Today is U.S. Thanksgiving. While Americans are busy eating Turkeys and pumpkin pie, then enjoying an afternoon of football or a nap… or both (including yours truly), we’re offering an inside look into airline network planning.

This is what the airlines see.

Once a week, airline network planning teams receive a 13-page PDF detailing the strategic moves made in North America during the prior week. Cranky Network Weekly is subscribed to by hundreds of airline executives worldwide. Each Sunday afternoon, they receive the report describing the North American chess moves of the prior week and setting the gameboard for the strategies about to be deployed.

The weekly report is also available for those interested in following the detailed strategic moves of the airlines more frequently than during quarterly earnings. That’s some impressive industry intelligence for $125 / month.

Never heard of Cranky Network Weekly? If you’re not in airline strategy, you’re not alone. It’s ok. We’ll fill you in.

For over three years, we have detailed the attacks, counterattacks, network moves, and fleet redeployments of the North American airlines. Here is a quick rundown of the biggest moves we’ve been tracking over the past 12 months in Cranky Network Weekly:

Story of Q1 2024: International up, domestic flat

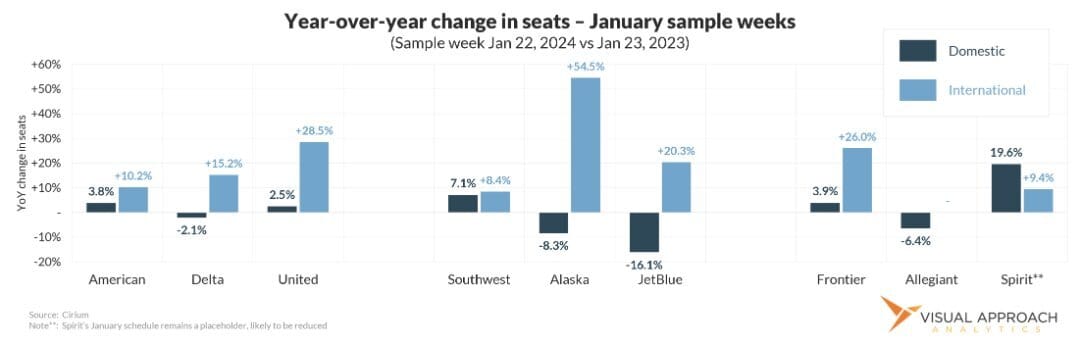

Things changed in the U.S. in Q3. The domestic recovery became recovered, but the international recovery continued. As we were watching huge year-over-year capacity increases continue through the year, at some point you start lapping last year’s big increases.

That’s happening now.

Looking into the Jan 2024 schedule, we have noticed a distinct split between domestic and international flying. Some international comps are still in crazy land, with 2023 numbers not yet in full recovery mode, but the domestic comparisons are… um… less.

As of last month, JetBlue was anticipating deploying 16% fewer seats on its domestic network than January 2023. Delta expected to reduce January domestic capacity by 2.1% while international was still up an impressive 15.2%.

Spirit was still operating a placeholder schedule, which was expected to be reduced and since has been.

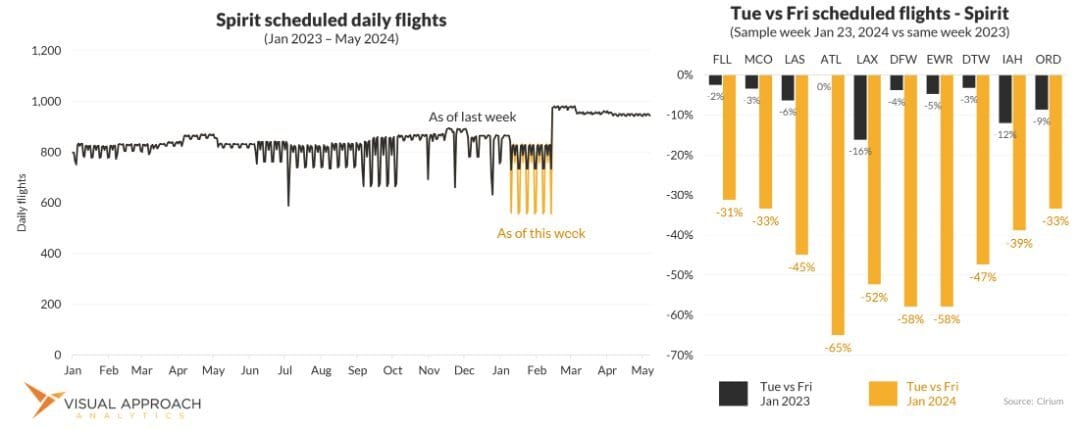

Day of week matters again for Spirit

Amid the noise surrounding Spirit’s terrible, horrible, no-good Q3 earnings, the rush to classify the ULCC model as dead among the masses overlooked the critical details. What is underperforming in Spirit’s network? Tuesday and Wednesday.

Day-of-week seasonality has returned to Spirit with peak day flying up near 2023 levels, but not so much for the days nobody want to fly.

But what about the much higher schedule starting in March, you ask? Aha! That, my good sir or madam, is what we affectionately refer to as a placeholder. Otherwise referred to as “bullshit.”

Spirit is by no means alone in their deployment of placeholder schedules. Nearly all airlines are offering full initial schedules out into the future, from which they are inevitably trimmed.

So when is a schedule accurate and what capacity can you count on being deployed? That is one of the key assets of the Cranky Network Weekly. We follow schedules to the nerdy level, identifying when you can consider the schedule as accurate for your own forecasting purposes.

Austin buildup - fun while it lasted

Well, the Austin experiment went a little sideways. American wasn’t the only airline to enter the market share fight for Austin, but it did take the biggest swing at it.

Rather than continue flying from Austin to non-AA hubs, American has scaled back the number of destinations it serves. Still, overall seats remain high, again primarily deployed to American hubs.

This represents a post-COVID trend we are seeing where markets are starting to revert to their pre-COVID trajectories. That works for markets that were overachievers during that time and those that have yet to recover.

Canada’s uneasy cease-fire

One of the significant trends we’ve been watching in the Great White North has been the retrenchment of WestJet and Air Canada into their fortresses. For Air Canada, it’s the eastern bases of Toronto and Montreal, while for WestJet, it’s Calgary and Vancouver.

Along with the cacophony of new ULCCs in Canada, it has made for a dynamic market with many strategic moves setting the stage for significant change in the long term.

Subscribe to Cranky Network Weekly

These are just some of the top trends we’ve identified over the past six months. Each week, we identify the strategic moves setting the stage well before earnings.

Last week, we identified some changes in Allegiant, Southwest, Alaska, and Spirit. The week prior found strategic shifts in American, WestJet, Spirit, Breeze, and Frontier.

Select investors, airports, airline suppliers, and research analysts already receive Cranky Network Weekly alongside the airlines. Ask your friendly neighborhood airline network planner how they like Cranky Network Weekly, then subscribe to see what they see.

$125 / month for a peak behind the strategic curtain.

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact