Technology took nearly seven decades after the advent of flight to deliver the next milestone: the advent of flight with two aisles.

Okay, maybe we’re skipping over a few dozen milestones in between, but the point remains. It wasn’t until 1970 that the history of the widebody began with the arrival of the 747.

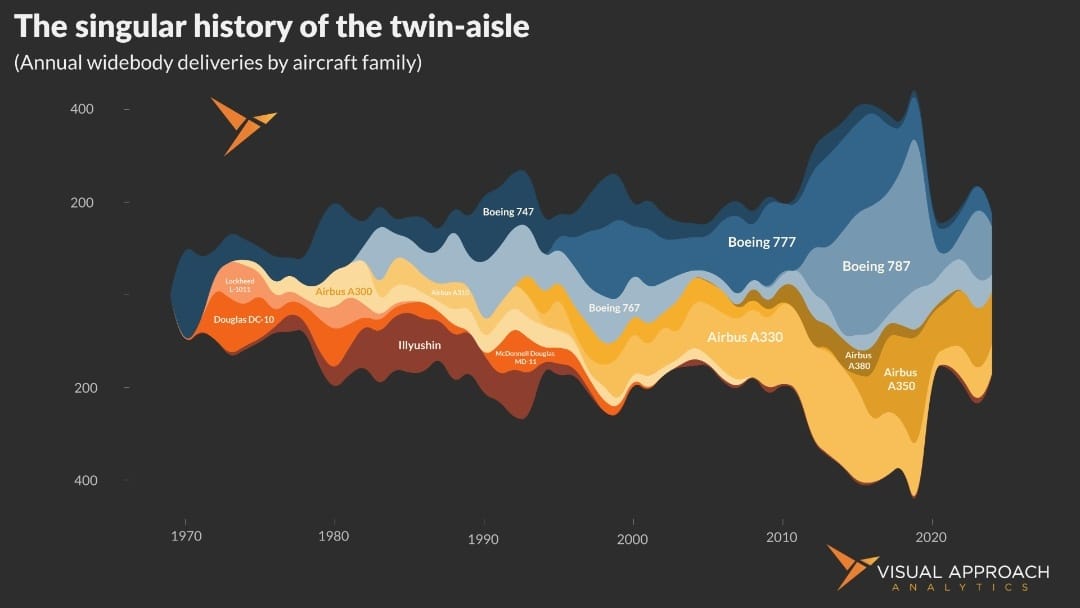

This week, we set aside the traditional area chart and turned to digital oil paint to show the singular history of the twin-aisle. Boeing dominates the blue shades, while Airbus is depicted in yellow. Everyone else gets orange.

Looking back nearly 55 years, the peak widebody production between 2012 and 2019 is highlighted —a period now better defined as an anomaly than a trend.

This faux-trend is easier to spot now that widebody production has returned closer to historical levels, further exposing the excess of the extreme decade. Today, a pandemic has opened the realm of the possibility of a deep downturn, coupled with new geopolitical barriers, and it looks more like the sector has returned to the long-term trend.

Unlike their narrow counterparts, the diversity of widebody aircraft has remained fairly consistent over the years. Starting with the 747, Douglas and Lockheed were close behind to compete with their tri-jets before Airbus arrived on the scene with the first wide twin.

We would be remiss to forget Illyushin, which operated behind the Iron Curtain during the 1980s. The manufacturer is still trickling out Il-96 aircraft today, having exited the Iron Curtain and reentered a geopolitical situation more akin to an aluminum curtain.

Today, it’s largely back to four families going forward: The A330, A350, 787, and 777 (eventually through the 777X). Deliveries of 767 freighters are already set to cease, leaving us with the four - a landscape like to hold for a very long time.

Our published research

Find us in person at upcoming events

This is the busy time of year, and we’re preparing for two conference presentations and two panels in the next few weeks.

First up is the Cranky Network Awards on February 27. This year, we will start Thursday afternoon with the Cranky Confab, where I will lead an OEM panel on the future of aircraft supply. The awards are held that evening with the airlines and free-flowing booze. Friday morning includes the annual Forecast Breakfast under Chatham House Rule, where we talk about all the weird things happening—and about to happen—in aviation.

After a weekend of minor league baseball, I will be staying in Phoenix for ISTAT Americas. I will either be dashing between meetings or leading the panel on mid-life exit strategies. Gueric Dechavanne will be leading the panel discussing the engine market.

I’ll also be speaking Tuesday afternoon at ISTAT with a presentation titled “A Contrarian’s Guide to the Future of Aviation.” This one will be very different from anything I’ve presented before, and whether it’s genius or a trainwreck, at least you’ll be entertained.

Finally, March rounds out with a panel at The Aerospace Event, where I will be sitting alongside three industry experts, including long-time colleague and friend Jon Ostrower. Prepare to be both amazed and disappointed — Amazed by the depth of conversation and disappointed by the amount of gray hairs not appropriately depicted in the picture.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact