While the U.S. celebrates Thanksgiving and the turning of temperatures to the frigid, we look toward paradise.

Hawaii is a paradise for some, including the welcome duo of warm sand and beautiful weather. Unfortunately, for Southwest, Hawaii brought the unwelcome duo of lagging fares and load factors.

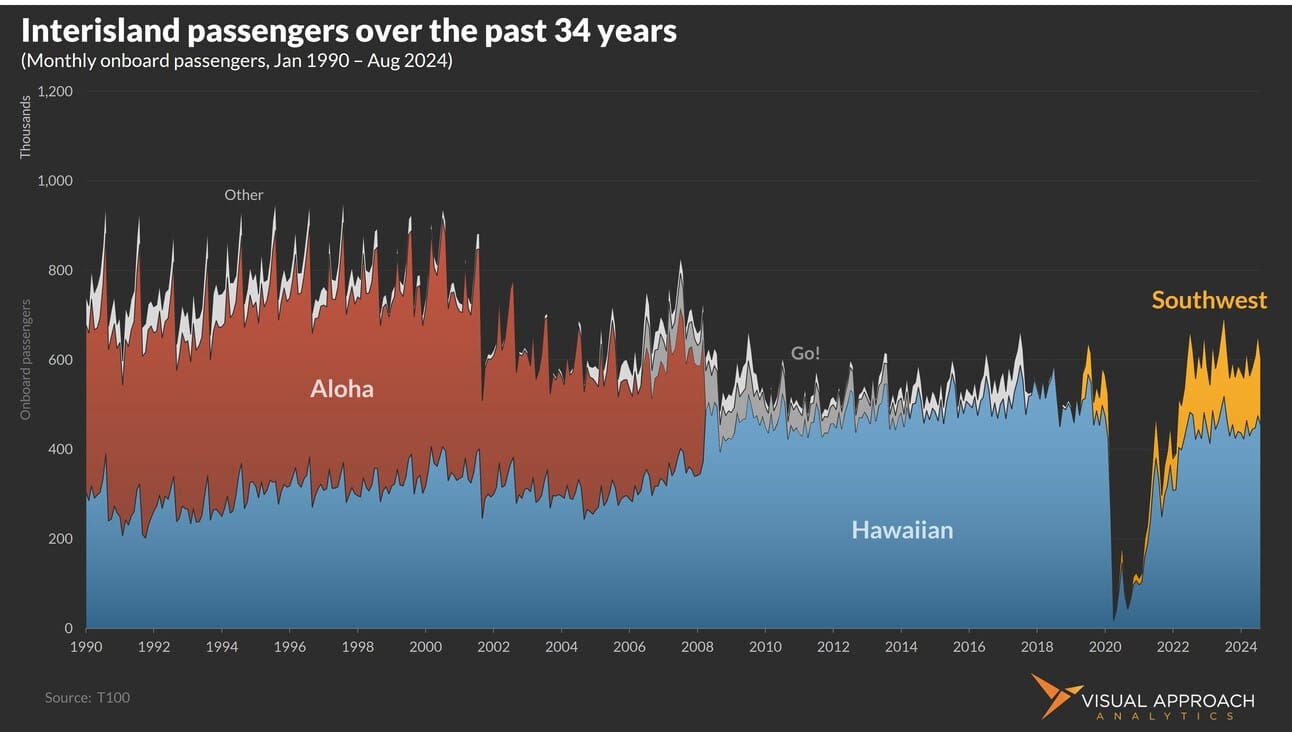

The Dallas-based airline recently pulled back on some of its Hawaiian interisland flying, and it took all of 30 seconds of looking at the data to understand why.

Flying between islands in the middle of the Pacific isn’t exactly killing it for Southwest. in fact, when compared to the incumbent airline, Hawaiian Airlines, Southwest lags in both meaningful metrics: how many Hawaiians Southwest attracts and how much the airline can get them to pay.

According to DOT data, barely half of Southwest’s seats flew full between Hawaiian islands in Q3 2024, the highest level since Q4 2022. This is compared with over three-quarters of Hawaiian’s seats being filled between the islands.

It gets worse.

Even with anemic load factors, Southwest is only able to command 75% of the fare local Hawaiian Airlines is able to command. Even as fares have gradually risen through the pandemic and into 2024, the gap remains the same. Southwest has consistently lagged Hawaiian on local Hawaii markets.

The timing of Southwest’s pullback makes sense to us for three reasons:

The airline is rolling out new red-eye flights that reduce the opportunity of rotating aircraft through interisland markets after making the long crossing.

The recent fight with Elliott (that we think is better described as “in remission” than as any type of truce) has pushed an intense focus on making money. Southwest doesn’t do that between islands in Hawaii.

Hawaiian isn’t going anywhere. Well, not really. It’s already gone somewhere, and that somewhere is to Alaska (the airline, not the state). Any advantage from keeping pressure on a weak competitor is now toast. That weak competitor is now a strong competitor - one that can easily withstand a money-losing interisland fight, even with a long-time fare premium.

Taking a long-term look at the interisland market, we see that it is a fluid, if declining, market. Once a two-airline race between Hawaiian and Aloha, traffic remains below highs in the 1990s - a trend shown across the U.S. with short-haul flights.

Yet Southwest’s attempt to wrest control of the interisland market resulted in fewer people flying for lower fares than the local airline.

The end result is a simple observation: local matters to Hawaiians - a point that Alaska Airlines appears to understand well.

Maintaining the Hawaiian brand is far more than a point of nostalgia; it is good business.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact