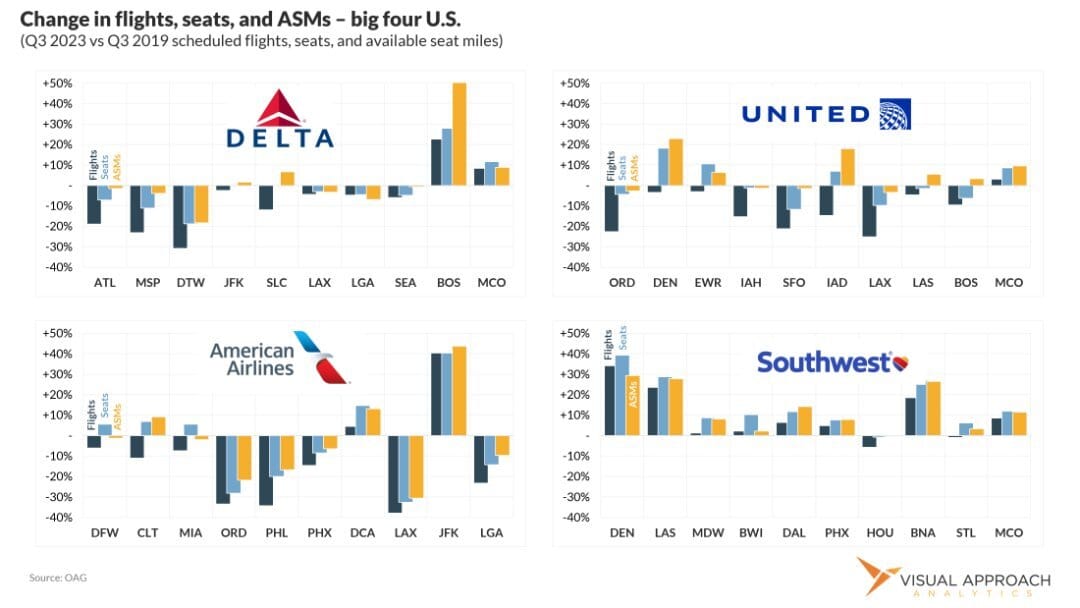

The Big Four airlines in the U.S. have come a long way since COVID. Looking at seats deployed, you can begin to see the structural differences in how the airlines have approached the post-pandemic world. The stories are quite simple:

For Delta Air Lines, the middle of the network has experienced the steepest loss in seats since 2019, while the East Coast has attracted the Widget’s attention. Yet Boston - a surprise to us - is up 28%.

United is growing Denver and Newark while the West Coast suffers from the transpacific lag. Didn’t expect Newark to have grown so much? Seats, not flights. We’ll explain later.

American is retrenching into fortress hubs, boosting DFW, CLT, and MIA - largely at the expense of ORD, PHL, and LAX. But the 40% growth in JFK stands out as a strategic move worthy of review (and ultimate rejection) by a grumpy judge.

Conversely, Southwest is on the move, growing each of its top 10 markets, save for Houston Hobby. Denver, again, emerges as a leader in growth, benefiting from the strong geographic presence in the domestic network.

But Southwest’s differing chart also hints at another dynamic at play. The size of aircraft and the distance they are flying are having a distinct effect on the market. Considering how the change in flights differs from the change in seats and available seat miles (ASMs), the trend of bigger/further is accelerating.

Up and to the right

When we compare the change in flights, seats, and ASMs since 2019 for the top markets, a clear trend appears - up and to the right. More accurately, bigger, further.

Flights are down, but aircraft are larger. For instance, Delta’s average seat gauge in Atlanta has increased from 145 seats to 165 seats per departure during Q3. But ASMs have fared even better as larger aircraft are deployed on longer routes.

That has led to the accelerated trend of bigger, further. Southwest stands out as not being as affected by the up gauging and longer flights, even though the airline continues to take delivery of their largest model, the 175-seat 737-8.

Still, the trend is remarkably consistent across the airlines’ top 10 markets. Flights are down; seats are up, and ASMs are upper.

Delta Air Lines Q3 2023 earnings at a glance

Delta kicked off earnings season by announcing a Q3 profit of $1.1 billion. But, as is heard worldwide during any Q3 earnings: “Talk to me in Q1 - everyone makes money in Q3.”

Or do they?

Just as happened during Q2, bullishness launched the earnings season only to be disappointed as more domestic-focused carriers reported later. The party spoiler last quarter? Domestic unit revenues.

How are those domestic unit revenues shaping up to look in Q3? Not so hot.

For Delta, overall passenger revenues increased 14%. Score. Massive increases led those revenue bumps in international tickets, including across the Atlantic at a 34% year-over-year increase, the Pacific at a whopping 65% increase, and Latin America at 20%. Domestic revenues, by far the largest sector, increased by 6%.

Cool. But domestic capacity increased by 11%.

Not cool. The resultant domestic RASM decreased by 4%. Not terrible, but very similar to what we saw in Q2 right before the domestic-heavy airlines reported disappointing numbers.

In other, not-so-surprising news, cargo revenues dropped 36% from Q3 2022. Such is the plight of the cargo world today.

Aircraft Intelligence Monthly

The October issue of our research report Aircraft Intelligence Monthly was published this week.

The report includes data visualizations of the market affecting commercial aviation, aircraft leasing, and investing.

It also includes historical values and lease rates for the A320-200, as well as detailed market outlook for the aircraft.

Topics covered in the October AIM:

Latest PW1000 inspection estimates

CFM56-7B shop visit costs versus LEAP-1B

Growing concentration risk in OEM backlogs

Widebody replacement cycle

Global fares and traffic by region

Brazilian market dynamics - things are getting interesting again

Visual Approach Research subscribers have access to the full report. You can learn more about subscribing here: https://visualapproach.io/pricing/

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact