Based on the sheer number of questions we’ve received over the past week regarding how tariffs will affect aviation, we’re dedicating a free weekly post to the topic. It’s long but packed with various scenarios we see playing out given the current situation. (Oh, and the current situation isn’t likely to last, so take that for what it’s worth.)

First, a note: This is the type of detailed information and insight we typically reserve for our premium research subscribers. The U.S. tariffs are a big deal, and we have decided to release this research to the broader group for free. If you appreciate this level of detail, consider subscribing to Visual Approach Research.

Second, a warning: We don’t do political research and typically avoid any talk of politics like the plague. However, this current situation is a direct result of policy. It simply must be discussed to understand future scenarios. We have gone out of our way to remain objective and set any biases aside. We avoid opinion on the policies themselves and focus only on how they may change over time.

What is going on?

In short, nobody is quite sure. Global tariffs went into effect yesterday for goods imported to the United States. The tariffs originally ranged between 10% and 104%, based on a calculation of a country’s trade surplus with the United States; however, after a “pause”, all countries excluding Canada, Mexico, and China saw a blanket 10% tariff rate for 90 days. As of yesterday, Canada and Mexico have been excluded from the tariffs and are awaiting separate negotiations, while tariffs on imports from China have now been increased to 125%.

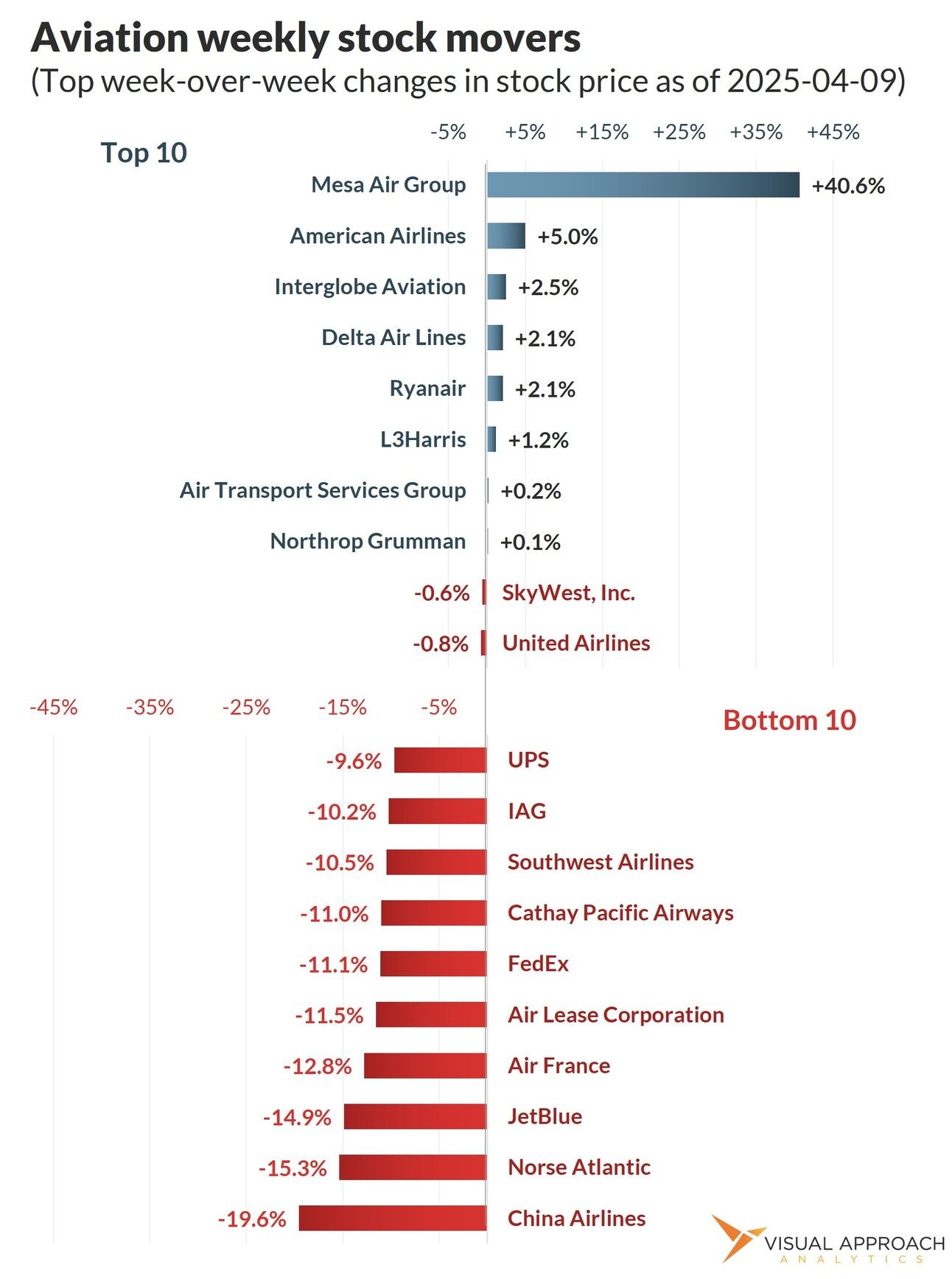

As of midday on April 9th, the U.S. stock market was down over 11% for the week. After a pause was announced on social media, it recovered some (but not all) of the lost territory. While the equity markets do not explicitly determine economic activity, they are trading on future expected earnings. Those expected earnings have now dropped.

Our Focus: Supply vs Demand

Our focus on the aircraft and overall aviation market in the new tariff economy will be on the impact on both supply and demand. Despite the seemingly oversimplistic nature of that statement, many factors are moving in conflicting or offsetting directions.

For instance, tariffs are very likely to limit the ability of the aviation supply chain to continue without financial risk to various suppliers and airlines. This means the supply of new aircraft will drop, resulting in upward pressure for the values of the existing fleet. In the current aircraft shortage, further limiting the supply chain only decreases capacity, reducing overall supply in a growing environment.

However, we cannot necessarily assume the aircraft shortage will continue expanding. This is because the overall demand for aircraft is falling as well. The economic slowdown expected from extended tariffs will cause demand destruction to some extent. It is still unknown how bad it will become. Both the demand for air travel and the ability to supply it have been dislocated from prior trends, but both have moved in the same direction.

In this same way, the industry (and globe, for that matter) is dealing with both inflationary and deflationary pressures. The inflationary pressures are obvious through the tariffs. However, deflationary pressures are a real risk going forward, as well. The current price of oil at $60, along with an overall demand reduction, will produce deflationary pressures in certain areas. Both will be happening, putting higher inflation and deflation in direct conflict at higher levels. The question is whether the impact to supply will outpace the impact to demand or vice versa. This is compounding the very short-term problem for aviation: uncertainty.

Short-term impact: uncertainty

The tariffs arrived suddenly and at far greater magnitudes than anticipated. Originally promised as reciprocal tariffs, the rates were not expected to be calculated based on trade deficits. This shocked the markets and drove uncertainty through the system. Even after the 90-day pause, uncertainty continues to hang over both aviation’s supply chain and international demand.

This uncertainty is defining the first few weeks. Aside from the stock market reaction, we also see uncertainty being largely disruptive from an administrative standpoint. The precise way imports to the U.S. will be charged and administered is unclear. For instance, an A321XLR aircraft set to be delivered this month into the United States could arrive with a bill from the U.S. government for 10%. Or not. That bill may come as a surprise after delivery of the aircraft, resulting in up to a $7 million cash payment due the United States government for each incremental delivery. The same aircraft set to deliver 90 days from now could have a $14 million payment due. The uncertainty has very high price tags associated with it.

We do not believe U.S. airlines will risk the potential liability of large tariff payments to the U.S. government. This appears to be resulting in a “pencils down” scenario on any new aircraft that could trigger tariff payments until it is known exactly how the tariff will be calculated and collected. Indeed, Delta Air Lines confirmed this during their earnings call yesterday, saying they would take no delivery of an Airbus aircraft that would be subject to a tariff. That means very few (if any) new aircraft will be delivered into the United States from Toulouse or Hamburg through this period of uncertainty.

We anticipate the aircraft most impacted will be the A321XLR, with a large portion of its now-starting deliveries destined for United Airlines and American Airlines in the U.S. The A330neo and A350 will also be impacted, with Delta Air Lines being the only U.S. customer for these types. Various A321neo and A220 aircraft have been delivered from Hamburg, Toulouse, and Mirabel to U.S. customers in the past, and we expect those aircraft will not be delivered until further clarity on tariffs is provided.

As a result, aircraft currently outside the United States destined for U.S. carriers are likely to be parked and awaiting delivery. While this may appear to be a catastrophic scenario, we do not expect it to last. The incentive for the U.S. airlines is to stall for time while the uncertainty is eventually resolved. We expect that timeframe to be in weeks rather than months.

However, should full tariffs be applied to potential deliveries after the pause, we could see a growing inventory of Airbus airplanes in Toulouse and Hamburg. Our expectation is that these delayed deliveries will be a part of the negotiations to apply full tariff exemptions at best and reduced tariffs based on pro-rated U.S. content at worst. Regardless of the outcome, we expect the short-term impact to be a rapid decrease in Airbus aircraft imported into the United States.

We also believe the immediate impact to the tariffs will be muted for Boeing and Airbus beyond stalled deliveries for Airbus. Both manufacturers will be working through an international inventory of supplies already on site or in country. Any tariffs owed by the two manufacturers for billable materials inbound to their U.S. assembly lines will be from content purchased for aircraft delivering 6 to 12 months from now. Risk to billable material costs for deliveries from U.S. assembly lines could materialize toward the back half of 2025. This coincides with the potential for the pause to end and original rates to be reapplied, creating a conflicting scenario where manufacturers will be required to decide whether to secure inventory at 10% or risk it becoming 20%+… or nothing.

Similarly, it is only the near-term deliveries to U.S. airlines that are at risk of not delivering for Airbus. These aircraft are either complete or beyond the point at which they can easily be converted for other customers. Any deliveries out beyond 12 months could likely be transitioned to other airlines, while all later U.S. deliveries of A220 and A320neo aircraft could be diverted to Mobile. The timeline to prepare for the XLR to be built in Mobile remains an open question, but one we expect has an answer if incentivized by a lack of deliveries into the U.S.

At the same time, Q1 earnings for airlines and companies will be released. We do not expect them to have much effect other than for the market to realize this isn’t as bad a scenario as COVID-19. Still, the threat to aviation is not in the near term, nor is it with the impact of supply. We believe the threat to aviation is in demand destruction, a long-term impact largely dependent upon economic scenarios.

Medium-term impact: Guidance vs exemptions

Economic concerns will likely build through the remainder of Q1 but without solid evidence of how the tariffs will impact corporate earnings. While most companies will suspend guidance, we do expect more data to be released showing a slowing economy around the world. This soft guidance from the market will continue to put pressure on aviation as a whole.

The potential silver lining lies in the negotiation of specific tariff exemptions. We believe aviation to be uniquely positioned to argue for industry-specific exemptions on tariffs alongside the automotive industry. Whether those exemptions come from pro-rated rebates on imported material re-exported as is the case with Boeing aircraft delivering to non-U.S. airlines, or once exported U.S. material being re-imported to the U.S. as is the case with Airbus aircraft delivering to U.S. airlines, we expect exemptions to be a major player in aviation eventually. As the process of accepting tariffs is better defined by the U.S., the prospect of exemptions to be outlined and deliveries to then resume.

Long-term impact: Demand impairment/destruction

However limited we believe the pressures tariffs will have on supply to be for commercial aviation, the impact to demand is dangerous for the industry. Already, international visitors to the United States are down 25% from Canada and Mexico and an estimated 10% worldwide. We will be releasing more detailed data regarding these trends in our upcoming April Aircraft Intelligence Monthly report.

More importantly, we must consider the reasons for the tariffs explicitly. The attempted unwinding of globalization will either fail with economic consequences or succeed with consequences to industries built around global connections. By definition, commercial aviation is designed for globalization and is subsequently poorly positioned for a post-globalized economy.

However, we do believe the push to deglobalize is destined for one of two paths: failure or conflict. We expect the recent deglobalization push to expose the benefits globalization originally brought, as those benefits are strained and finally properly weighed economically against the costs. Today, the costs are the focus of the U.S. administration. It will take 15-20 years for any benefits of deglobalization to be materially felt by way of a sufficient manufacturing base being constructed in the U.S., while the loss of benefits and economic slowdown are already being felt and will continue to be for the next 15 years. Given relatively rapid administration changes in the United States, it is increasingly unlikely that the public opinion will hold out long enough for the benefits to (potentially) materialize.

It is far more likely that the administration will point to political “wins” to remove individual tariffs and provide exemptions over the next 90 days. Our reference is the sudden willingness to pause the excess tariffs calculated above 10% for 90 days and the political rhetoric associated. We find this as a positive sign that exemptions will be able to be negotiated, bringing tariff rates for aviation to zero or in line with the non-U.S. content of the aircraft.

The conflict scenario is hardly one worth strategizing, but our research has identified it as a potential black swan event for the past year. Tariffs will not cause conflict, however, history has suggested that trade is one of the key factors in preventing conflict. Certainly not imminent or even expected, the latest increase in likelihood is a trend of its own since COVID-19.

Moving forward

Uncertainty in the near term is likely to impact the tariffs, resulting in parked Airbus aircraft awaiting delivery to U.S. airlines that refuse to pay the tariffs. The next stage is expected to focus on negotiation exemptions, an initiative likely to be led by U.S. business leaders as much as international political leaders.

From a supply perspective, the tariffs will only work to hamper production ramp-ups and put even more pressure on an already strained supply chain. Another area of risk is the development of a prisoners’ dilemma for suppliers. In that scenario, suppliers concerned production may drop based on the tariffs or another critical supplier’s expected inability to produce product. The result would be a drop in production simply because suppliers thought other suppliers would be the problem, only to become the collective problem themselves. Still, we think any disruption to production from this would be limited to the next six months or less.

Should exemptions on tariffs for aviation not find purchase, the long-term supply impacts could bifurcate the industry. While we consider the aircraft market as one large market today, if tariffs are required any time an aircraft is moved into the U.S., we expect two distinct markets to form: The U.S. and the rest of the world. The liquidity of the aircraft market would take a substantial hit in this scenario.

However, we remain concerned in the long term that the U.S.'s deep step toward deglobalization will negatively impact commercial aviation, which is built to connect the globe. International travel has already shown signs of strain, though that has been offset by point-of-sale. The demand drop is primarily from visitors to the U.S. rather than travelers from the U.S. This bodes well for U.S. airlines and their point-of-sale advantage, as evidenced by the strong booking data discussed on the Delta Air Lines earnings call. Still, we expect the short-term impacts to be supply-driven and manageable, while the long-term impacts will likely reduce the growth rate in the future.

Notably, all of this is changing in real time. Consider this research as a thought experiment on how the current situation would play out over time. It is equally as likely that things will change again, for which the thought experiment would fundamentally change. Take the creation of this research as an example. When this analysis was started, global tariffs were at much higher levels than they are now.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact