It’s been a while since the price of fuel has topped the list of concerns for airlines.

And for good reason. The price of oil has largely followed traditional supply and demand forces for over a decade.

As of Thursday, June 26, 2025, this continues to be the case. Fuel still has not topped the list of concerns for airlines.

But it was a close one.

The price of oil - and subsequently Jet fuel - moves primarily with demand. This makes sense. When economies are strong and energy is in demand, prices rise. When economies slow, so do oil prices.

It’s a simple dynamic that retains a self-correcting nature for economies. Oil prices rise when economies are doing well but fall when they aren’t.

Why, then, do we remember the opposite? Why do we remember hearing airlines warn of spiking oil prices as demand is falling?

Because it used to be that way - at least for a memorable stretch.

During the 2000s, the U.S. airlines went through a bit of a rough patch. In June 2025 dollars, jet fuel increased from a low of $1.00 to over $7.00 a gallon. Why?

Two primary reasons: The first is the age-old demand story. Even though the U.S. was feeling economic tightness, particularly in the travel sector, the rest of the world was not. Demand for oil rose around the world as economies emerged, middle classes were created, and the propensity to travel was propensiated (a technical term in case anyone thought these newsletters were AI-generated).

In short, demand still drove oil prices higher; it was just demand in other regions than in the past. Prices increased by 700% during the decade, until the economic crisis at the end, that is.

But we’re not here to talk about demand. We’re here to talk about those “other” times. The times when economic demand didn’t materially change, but the price of fuel did. We’re talking supply - specifically crises in the places with the supply.

The Middle East hasn’t exactly been the most consistent region when it comes to geopolitical outlooks. Since so much oil emerges from (and is effectively price-controlled by) the Middle East, any threat to the region can spike fuel prices. This largely explains the times higher oil prices have diverged from higher economic demand - up until about 2015.

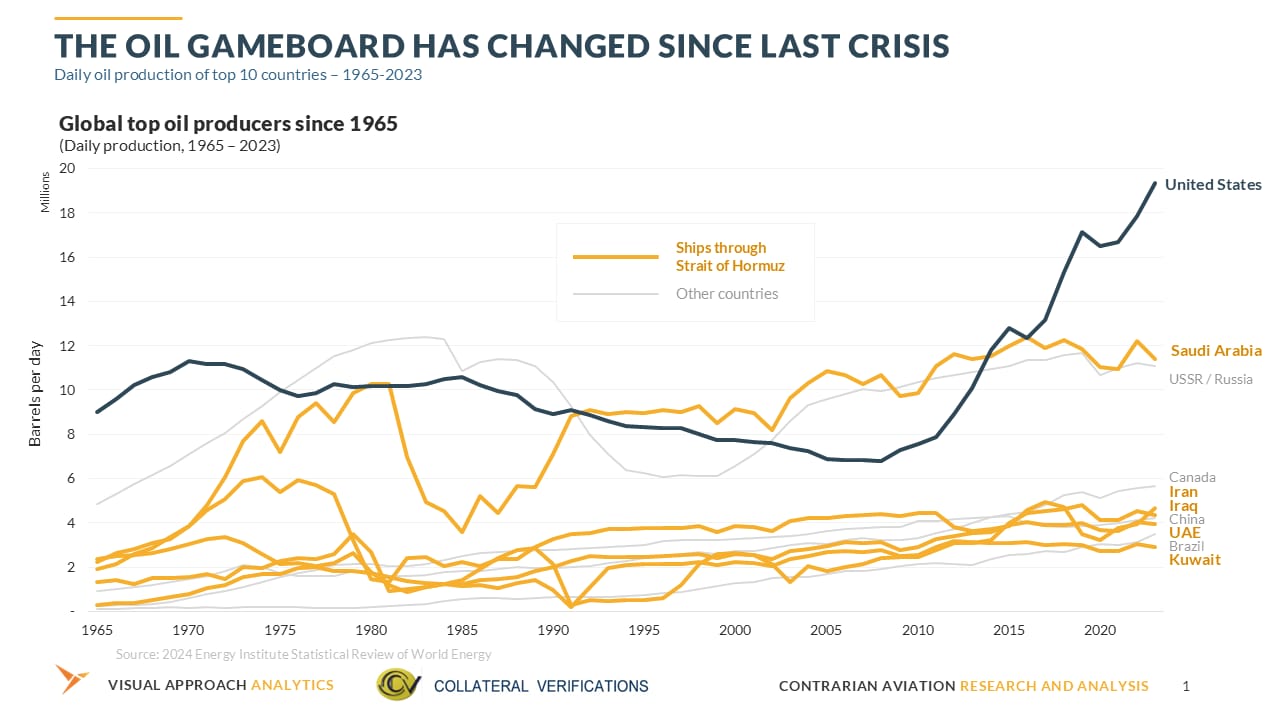

A shift happened in 2015. It fracking changed everything.

In 2015, the United States became the largest producer of oil in the world, passing Saudi Arabia and Russia. While global prices are still affected by events in the Middle East, they aren’t as affected, particularly for North America.

Fast forward to 2025, and a geographical term has re-emerged to the forefront - the Strait of Hormuz.

We estimate that between 18% and 25% of oil production would be impacted by a closure of the strait. Saudi Arabia is able to send roughly half of its oil exports through a Western pipeline. The catch there is that, while Saudi Arabia could avoid the Straight of Hormuz, it could only do so through the Red Sea. That’s not exactly the safest seaway of its own, subject not to Iran, but to Iranian-backed Houthis who have shown a proclivity for lighting ships on fire and sending a few to the bottom.

But things played out a little differently this week - at least for now.

Oversimplifying centuries of deep cultural history, the Strait of Hormuz matters because it is a choke point through which roughly 20% of the world’s oil supply travels. On the south side of the strait, you have Oman, the United Arab Emirates, Qatar, and Saudi Arabia. On the other side, you have Iran.

Following the airstrikes by Israel and the United States, Iran has threatened to close the Strait of Hormuz. That means anywhere between 18% to 25% of the world’s oil supply could be without a way to get to the world.

Prices rose.

In the days since, of course, we know that Iran has not closed the Strait, due to political cover from retaliatory airstrikes, and pressure from China, not to mention the logistics and military challenges required to blockade the Strait.

In fact, 2025 marks the first time in this author’s memory when Iran attacked a neighboring oil-producing country and oil prices actually dropped.

They dropped because it meant the Strait of Hormuz would remain open.

What does this mean for airlines?

For Q3 2025, the price of jet fuel is likely to remain in the band it was in during Q3 2024. Crisis averted - for now.

But just how much would a spike in the price of jet fuel affect the airlines in the U.S.? It’s a bit less than you’d expect.

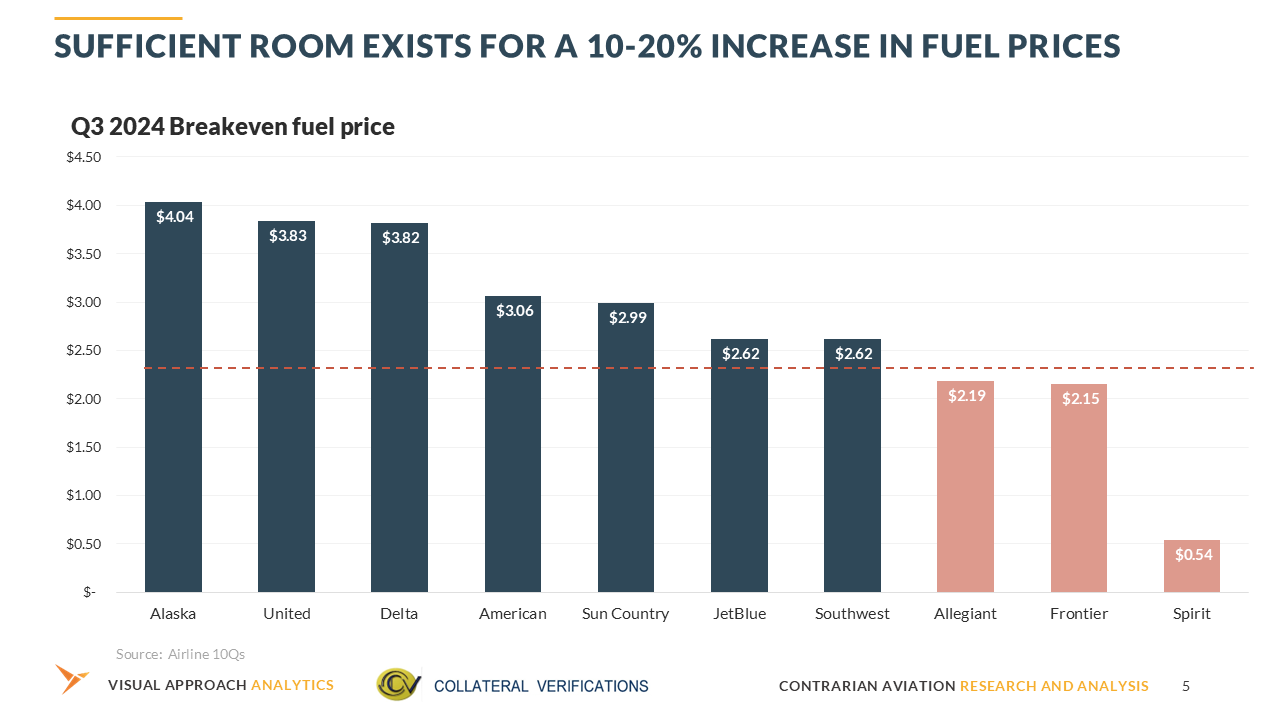

Rather than calculate profitability based on estimated fuel prices, we considered how high fuel prices could get before profitability would be affected. Keeping seasonality constant, we used Q3 2024 financials in an imprecise, yet directionally accurate calculation. Notably, we have extracted special charges, refinery costs (and revenues), and any strange sale-leaseback accounting that probably shouldn’t be where it is.

Some airlines are on a bit of a razor’s edge. JetBlue and Southwest’s Q3 results last year leave little room for increased fuel prices. The ULCCs clearly have a problem despite fuel (although we must point out that Allegiant’s red numbers are a result of Q3 last year. The airline has since put up some positive numbers that suggest things have changed for the better.

The four legacy network airlines could withstand quite a large increase in fuel prices. Alaska, Delta, and United could all withstand a jump to $3.80 and maintain profitability - a 78% increase from today.

But $3.80 isn’t impossible. During the shortages that followed COVID, fuel prices topped out well beyond $5.00. The period between 2012 and 2015 averaged $4.00.

The irony of the current situation is that the airlines dodged a bullet largely because the bullets were real. Had Iran followed through with its threat to mine the Strait, things could have turned south. Even though North America is now a net exporter of oil, the constriction of up to 25% of the global supply would send prices higher.

But this threat still does exist, even if no longer imminent.

And so, things revert back to normal - at least for this week. We’ll wait to see what the new crisis is next week.

Our published research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact