London has long been a global transportation mega hub. With six airports serving the metropolitan area (LHR, LGW, LCY, LTN, STN, and SEN), which airport you use is not cut-and-dry.

This choice of airports for visitors and local Londoners has been the source of perennial debate: Which airport do you use?

This week, that question collides with three specific circumstances:

Our data warehouses are full of data we use with airlines and airports to determine passenger movement and catchment areas,

The nearly four years of continuously integrated data science infrastructure is in place and humming, and

It’s Christmas time. We like making pretty pictures for Christmas.

London City (LCY)

How could we possibly include London City and not Stansted, Luton, or Southend?

We have to start somewhere. Besides, LCY happens to be our preferred entry point into London. It’s just that there are not many points from which one can enter the city through LCY.

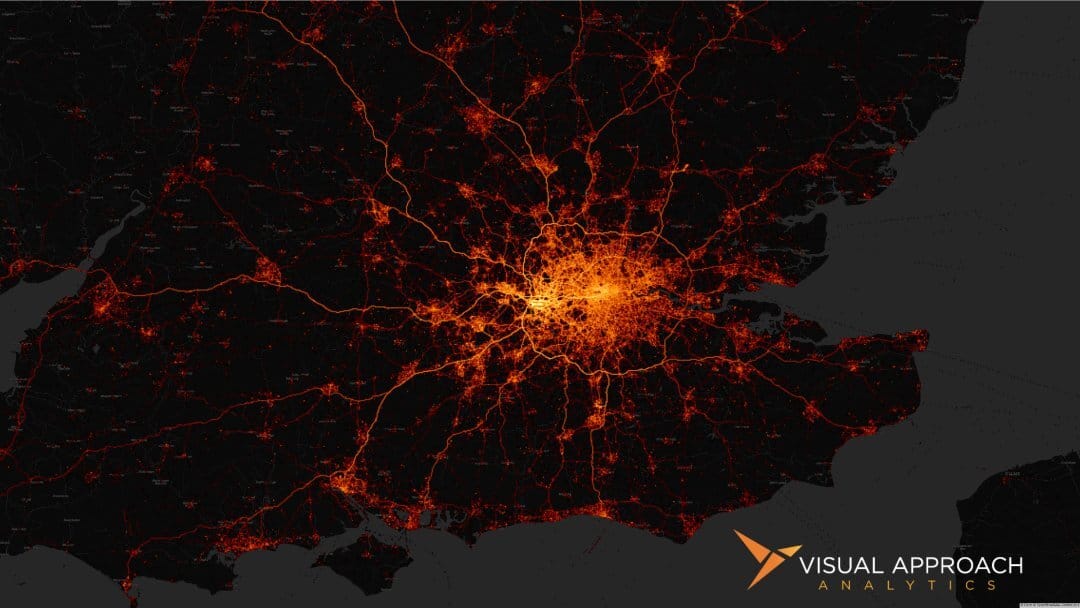

The airport’s limited capacity restricts passenger flows largely to the city, making the airport aptly named. With rail connections through the local DLR rather than regional rail, LCY passengers are further limited to the city.

It makes sense. LCY is a small city airport with short runways, steep approaches, limited local rail connections, and pain-in-the-butt driving options.

London Gatwick (LGW)

Located south of the city, Gatwick airport offers enticingly similar connections to downtown London as Heathrow.

Going to Paddington? Heathrow’s your bet. Going to Victoria? Gatwick.

Similar to the regional connections of Heathrow, Gatwick has rail connection and even a “Gatwick Express” to Victoria Station (though reports of reliability are not as strong as the “Heathrow Express”).

Yet, what Gatwick lacks is international flights, at least when compared with sibling Heathrow. LGW used to be better served, particularly from the U.S.. However, LHR has driven priority away from LGW as more airlines are admitted into the tightly controlled airport.

Yet, LGW still pulls heavily from the south of London, from South Hampton to Dover, and with particular gravity in Brighton.

London Heathrow (LHR)

Which brings us back to the granddaddy, Heathrow.

What impresses us about London’s Heathrow Airport is that it’s not really a London airport; it’s a South England airport. The mega hub pulls from the entire region, feeding central London, but also every municipality within 200 miles.

The reason is simple: there are just some places you can only reach through LHR. This broadens the local catchment of LHR well beyond the west side of London. Passengers looking to fly to locations unserved by other airports will drive past those airports to board flights at Heathrow.

Wait a minute! Where is Stansted, Luton, and Southend, you ask? We picked our favorite three. Editor’s prerogative.

But they’re still there. If you have a need for this level of detail to show customer movement, reach out. We work with several industries beyond aviation to provide this detailed edge.

That’s the thing about data science and visualization - it’s pretty industry-agnostic. Intelligence is not limited to the world of aviation.

Visual Approach Research - American’s widebody strategy shift

We published research this week detailing the apparent shift in widebody capacity at American Airlines as of Q3. While something considered in prior American Airlines calls, this marks a distinct shift away from the strategies employed by Delta and United.

You are reading our free newsletter, highlighting an interesting previous week's analysis. A lot of work goes into this weekly analysis, but it is merely a hint of the detailed data science and research we do every day for our customers.

Visual Approach Research is a contrarian research that identifies areas the market overlooks. What do we mean by contrarian?

We don’t start by assuming that what we hear in the market is true… or false. We start from the data, free from the assumptions.

Most of the time, our analysis agrees with the prevailing opinion. You never see those. At least six were tossed for every analysis that made it to Visual Approach Research.

But sometimes, the data paints a very different picture - contrary to the current narrative. That’s what we identify as contrarian.

Not opposite. New. Different.

For instance, in 2021, it wasn’t exactly popular to suggest a narrowbody shortage was inbound. Yet, contrary to the market narrative, the data led us to a very different conclusion. Our clients were aware of this a full year before it became mainstream.

Hundreds of leaders at aircraft lessors, investors, OEMs, and airlines receive our premium Visual Approach Research. If you would like to learn more, review our track record, and discuss how you can be a part of the contrarian conversation, simply reply to this email.

We very much appreciate our customers who continue to support our aviation habit.

You should do a chart on…

This week’s chart is a great example of a subscriber request.

“Hey,” offered said subscriber. “How about a look into the African market?”

So we did.

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact