This is an expansion of the analysis first published on July 10 in our monthly research publication. If you are interested in learning about subscription options, let us know.

In a post-COVID world where we have come to expect things only to get better, we tend to forget that, at some point, things will have already gotten better. Then what?

This month we saw the first sign the industry may be coming to grips with that reality. The sneaky metric at the center of it all? Domestic RASM.

Many of the U.S. airlines have reported Q2 earnings. They are good numbers.

Delta reported passenger revenues up 21%, with RASM up 3% across the network. The international travel boom is back, but pay attention to the domestic RASM - down 1%.

Wall Street: “Ok, no biggie.”

United reported revenues up 20% with a 2% rise in RASM. Domestic? Down 2.4%.

Wall Street: “Sounds legit.”

American: Revenues are up 7%, with a 1% rise in RASM. Domestic? Down 3%.

Wall Street: “Sure, why not?”

Alaska reported passenger revenues up 7%. Domestic RASM? Down 3%.

Wall Street: “Oh dear sweet mother of god, domestic fares are falling apart! It’s mayhem! A catastrophe! Human sacrifice, cats and dogs living together… mass hysteria!”

(… or something like that. We’re paraphrasing.)

In fairness, it wasn’t this quarter’s RASM that shook the markets so much as Alaska’s guidance that domestic fares were softening. Southwest Airlines just reported RASM softening by 8%, a not-insignificant number, but one that came amid a 14% rise in capacity. Fares are down 3%.

Fares and traffic can’t keep going up forever. Sounds obvious, yet here we are. So what is going on?

The path back from COVID has introduced the term “supply chain challenges” to the global lexicon. By 2021, we had identified a looming narrowbody shortage that also entered the lexicon by 2022.

Better-than-expected demand. Not enough capacity. It is during times when you have more passengers than seats that airlines commit to more seats. Sounds about right.

The U.S. airlines made many new aircraft commitments, particularly during the early COVID recovery months when U.S. domestic capacity was on an early recovery trajectory. Only those seats don’t show up right away, and when they do, they tend to deliver right when the other airlines’ seats are also delivering.

Our research subscribers also know that revenues had already recovered in the U.S. market earlier this year. Even as international travel had yet to recover, the robust domestic recovery continued into the peak summer months. Capacity across the system continued to increase by 15-20% year-over-year - an incredible amount by usual standards.

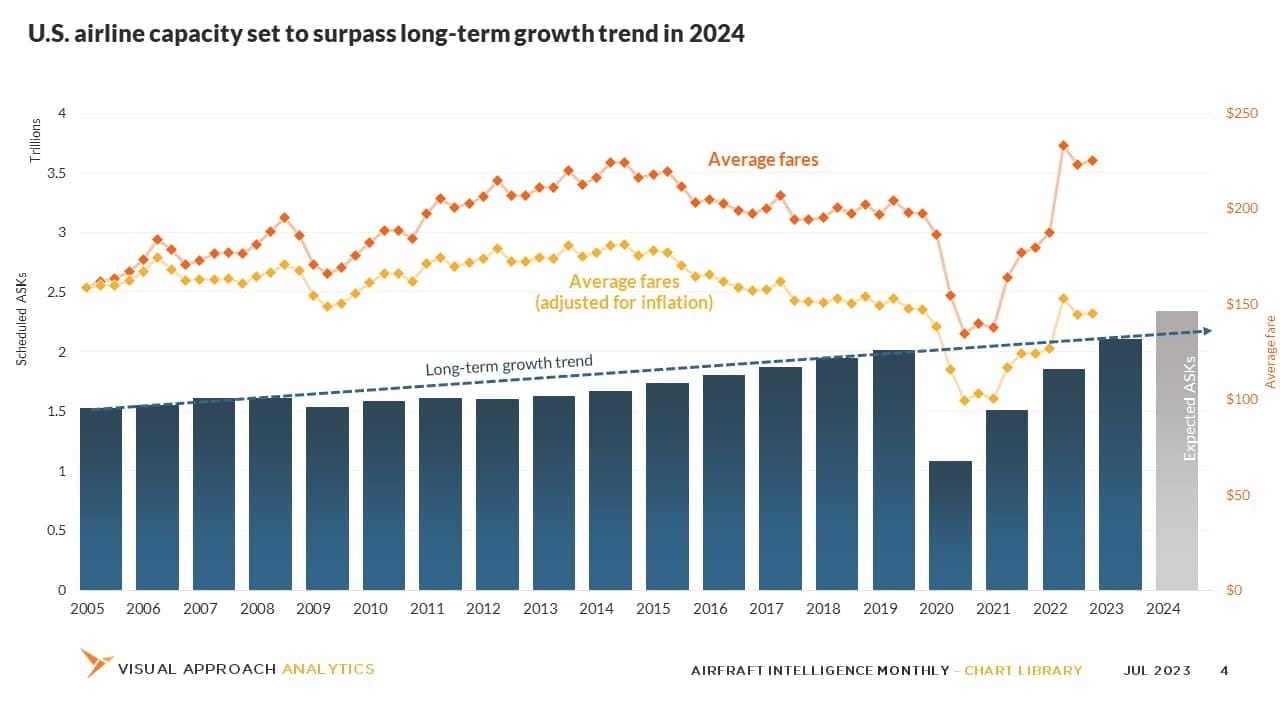

Indeed, the speed at which the U.S. airlines added capacity - even with supply chain and pilot shortages - was impressive. Only, it’s not stopping. Even as revenues recovered, deliveries continued well beyond where the pre-COVID trend was headed.

Does this mean demand is tanking? Has the U.S. traveler finally had enough?

No.

But it does mean that there is a lot of capacity still coming into the system. Probably too much. This is why we have long expected fares to be the first indicator, not of faltering demand, but of excess capacity.

We’ve long discussed this scenario with our clients. At any other time, this could be attributed to demand weakness. But at any other time, the industry wasn’t adding 20% capacity per year. This doesn’t mean demand won’t soften if the long-expected economic slowdown finally arrives, just that this isn’t it.

As far as demand and fares, 2024 could be depressingly normal. Unfortunately for the airlines, normal is south of what the past two years’ worth of growth has been. That means Wall Street jitters at any mention the gravy train may not keep accelerating.

We just completed a massive international recovery that will go through the same stages as domestic. At some point, the recovery will be recovered in those markets as well. That’s next summer.

Then comes 2025.

A discussion with J.P. Morgan’s Mark Streeter and Jamie Baker

Think you know Mark Streeter and Jamie Baker? Ok, hotshot: Which one had the better pin-up on their bedroom wall as a kid?

The latest Time on Wing podcast features Mark and Jamie from J.P. Morgan.

Gueric Dechavanne and I have far too much fun with the duo, trading funny industry stories, the direction of aviation, and how the industry has changed - and continues to change. This is a discussion on the leading edge of the industry with just a smidge of fun. (Ok, a little more than a smidge.)

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… well… nothing.

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering a data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

Reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry, it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact us.