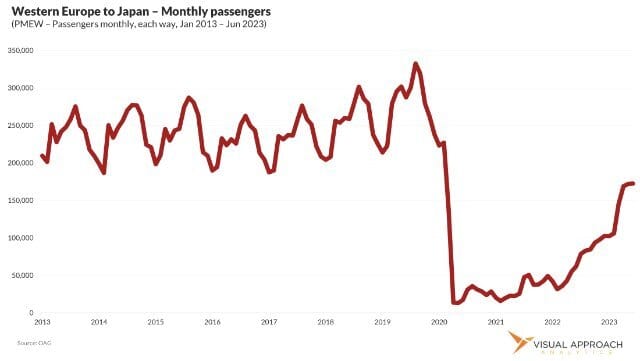

The tight connection between Japan and the Western world has existed throughout the commercial jet age. However, new obstacles have challenged that connection, from a global pandemic to a closure of nearly all airspace on the straight line between Japan and Europe.

This week, we spent extra time looking at passenger flows between Western Europe and Japan. Several trends stand out.

Firstly, Japan’s carriers now dominate the corridor. Still offering nonstop service around Russia, JAL has moved into the top spot as of 2021, a position long-held by ANA since 2014.

The European airlines (in dark blue) fill in the next tranche of airlines serving the market, often in their own local dogfights. For instance, Lufthansa held the top spot in 2013, now fifth in the market. KLM kept pace with partner Air France until 2022, when it fell to 10th position and currently sits at number 11. The limitations of Amsterdam departures has shifted capacity for the group to Air France.

Aeroflot offered connections in the market, taking advantage of the Moscow geography. As of 2022, Aeroflot not-so-mysteriously disappeared from the market entirely.

Without the availability of Russian airspace to the local carriers of Europe and Japan, other hubs become geographic powerhouses. Emirates has taken advantage of relatively southern Dubai to connect markets without a northern route.

From a macro perspective, the overall market remains down 40% compared to 2019 levels of traffic, even with the early surge in 2023. Even with economic headwinds facing the segment, we still see this as an opportunity for growth, likely to be accompanied by other Southeast Asian markets whose reentry into the global travel sphere did not begin in earnest until this year.

If the trend holds, the expectation is for Japan to maintain its lead in the market, but the landscape is changing elsewhere. Dubai is increasingly valuable for airlines excluded from Russian airspace. Istanbul also matches a similar benefit, driven further by Turkish Airlines’ aggressive growth - and access to Russian airspace.

If you would like a large version of the visualization, we’ve set up a form to receive it via email. Simply enter your email, and we will send it over. (Don’t worry. You won’t be subscribed twice.)

Tom Brady joins Delta Air Lines as a strategic advisor

In other, completely unrelated news:

Credit to Jean Druckenmiller for the photo of a Delta Air Lines 757 with a deflated popped tire in Atlanta last month. You can read the not-at-all-related-to-Tom-Brady story here.

Too easy.

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contac