There have been numerous explanations attempting to decipher the Q2 domestic RASM surprises in the U.S., but none consider they were no surprise at all.

Expressly ignoring the warnings leading into earnings season (yet implicitly and selfishly reminding that it was our research that warned of this very phenomenon), the explanations of sub-par domestic RASM have spanned the spectrum: either demand is collapsing, or passengers are just busy visiting Europe.

We don’t believe either of these two explanations to be the case. But with only a small sample of airlines reporting, it’s not always easy to find the correlations needed to show what’s happening distinctly.

Enter Allegiant.

Yes, we know. Last week’s newsletter was full of sudo-rants about Allegiant bucking the beautiful trend that was crappy domestic RASM numbers. But hear us out. What appears an anomaly at first glance with Allegiant was the missing piece to show what’s happening in the U.S. domestic market.

Just what is happening in the U.S.?

Too many seats. And there are more on the way. There. We said it.

A clear trend emerges of airlines that added domestic capacity, and the resultant RASM decreases. The more seats, the harder it is to fill them at reasonable fares. Yet passenger numbers and revenues are still up. Why is that? Because demand is still strong. The problem isn’t that passengers have gone away (yet). The problem is the 10%-20% increases in domestic capacity.

Simple TSA numbers show the passengers are still there. Sure, it mixes international and domestic; however, it’s a quick way to show what we see in each airline’s results and in the early traffic reports. Passenger demand is there.

But Allegiant bucked the trend this quarter. We’ve identified two extremely scientific factors at play in Allegiant’s quarter: luck and skill.

First, luck. Year-over-year numbers for Allegiant look stellar, partly because the airline could not add capacity due to the pilot shortage. Not exactly what we’ll call planned, but it works now.

But the skill component is interesting. Remember that Allegiant has the least competition of any large U.S. airline. Not because they’re so great at fighting off competition but because they fly to the smallest cities where any other airline would be crazy to try to compete. And Allegiant makes money doing it.

Why does this matter in this context? Because capacity added by one airline affects the market for all airlines. From an oversimplified macro level, it’s all dumped into the big domestic ASM pie, and the airlines must then fight to ensure they are getting their slice. It’s why terms like “capacity discipline” exist. This is the opposite of that.

Only that doesn’t apply to Allegiant. Allegiant owns most of its markets, which means it is least affected by the capacity additions of other airlines. The Las Vegas-based ULCC effectively operates in its own market, and in that market, there were minimal capacity additions. The result? Limited capacity additions, strong RASM.

In the other market? Lots of new capacity, disappointing RASM.

…which brings us to the ULCCs and ancillary fees

Notice the separation between RASM and TRASM in the above chart? The separation matters this quarter because one did better than the other. (Allegiant being the exception. Again.)

You might have noticed less-than-terrible TRASM numbers for the ULCCs, but an ugly passenger RASM. There’s a reason for that.

With the new capacity entering the system, passenger fares for the ULCCs were sharply lower year over year. A passenger fare is the fare a passenger pays to be on a flight. Essentially, it’s the advertised fare plus government taxes and fees.

Sounds obvious, but that distinction matters. Because what is not included in passenger fares is ancillary fees. We know those ancillary fees matter, but things just shifted again. For instance, Frontier Airlines’ average passenger fare changed from $64 to $48 - a 26% drop. But ancillary fees rose from $75 to $80 - a 6% increase making it the clear leader in the industry.

Sun Country saw the greatest increase in ancillary fees per passenger from $50 in Q2 2022 to $66 in Q2 2023 - up 33%.

What’s going on?

Our analysis is that fares and ancillary fees react differently to capacity and inflation. Base fares are largely revenue managed to fill the available seats - a situation rapidly drawing down those fares.

But ancillary fees are generally not affected by capacity. The price is the price, and customers are now used to increasing prices. We believe inflation is much more easily captured in ancillary revenues than fares.

So for ULCCs, overcapacity = bad for fares. Inflation = good for ancillaries. The net effect? Positive for Allegiant and Sun Country, negative for Spirit and Frontier.

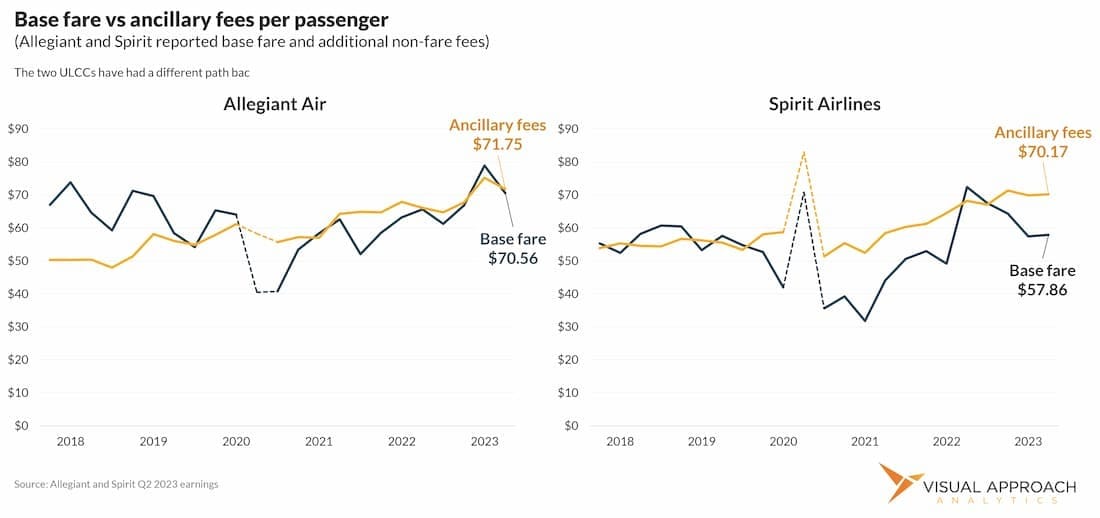

But it is the drop in base fares that is so striking when considering the historical context? Not really. Consider Spirit’s average base fare was flat compared to Q2 2019, while ancillary fees were up 26%.

Allegiant, with their captive collection of micro-markets, saw fares up 20% vs same quarter 2019 and ancillary fees per passenger up a whopping 28%.

For the two airlines, base fares appear more cyclical and subject to the balance of supply and demand. Ancillary fares appear more… well… inflated.

Economic challenges return to the risk outlook for global aviation

Today, we published the August edition of the Aircraft Intelligence Monthly. The monthly report focuses on emerging trends and pockets of edge in the commercial aircraft market.

Notable this month is the rise of economic challenges as leading risks to rival the Russia / Ukraine war. Sentiment shifted away from recession, but our models still show a high likelihood of recession in the next few years. That likelihood is beginning to eclipse other geopolitical concerns (namely China and Taiwan).

Learn more about accessing our research through Aircraft Intelligence Monthly and request a free report.

Short Approach:

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… well… nothing.

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

In fact, next week, we will be featuring a subscriber request. It’s a good one. It’s taking us some time to complete, but we have thoroughly enjoyed ourselves looking into the history of some airline fleets.

We’ve said too much.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact us.