Well, we did it. 52 free weekly newsletters published in 2024.

Despite the estimated 250 hours spent during the year on a free newsletter (equating to over 31 working days) and the not unrelated questions about life choices, we’re declaring the year a success.

In 2024, active newsletter subscribers increased 55%. That's not bad, considering this is our seventh year publishing Aviation’s Week in Charts. Subsequently, total revenue has rocketed to $0.00 (inflation-adjusted, of course).

Our newsletter was read over 350,000 times during the year, meaning the 50,000 words typed were not done so in vain.

We ended the year with an average open rate of 51% and click-through rates touching 20%. That may not mean much to you, but in the newsletter world, that’s good. We know they are good because advertisers have taken notice.

Better than the seemingly endless unsolicited advertising opportunities these numbers generate, we are finding unexpected satisfaction by telling each to pound sand. But, as much as I’m sure you would benefit from another ad for Skillshare or a self-proclaimed AI expert, you’ll have to do without — Can’t mess up that perfect revenue streak.

We had several dozen people unsubscribe during the year, which is cool. We don’t want you to receive unwanted emails, so we always offer a one-click unsubscribe link with each email. No hard feelings.

However, we received 75 spam complaints, which speaks a bit to the dark side of this business. The vast majority came from a few bad actors signing up in order to forward every email to spam complaints. As a result, every new sign-up requires a confirmation to ensure that each person who receives the newsletter explicitly requests it. And yet…

We have had several top posts throughout the year, fitting into a few categories. Some were quantitative, while others were our picks. It’s good to be the king.

Without further ado, here are the top posts for 2024:

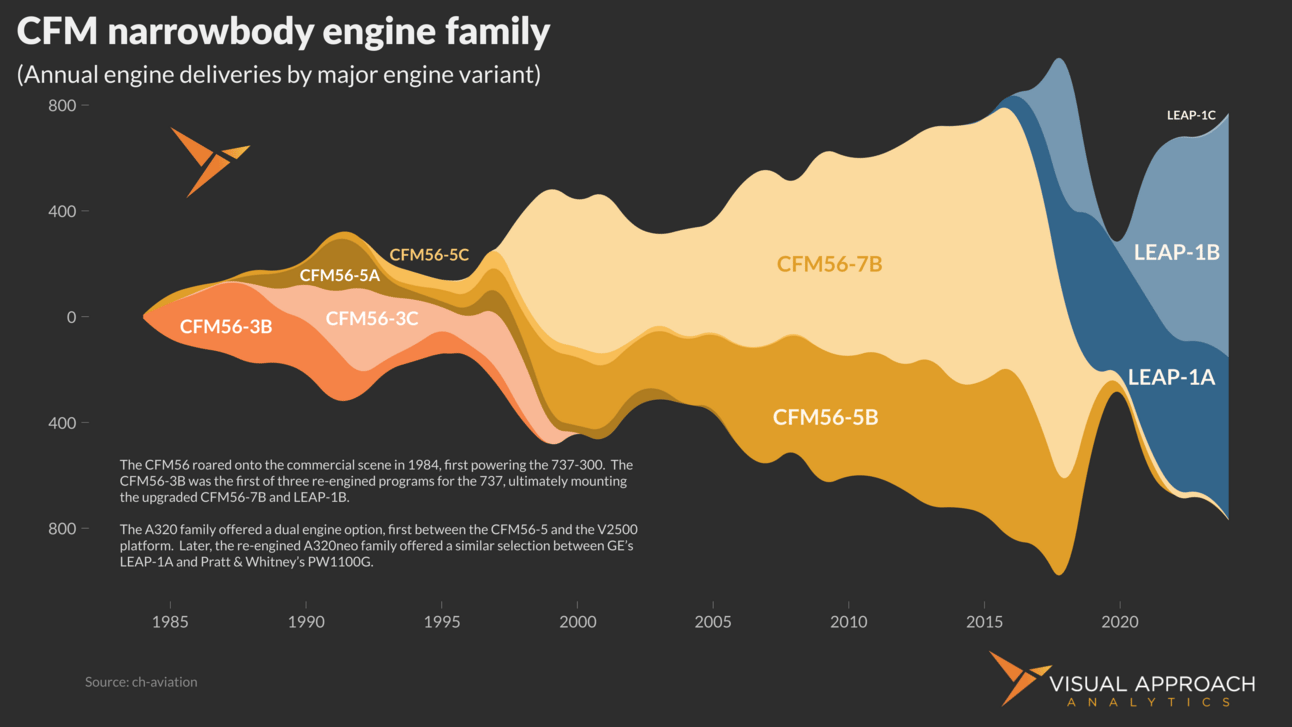

Most clicked - CFM’s narrowbody engine history

Our most clicked chart was a chart from early in the year, the history of the CFM narrowbody engine family.

The chart deploys a combination of ch-aviation data, python programming, and vector graphics. It was also the one most complained to us by the self-appointed “chart police.”

Look, if we wanted a chart for a board deck, it would have been a stacked bar chart. It would have also been boring and borderline unreadable. It wouldn’t have been this.

I am personally a fan of the steam chart. However, if you’re one to get out a ruler and measure each point to determine the number of engines delivered on new aircraft each year, this chart is not for you. We would dissuade rocket scientists from using a chart like this to determine orbital escape trajectory. This chart is accurate; not precise.

Despite the complaints about the mid-point x-axis and the challenges of seeing the chart as oil paint poured on a canvas, that’s not even the chart's problem. If we wanted to be precise, the lines would all be jagged. Smoothed lines have no business being in quantitative charts. They were also the most complex part of the code, and they were intentional.

Sometimes, you just need a way to look at a complex chart and get an idea of the flow of time. Things change. There is a beautiful symmetry in the history of the aviation story. As close as we can get to art, this was it.

Most controversial - new hires and unemployment data

Economic data. Who would have thought the most controversial post would have been good ‘ol hard economic data.

The number of angry emails we received about this chart topped the year. To be frank, we’re still not sure why, exactly, other than that it was an election year. If anything, the key takeaway from this analysis wasn’t in the data we found, but in the response. It was still early, but the divergence between economic performance and economic sentiment was still young by the time we published this chart. Now, it’s a well-documented phenomenon.

Most misunderstood - aircraft production shortfall

We’ve been documenting the narrowbody shortage for years. However, this chart does not show that. This chart shows the shortfall in aircraft production.

Subscribers to our premium research know we expect the narrowbody shortage to sharply slow in 2025 or 2026. Many factors are involved, not the least of which is the shift in lease extensions and aircraft retirements.

The feedback we’ve received from this chart being presented by other people appears to be incorrectly building the expectation that we expect the shortage to last forever. In fact, our forecast last year warned of just the opposite.

If you see our work presented elsewhere, that’s cool. Hopefully, it’s properly sourced (with our logo), but we aren’t so protective of our analyses that we don’t want anyone else to see them.

But, if our charts are used to make conclusions, don’t assume those are necessarily our conclusions. Shoot us a note. Better yet, subscribe to our full research. We’re not shy.

Biggest surprise - A321XLR market

We expected pushback on our A321XLR analysis. With the level of excitement (read: “hype”) around the aircraft as it entered service, our expectation that it would not exceed the market of the 757 was expected to be met with pushback.

We did receive pushback, just not the kind we expected.

The most notable feedback came from airlines suggesting the XLR may ultimately deliver fewer aircraft than are currently on order. That means they expect more cancellations than orders from this point forward. The real kicker is that some of the airlines that reached out have A321XLRs on order.

I’ll let that one sink in for a bit.

Our favorite - Ages of the world’s largest airline fleets

I mean, look at it — a programmatically generated ridgeline chart, manually calculated color gradients, varying transparencies, and vector graphics. Chef’s kiss.

Did you forget which of the 25 largest airline fleets retains the youngest? You can find it here.

So concludes 2024’s 52 aviation charts of the week. We can’t wait to get started on the next 52.

We can’t say enough about the past year and the overall growth of Visual Approach. All our metrics are moving in the right direction. We smashed our business targets for the year, and the first half of 2025 is already packed.

You’ll see us in Dublin, Phoenix, and Tokyo for Airline Economics and ISTAT. Invitations have already gone out for the Cranky Network Awards in Phoenix in February, where we’ll be celebrating the best of the airline network teams in North and Latin America.

I will be speaking at Aero-Engines in January, as well as leading the OEM panel at the Cranky Confab and the annual forecasting breakfast. If that’s not enough, we have another year of Time on Wing podcasts with industry professionals on the way.

Already, the gains from 2024 have been invested in creating more tools and a new website to further expand the research library.

In short, you’re going to be seeing more of Visual Approach Analytics in 2025.

Happy holidays, all!

2024 in review and a look toward 2025, podcast-style

Published this week is the latest Time on Wing Podcast with Mark Streeter and Jamie Baker. The first repeat guests in our two-year recording, Jamie and Mark talk about the trends in 2024 and the expectations for 2025.

There were a few surprises in 2024, but much of it played out as expected, only more so. To understand exactly what that’s supposed to mean, listen to the podcast.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact