Spirit and Frontier have too much capacity.

Sometimes.

The two airlines have been cutting capacity over the past year, though through slightly different methods. Spirit has actually removed aircraft, in part, through the fast Chapter 11 restructuring process. Frontier has not.

However, the two airlines are deploying other methods to reduce capacity without reducing fleet size. They’re flying less during the off-peak days - A lot less.

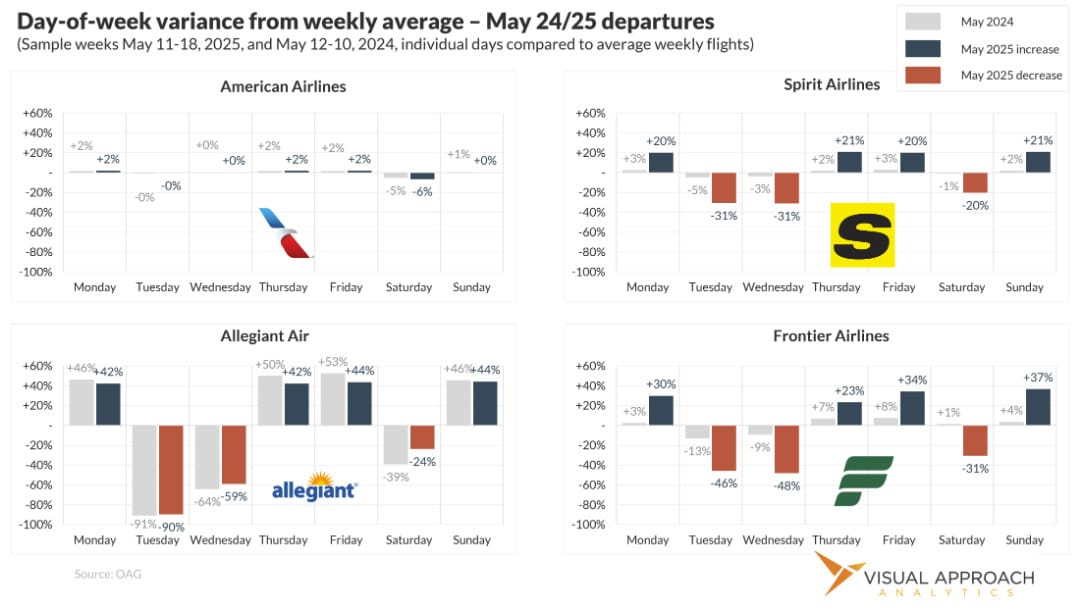

When considering a week in mid-May 2024, both Spirit and Frontier only saw minor deviations in flights during the weekly Tuesday/Wednesday/Saturday lull. Spirit saw Tuesday flights down a peak 5% from the weekly average last year; Frontier saw 13%.

During the same week in 2025, the variation in day-of-week flying has exploded at both airlines. Rather than a Tuesday lull of 5% for Spirit, in May 2025, Tuesday flights are down 31% from the weekly average. Frontier turned its 13% drop in Tuesday departures to a 46% drop. Wednesday was even worse.

How does this compare with other airlines? Consider American Airlines, which we’ll call our control group. The network airline does see fluctuations in its service by day of the week, just nowhere near Spirit and Frontier’s new strategy. But American’s lull is on Saturday, when those valuable corporate travelers are not flying, not on Tuesday and Wednesday.

Which brings us to Allegiant - the airline other ULCCs appear to want to be. Allegiant has been doing this since just after the Stone Age, during a period we refer to as The DC-9 Age.

There were times when Allegiant didn’t fly on Tuesdays at all. Today, Tuesday flying is only down 90% from the weekly average - a proverbial rush hour in context. In fact, Allegiant has made a slight shift in the opposite direction. Slight, but still different.

Allegiant has historically positioned itself with a keen ability to park aircraft. What grants the airline the ability to park airplanes? Cheap airplanes. Long story short, Allegiant long figured out how to best align leisure capacity with leisure demand. Spirit and Frontier are being forced to pick up the same playbook - only with a different fleet.

This chart from Cranky Network Weekly shows how this shift has come about for Spirit. Once a tactic reserved for slow February months, the drastic swings in daily departures are not something we’re seeing during peak summer months. Frontier has experienced much of the same change.

(Chart explanation: the line goes from fewer squiggles to more squiggles.)

Even considering Frontier’s use of day-of-week fluctuations in the past, the change since last fall is stark. It is no coincidence that the Fall 2024 schedule changes for Spirit and Frontier happened simultaneously when airlines started talking about overcapacity in the U.S.

Each week, Brett Snyder and I follow these network trends at the airlines through the Cranky Network Weekly publication. It is distributed to network planning teams at over 26 airlines in the U.S., Canada, and Mexico. If you’re counting, that’s about all of them.

We’ve been watching this new trend emerge from Spirit and Frontier for almost a year. It’s just one of several competitive shifts in the U.S., Canada, and Mexico. (If you think this is interesting, you should see the fight at ORD right now.) Let us know if you’re interested in reviewing the same weekly competitive report that the airlines receive.

The contrarian’s guide to the future of aviation

Remember that presentation we mentioned preparing for a few newsletters back? It happened. Here is the result.

At the latest ISTAT Americas conference, ISTAT tried a new presentation style —the AeroTalk. Designed to be similar to TED Talks, the AeroTalk showcases storytelling in aviation and is limited to 10 minutes. The story was the easy part. The hard part was telling it in 10 minutes.

I firmly believe in finding the potential for the future by looking to our past. “What better way to talk about the future of airplanes than to talk about the history of boats?”

If you don’t know the story of the amazing women of the Western Approaches Tactical Unit, you should. Google “WATU” or simply watch the presentation. It was an oddly proud moment to speak the names of these amazing people in the past.

However, the video lacks some context. For that, we offer the following images presented during the talk. They’ll make sense when you watch the video.

Our latest research

Talking Tariffs

Well, this oughta be interesting.

Today at 10 am Eastern Time, I’ll be joining a group of aviation experts discussing the latest impacts on tariffs. The webinar is free, and you can register using this link.

Catch the webinar before something changes and makes everything we discuss obsolete!

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact