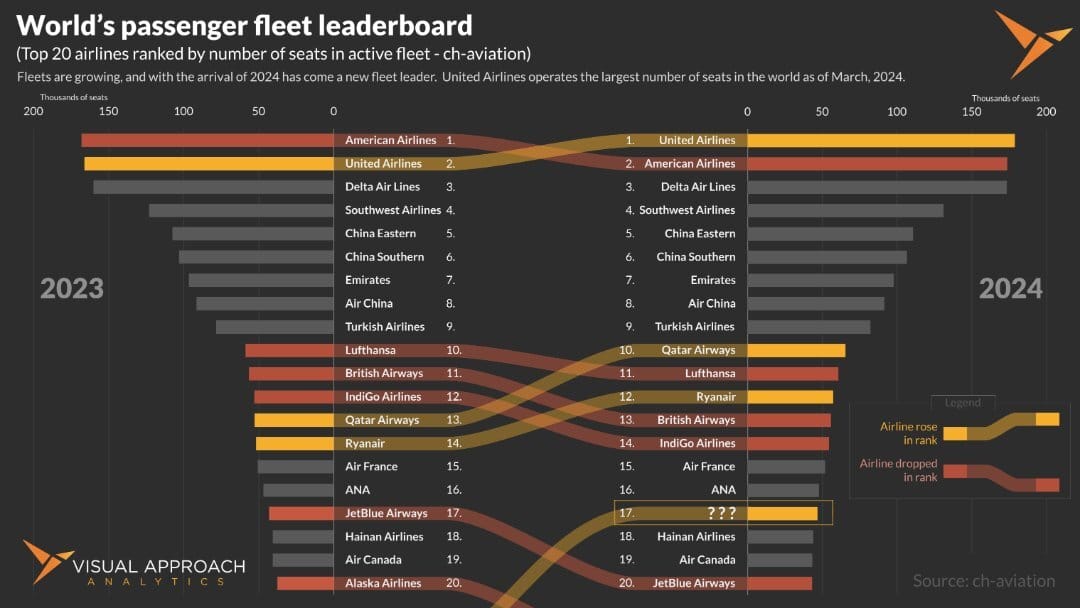

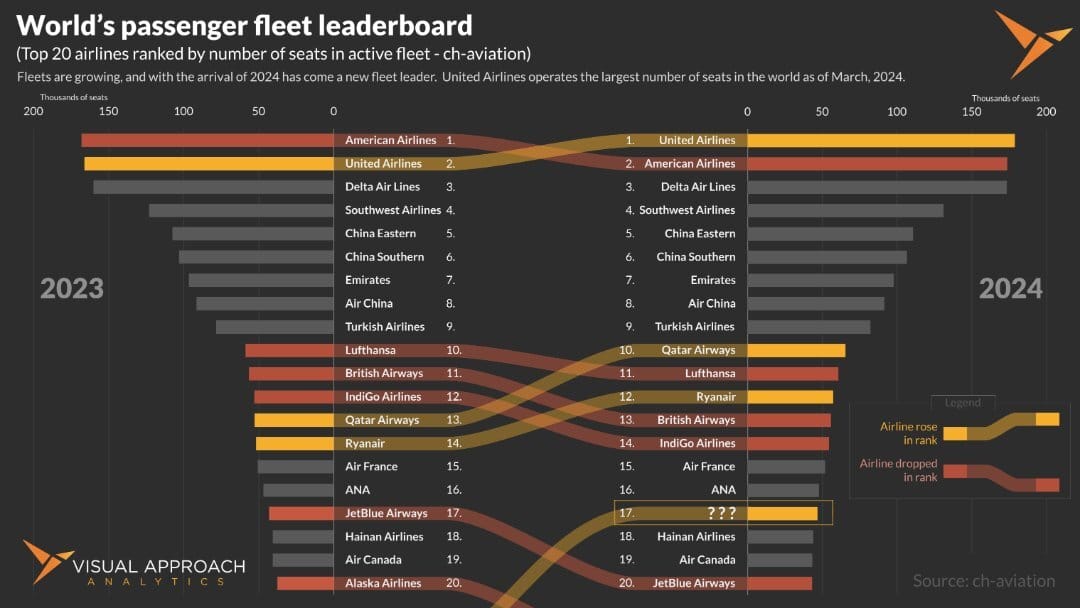

There are many ways to measure the largest airline. This week, we look at the number of seats in the fleet. It should come as a surprise to no subscribers of this newsletter that United Airlines has taken over the top spot.

The metric looks at total seats in the active fleet focused on operating airlines. That means regional or subsidiary airlines don’t count. Well, they do, just not towards the parent airline.

This is especially meaningful for United Airlines which controls a sizeable regional aircraft fleet as well, operated by other regional airlines. Despite not counting seats deployed by a large regional presence, the top three airlines remain United, American, and Delta, with Southwest Airlines remaining consistently in the fourth position.

We have noted some airlines expected to have moved up in the rankings. In particular, Turkish Airways and IndiGo Airlines have been in growth mode. Still, Turkish remained in 9th position, while IndiGo actually dropped from 12th to 14th. Since this metric considers active seats in the fleet, IndiGo still suffers from GTF issues, keeping some aircraft (and their seats) on the ground.

Qatar Airways and Ryanair are both in growth mode, increasing fleets relative to competitors, while JetBlue and Alaska take some needed breathers.

However, one airline rocketed (back) into 17th position. This airline caught our interest, especially considering its circumstances over the past five years.

Which airline is at number 17?

Research published this week

We have been in a research publishing frenzy the past week. Here are some of the analyses you may have missed if you’re not a subscriber to Visual Approach Research:

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact