It’s officially been over four years since COVID was declared a global pandemic.

Much has changed in aviation in the past four years:

Air travel has recovered faster than all expectations

Supply chain challenges are all the rage

The existence of the narrowbody shortage has reluctantly been accepted

The 737-7 and 737-10 have been certified(just kidding)

But one area that continues to lag in a COVID-esque reduction in traffic is transpacific travel.

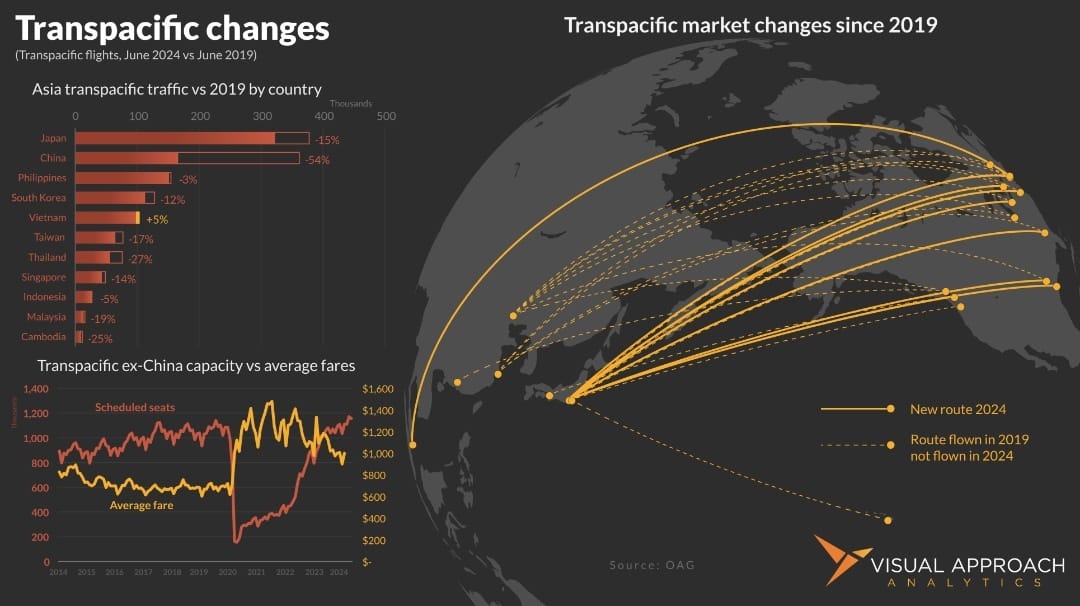

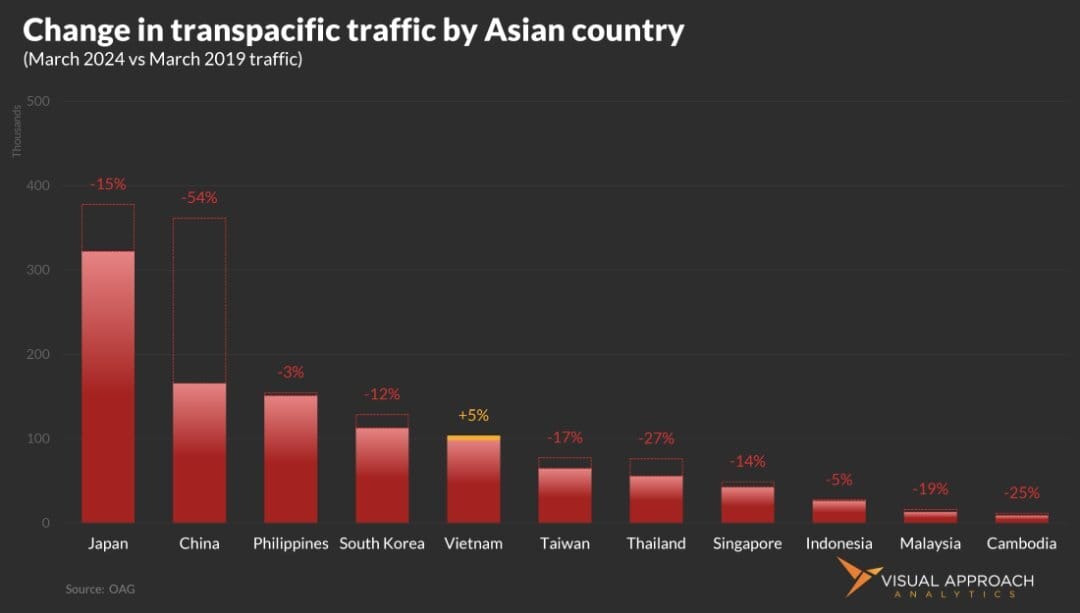

In fact, air travel between North America and East / Southeast Asia remains down 23% compared to 2019 levels. What gives?

China. China gives.

Traffic between North America and China is still less than half of 2019 numbers, a level driven by political fights between the two largest economies.

But, the majority of other transpacific routes are also down, with the exception of Vietnam. Does this mean there is no more demand between North America and Asia?

Even though traffic has been down since the pandemic started, fares have risen sharply. Once averaging a steady $700, ticket prices were twice that as recently as early 2023, peaking at $1,479 in 2021.

If we have reduced traffic but much higher fares, what does that tell us about demand?

Not since the reveal of Skywalker’s real dad has there been a plot twist of such proportions!

Maybe we’re overdoing it a bit, but consider what this data is telling us. By all measures, transpacific travel has been fundamentally damaged - all measures except the one that matters.

The transpacific market is just fine—like all of the other markets that have recovered. What it lacks is the ability to handle the demand that is competing for limited seats.

The news is good for the optimists. Demand has recovered. Now to appease the pessimists:

This also means that as capacity is added to routes over the Pacific, fares will continue to fall. Today, they are at a swanky $1,000. But if we have learned anything from the plethora of other markets years ahead in the traffic recovery (which we have learned lots), it’s that the fares will drop as capacity returns.

Sounds obvious, and yet, here we are. $700 fares are not necessarily a thing of the past.

Buckle up.

If fares are still over $1,000, what does that mean for first class travel? What about premium economy?

Did we see a shift to premium fare classes with the higher fares across the Pacific?

You’ll never guess the answer. Seriously, this one was a shocker → Answer.

Research published this week

We have been in a research publishing frenzy the past week. Here are some of the analyses you may have missed if you’re not a subscriber to Visual Approach Research:

Not a great week for aviation stocks. We could only find eight that were positive.

But American Airlines takes the cake this week - the disgusting, NDC-laced, maybe-I-shouldn’t-have-alienated-my-corporate-clients cake.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact