It’s Delta.

Again - though, things are getting tighter.

Delta reported an operating profit of $2.27 billion (with a B) on $16.7 billion in revenue, which ultimately became a net income of $1.30 billion (again, with a B). Delta's operating profit margin was 13.6%, compared to United’s 12.9%.

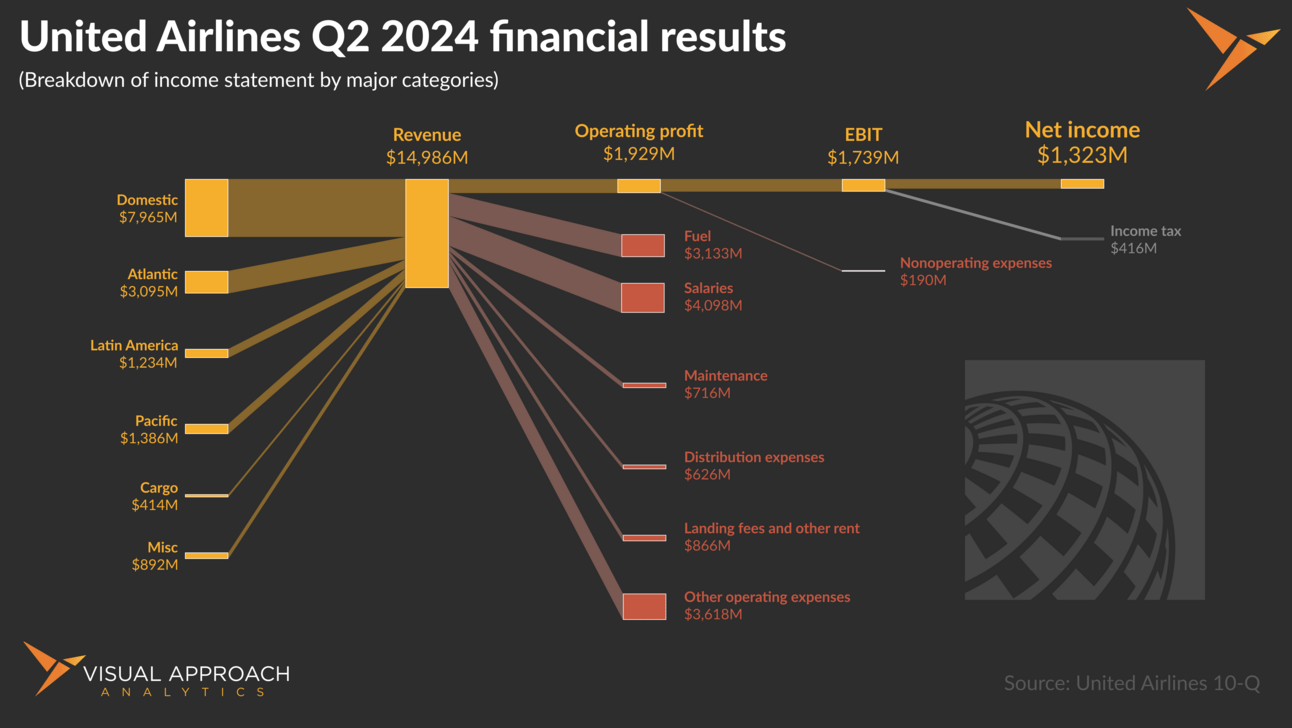

United earned $1.93 billion on $15.0 billion in revenue, resulting in $1.32 billion in net income.

Wait a minute - United had a higher net income that Delta. How can we declare Delta the winner?

Simply put, there are a lot of moving pieces between operating profit and net income, many of which don’t reflect the airline as an operation. Net income still matters, certainly, but the closest apples-to-apples comparison is operating profit.

But, as much as everybody seems to love the Sankey diagram when illustrating income statements, we’re left underwhelmed. Sure, they’re great for a first glance if you’re not familiar with the industry, but the airlines all look similar.

We prefer to look at year-over-year changes.

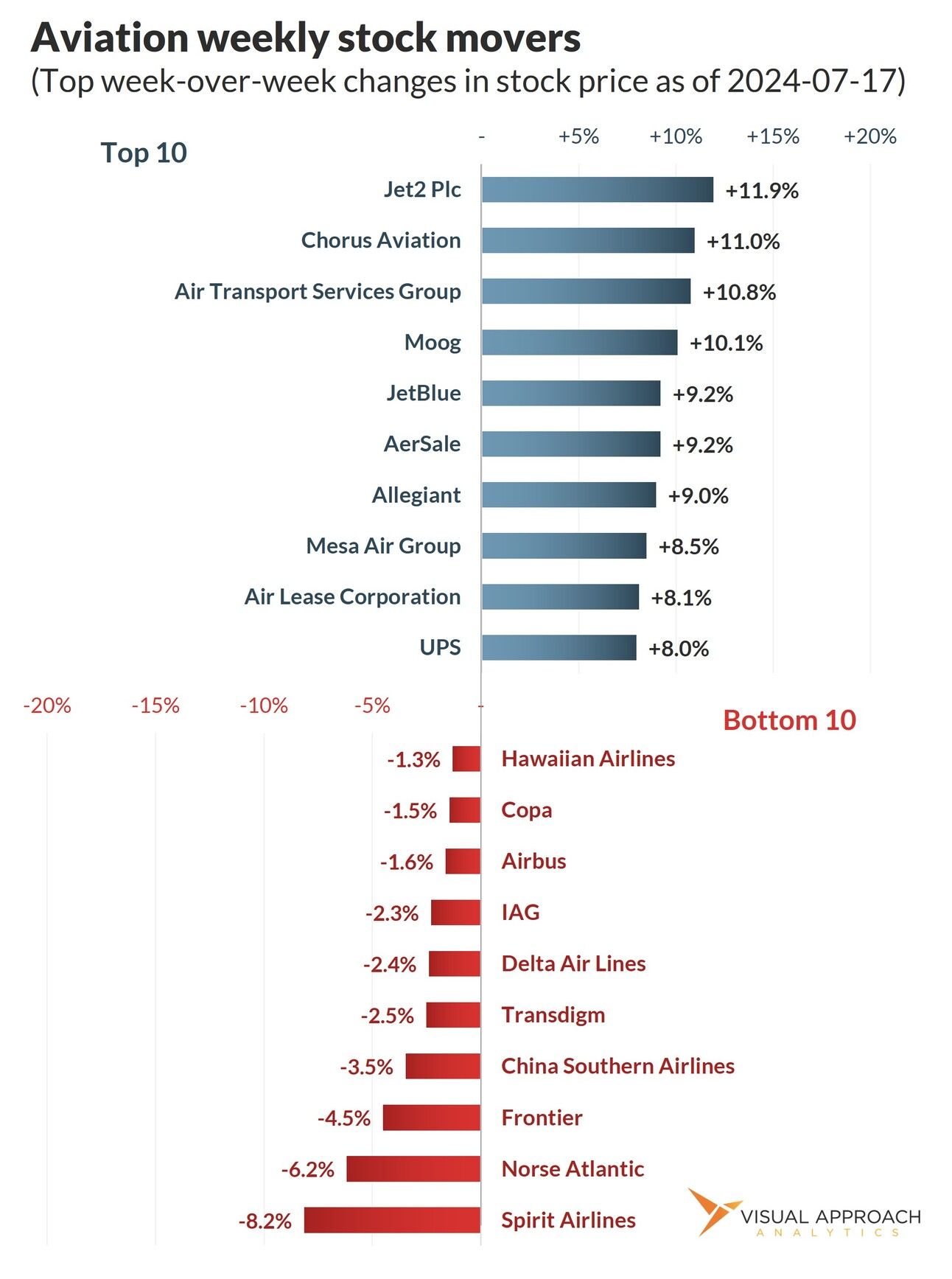

Yellow bars represent positive results (increases in revenues or decreases in expenses), while red represents the opposite. For Delta, the big mover was the bump in domestic revenues.

(Even though revenue from ancillary businesses jumped $285 million, the expenses also jumped $290 million, effectively making the change net negative, so we’ll disregard those larger bars.)

The two large unmistakable red bars are fuel and salaries. While the airline did grow since Q2 2023, those costs great faster.

Similar for United, which saw large increases in fuel and labor expenses.

Also of interest to us is the increase in distribution expenses for United. A $139 million jump (28.5% increase on a 5.2% increase in revenue) is interesting, particularly given American’s challenges with distribution compensation that came to a head this quarter.

However, the outlier isn’t United’s distribution spend in 2024; rather, it’s the lack of spending in 2023. Considering a new metric (one we just made up), this quarter, United earned $21.85 in passenger revenue for every dollar it spent on distribution and commissions - an effective 4.6% commission rate (including distribution costs). This is compared with Q2 2023, in which the airline earned $26.70 in passenger revenue for every dollar spent on distribution and commissions - an effective 3.7% commission rate.

Delta, on the other hand, sees $20.60 in passenger revenue for every dollar spent in distribution and commissions—an effective rate of 4.9%. Last year, it saw $20.29 at the same rate.

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact