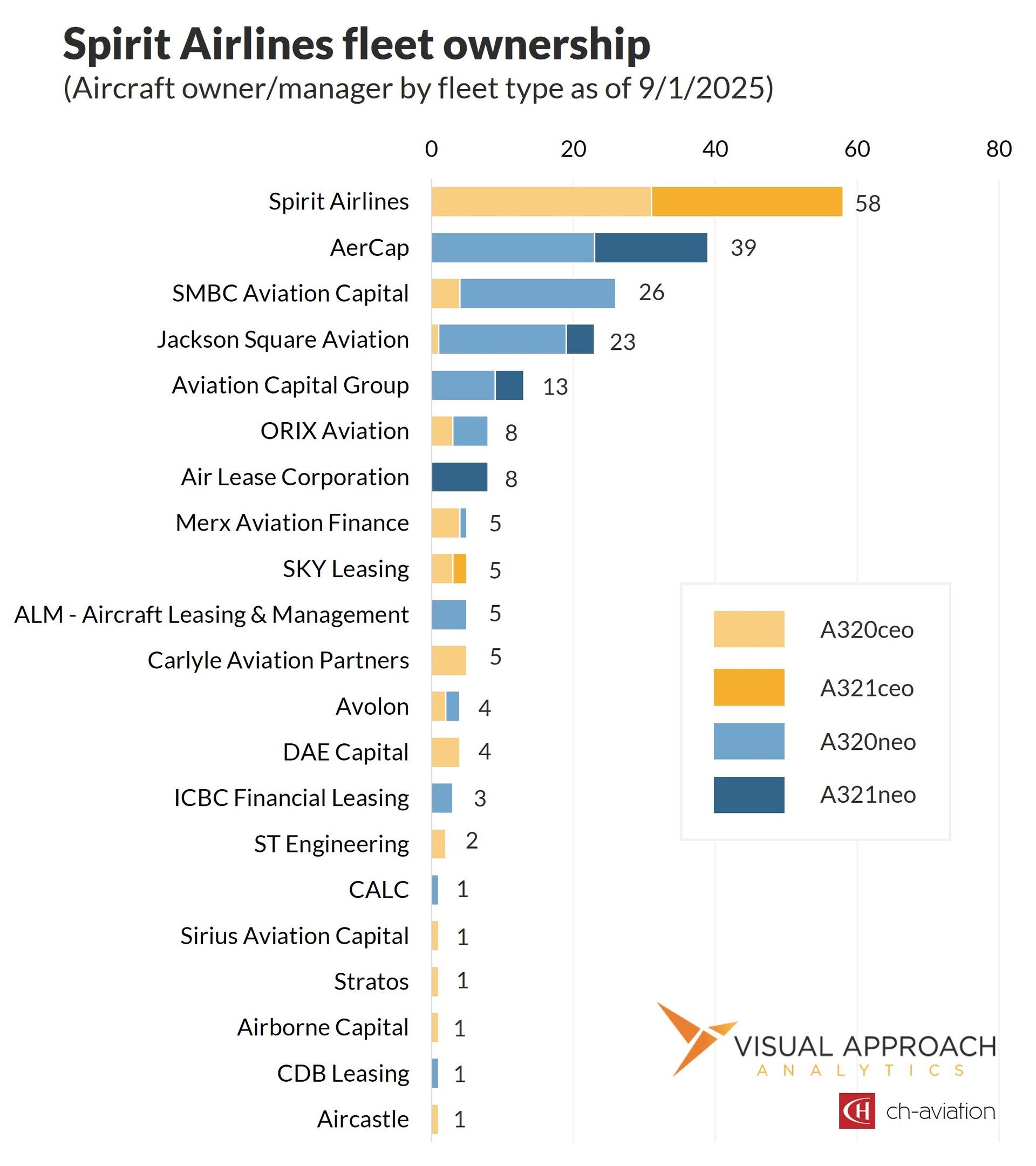

Spirit was quick to point out that AerCap had forced the airline into Chapter 11 by enacting a specific clause within the lease agreement. The world’s largest aircraft lessor terminated agreed-upon leases for 36 yet-to-be delivered aircraft and placed the airline in default on 37 leases for aircraft already in service. All are A320neo or A321neo aircraft.

The specific clause that triggered AerCap’s interpretation of a default?

“The occurrence of any of the following will constitute an Event of Default and material breach of this Lease by LESSEE:… (n) any proceedings, resultions, filings or other steps are instituted or threatened with respect to LESSEE relating to the bankruptcy, liquidation, reorganization or protection from creditors of LESSEE or a substantial part of LESSEE’s property.” - Declaration of Fred Cromer in Support of Spirit Chapter 11 Proceedings (emphasis added for our purposes).

The oversimplified: if I think you’re thinking something, I can do things.

This is quite fascinating from a few perspectives. Firstly, from Spirit’s perspective, it’s an automatic Chapter 11 filing. With the airline’s largest lessor taking back 73 aircraft, there would be a rush on the airline by other creditors.

From AerCap’s perspective, whatever. If you have leverage leading into an inevitable bankruptcy filing, use it. I guess. In a way, this WAS a rush on the airline — AerCap was just the first and last through the door.

But it’s from the third perspective that I find most interesting — the perspective of other airlines.

If you’ll remember the industry discussions back when AerCap acquired GECAS, the chief concern was that AerCap would dominate the space and make it difficult for other lessors to find deals with airlines. AerCap just sent a strong message to those airlines (aka, AerCap’s customers): don’t mess with us.

But to potential future customers of AerCap, the idea of putting an airline into default because of what the lessor considers a threat could make airlines think twice. I suspect every lessee of AerCap started pulling up their lease documents with AerCap starting last Friday afternoon (they likely started re-reading through all lease documents, for that matter).

The idea that aircraft can be repossessed on any type of threat to the protection from the lessor is a bit… shall we say… open to interpretation. In fairness, perhaps there is clarifying language not disclosed elsewhere, but still. This is what we would call someone having “a gun to your head” contract-wise.

Which brings us back to that NEO fleet. All of the AerCap aircraft at Spirit are GTF-powered NEO aircraft. In fact, most of the leased fleet at Spirit is made up of NEOs.

Put another way, Spirit owns no NEO aircraft. Assuming AerCap pulls its 37 aircraft (or 39 as of this month, according to ch-aviation), could Spirit just reject all NEO leases and carry on as an all-CEO airline?

It could. At least we know Spirit can very believably entertain the threat that they can. (There’s that word again.)

Spirit retains control of approximately 60 aircraft, split between A320-200 and A321-200 CEO aircraft. Based on some early modeling of the Spirit network, we see three bright spots: Fort Lauderdale, Detroit, and Orlando.

Spirit could continue to scale back its disastrous West Coast operations and focus on those three cities, with a smattering of other Florida and Las Vegas service. The kicker? Spirit could do this quite realistically with only its owned CEO fleet. Throw in some extensions on up to 34 of the CEO aircraft on lease, and Spirit has itself a viable plan.

But a viable plan for what, exactly? Does this mean Spirit could shrink to profitability?

Perhaps, but that’s unlikely to be the outcome. Consider that an all-CEO airline focused around the strengths of Spirit’s network - including the sexy FLL gates and Latin American presence, no more exposure to GTF problems, and a leveraged, yet fully controlled fleet of CEO aircraft - suddenly becomes a VERY attractive acquisition target. All of what other airlines want, with none of the extras.

Of course, that creates another problem. What will happen with the 137 A320neo and A321neo aircraft that could hit the market?

Given the FAA spec, there are likely to be some takers in the region. But it still represents a problem for the market. Not enough to upset the global narrowbody shortage, the GTF-powered aircraft would still hit the market at the wrong time. The GTF-powered A320neo is arguably the least in demand of the new-gen narrowbodies, particularly since the LEAP appears more preferred on lower-thrust applications of the NEO.

Or, Spirit could retain a large portion of the fleet. We wouldn’t even be surprised if they negotiated a deal with AerCap and kept the giant lessor on property, albeit in a more, ahem, less threatening capacity. Remember that Spirit’s NEO problem was with the engines delivered years ago. The new deliveries represent engines without the powdered metal issue.

However, the point remains that Spirit could definitely make a go of it without any NEO aircraft at all. And that injects a period of uncertainty into the market for second-hand NEO aircraft, particularly the GTF’ed version.

Will Spirit reject its NEO fleet? Maybe, maybe not — but that’s beside the point. The point is that the airline can realistically build an attractive airline without the NEO, and that makes the threats to lessors with yellow NEOs suddenly very credible.

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact