We’ve partnered with Falko to bring you more free analysis and charts. Roughly once a month, we’ll include a second analysis for the week on one of our favorite and least understood markets: regional aviation. Of course, our regularly scheduled programming will arrive on Thursday as usual. If you would like to skip to the pdf download of this analysis, you will find it here: https://app.visualapproach.io/research/the-regional-jet-risk-paradox-how-high-concentration-masks-hidden-stability

The large regional jet is living in a narrowbody world. From one perspective, this makes sense. The regional jet fleet is barely one-tenth the size of the narrowbody fleet. That evaluation standards would be created around the fleet with ten times the presence suggests a certain level of prudence.

However, if a single regional jet or aircraft were evaluated using the same metrics as the larger fleets, the evaluation would be incomplete at best; invalid at worst. Such is the case with the large regional jet fleet.

Of course, not all regional jets are created equally. The differences between the small and large regional jets are vast, driven by entirely different business models and forces better discussed in a separate analysis. Today, we focus on the active large regional jet fleet – the CRJ700, CRJ900, E170, and E175 aircraft.

Already, we have written multiple analyses describing the unique nature of the regional jet market. The vastly different business models from traditional airlines distinguish the regional airline business. The long-term nature of the Capacity Purchase Agreement (CPA) structure under which so much of the regional jet fleet operates today creates a unique, if nuanced market.

In a recent analysis, we outlined how this unique market creates different dynamics for residual value of large regional jets. Applying the narrowbody standard residual value assumptions to the regional jet market results in overestimated risk and underestimated value.

In this latest analysis, we consider the opposite side of the aircraft risk equation – airline credits. Is it prudent to evaluate regional airline credits the same way we do those with narrowbody fleets? Which airline is ultimately driving the demand for the aircraft, and are we subsequently evaluating the risk appropriately?

For a fleet barely 10% the size of the larger narrowbody standard, it can appear tedious to evaluate credits of the regional business differently. After all, understanding the regional aviation business takes context, nuance, and a deep level of understanding – just like any other sector. It’s hard, and that’s precisely why such value remains untapped.

The regional jet concentration tradeoff

In this context, we consider market liquidity as aircraft transitioning between airlines. By narrowbody standards, regional jets tend to have higher operator concentration than the typical narrowbody. Even after considering the smaller fleet sizes, regional jets are far more concentrated at fewer airlines, triggering metrics that may suggest risk.

Yet, if we deconstruct concentration and why it matters so much in aircraft leasing, we can reconstruct a more appropriate picture for regional fleets. The value of market concentration to investors and lessors is to have a broad base of aircraft into which new aircraft can be placed. In the case of default or a simple lease return, low concentration represents greater options for placement.

Yet, the risk of holding onto unplaced assets is more than simply a function of the options once an aircraft is returned. Integral to the calculation is the likelihood that the aircraft will be returned or transitioned at all.

When considering the large regional jet fleet (CRJ700, CRJ900, E170, and E175), only 24% of the fleet has ever been transitioned to another airline. This includes both owned and leased aircraft throughout the full course of the aircraft lives.

Narrowbody aircraft are 50% more likely to endure an operator transition than a large regional jet. Over 37% of the entire narrowbody fleet has either been sold or remarketed to a different airline. With more than one-third of the entire passenger narrowbody fleet seeking placement at a different operator during some point in its life, it is no wonder that reduced market concentration is so important.

Even with less than one-quarter of large regional jets needing to find new homes throughout the course of their economic lives, the shifts are more likely to be in regional airline only – staying within the same major airline fleet.

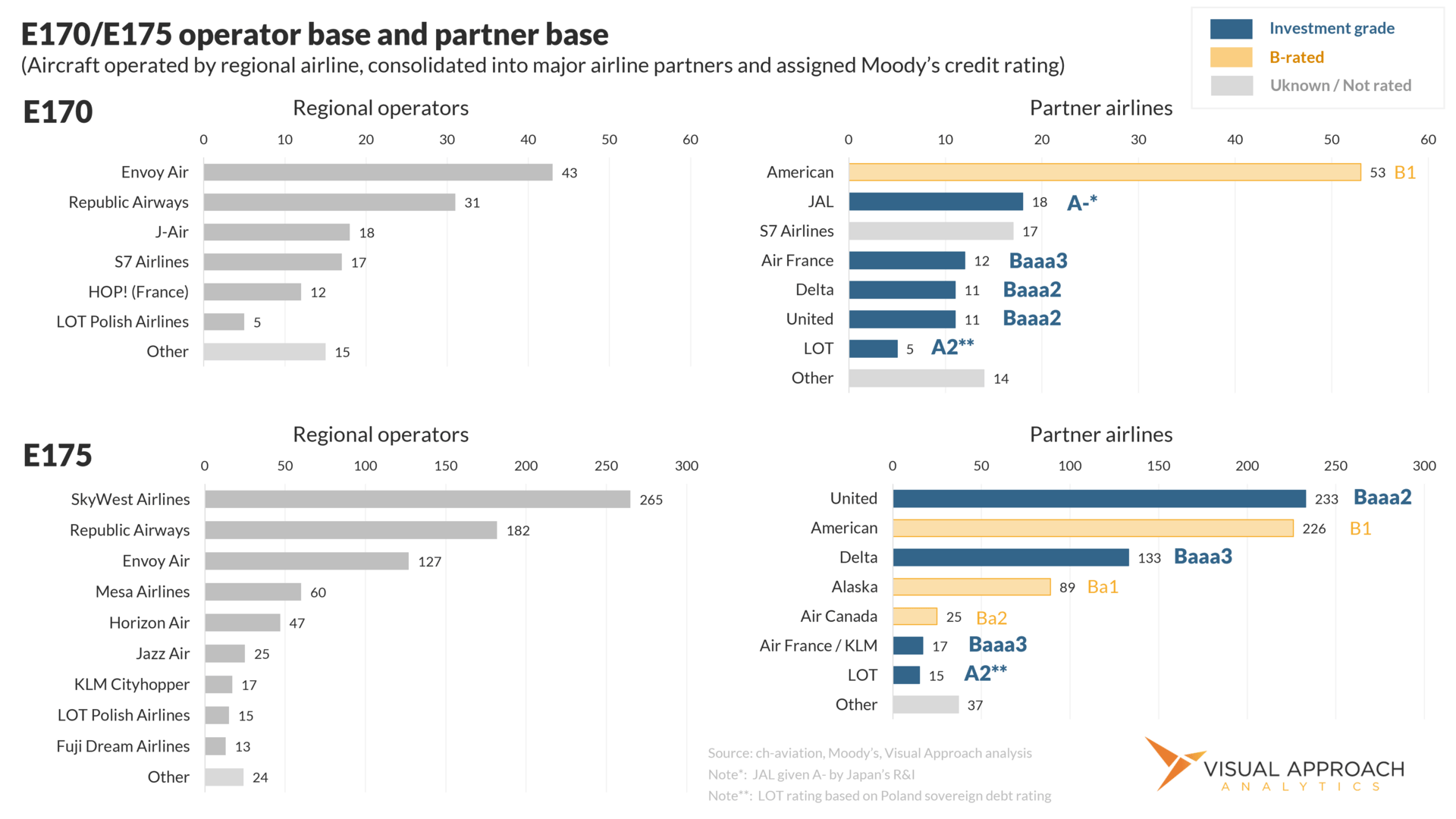

For instance, Compass Airlines once operated a fleet of 56 Embraer E175 aircraft. 36 were operated for Delta Air Lines while 20 were operated for American Airlines. After the airline was shut down in 2020 in the midst of COVID, the aircraft were transferred to different operators.

Of the 36 aircraft operating in Delta colors, 10 went to SkyWest Airlines and 26 went to Republic Airways – all 36 still operating within the Delta network. The remaining 20 aircraft flying for American were transitioned to Envoy Air, still operating for the same parent customer, but technically with an operator transition.

Our calculation of the 24% of the large regional jet fleet that has transitioned to other operators does not adjust for these pseudo-transitions. In reality, when accounting for transitions within the same partner airline fleet, the number is closer to 12%.

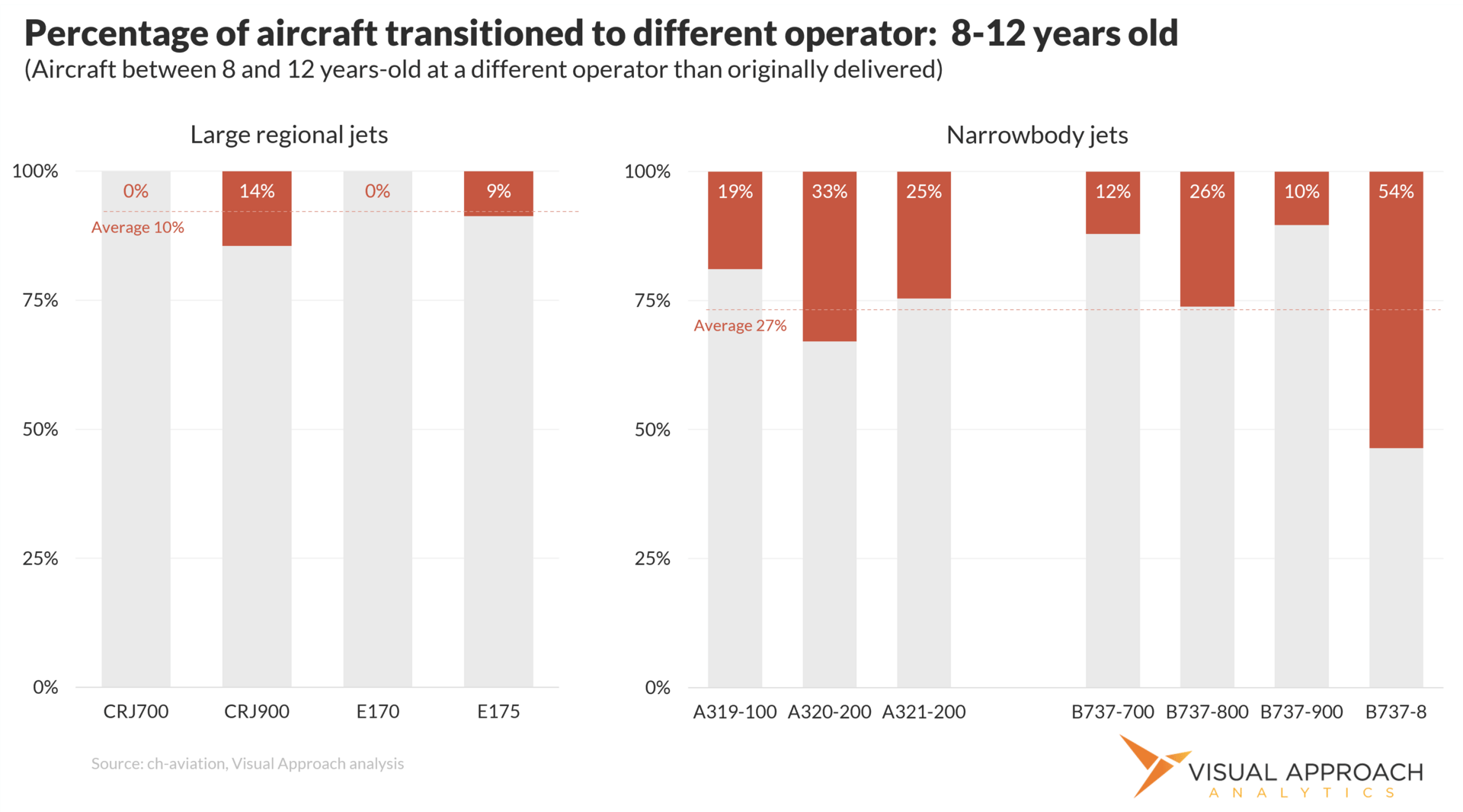

When considering fleets that have transitioned between operators after a typical first lease of 8-12 years, the differences between the narrowbody and the large regional jet become even more apparent. 27% of the narrowbody fleet has transitioned to new operators when aircraft are between 8 and 12 years old.

For large regional jets, only 10% of aircraft are moved to new operators during the crucial 8-12-year mark when first leases come due. This is before considering many of those aircraft also transition between operators within the same parent airline ecosystem.

The result is that overall fleet concentration is still important for large regional jets – just to a greatly reduced magnitude. Even though the number of operators at which to place remarketed aircraft is lower, so, too is the likelihood that large regional jets will need to be remarketed at all.

This is fundamental to the regional business, particularly with so many large regional jets present in the North American market. Capacity Purchase Agreements are not only traditionally long and aligned with lease terms, but they tend to be extended. Considering the pilot scope clause-driven environment creates such a stable and defined market, this comes as no surprise. Further, 95% of all large RJ deliveries in the past decade have been into the North American market.

It is for this reason we believe the metric of fleet liquidity should be reconsidered and adjusted for the likelihood the aircraft will ever need to rely on other operators. With fleet concentration three times greater than narrowbody aircraft, the large regional jet has proven to be remarketed one-third as often.

This creates a nearly one-for-one tradeoff between fleet liquidity and likelihood of a return. And yet, the nuance always remains within individual deals themselves. Yet, for investors avoiding the large regional jet space based on concerns of fleet liquidity, value has been missed.

And yet, even with the lower rate or remarketing required for the fleet, the question of the quality of airlines at which the fleet is currently operating remains an important question. Given that we can reconcile the relatively high concentration of large regional jets with the relatively low likelihood of needing to remarket the aircraft, how can we consider the creditworthiness of the airlines?

Airline credits in the regional airline business

The financial reputation of a lessee matters. Regardless of whether the leased item is a car, an apartment, or a commercial aircraft, the ability for the airline to pay rents is a critical factor.

This is equally as true in regional aviation. Airline credits matter. What is different in regards to airline credits and regional aviation is in which airline credits matter.

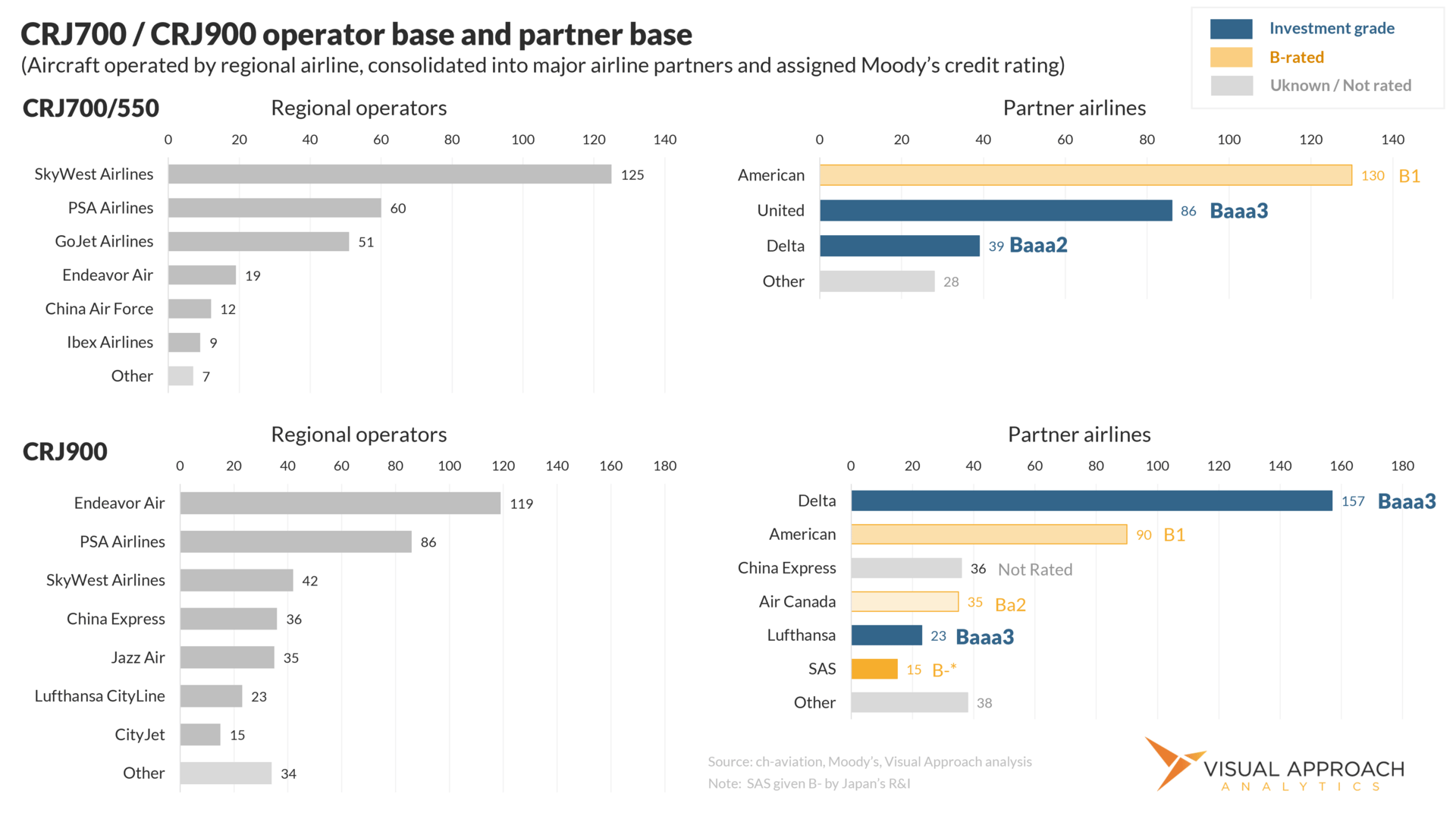

With over 80% of the large regional jet fleet operating under Capacity Purchase Agreements in North America, the ultimate demand for the aircraft is driven not by the regional airline but by the major airline partner.

Indeed, in many of these CPA arrangements, the aircraft are often fixed with the major airline partner, even though they may be moved between regional operators. The Compass Airlines example above illustrates just this very dynamic.

Considering then, the credit rating of the airlines ultimately generating the demand and choosing the aircraft types with which to fulfill their large regional jet needs becomes relevant.

Between the U.S. and Canada, over 90% of the U.S. regional fleet is operated for large major airlines, fulfilling the demands of the larger networks. Similarly, the fundamental need for the aircraft is driven, not by the regional airline, but by the major airline.

To be certain, the viability of the regional operator remains crucial in determining the risk of a particular aircraft; unlike the narrowbody market, it is often not the only credit to matter.

For instance, should a regional operator default on a lease, it is the major airline partner that would suffer the network effects of a repossession. Similarly, any lease returns are very likely to have separate Capacity Purchase Agreements that could be misaligned. In either case, the decision to return an aircraft to a lessor, for which the lessor would need to find a new operator, is substantially lower than traditionally experienced in the overall aircraft market.

Additionally, any regional operator unable to continue a lease would leave the major airline partner without needed capacity. In that regard, any default would see both the lessor and the major airline partner looking to remarket the aircraft – likely at one of the major airline’s other regional operators.

While we do not consider the major airline partner as the primary credit (though many major airlines own the regional aircraft they, themselves, then lease to regional operators), we do consider the health of the major airline partner as a very strong indicator of the aircraft’s ability to stay within that airline’s regional network.

In the narrowbody world, this is akin to considering a narrowbody on a long-term ACMI/wet-lease to an airline. Even if the ACMI provider were challenged in honoring the lease, it is the partner airline that would suffer the lost capacity. In some cases, large airline partners could represent challenging credits of their own, for which the aircraft itself should be considered a riskier asset.

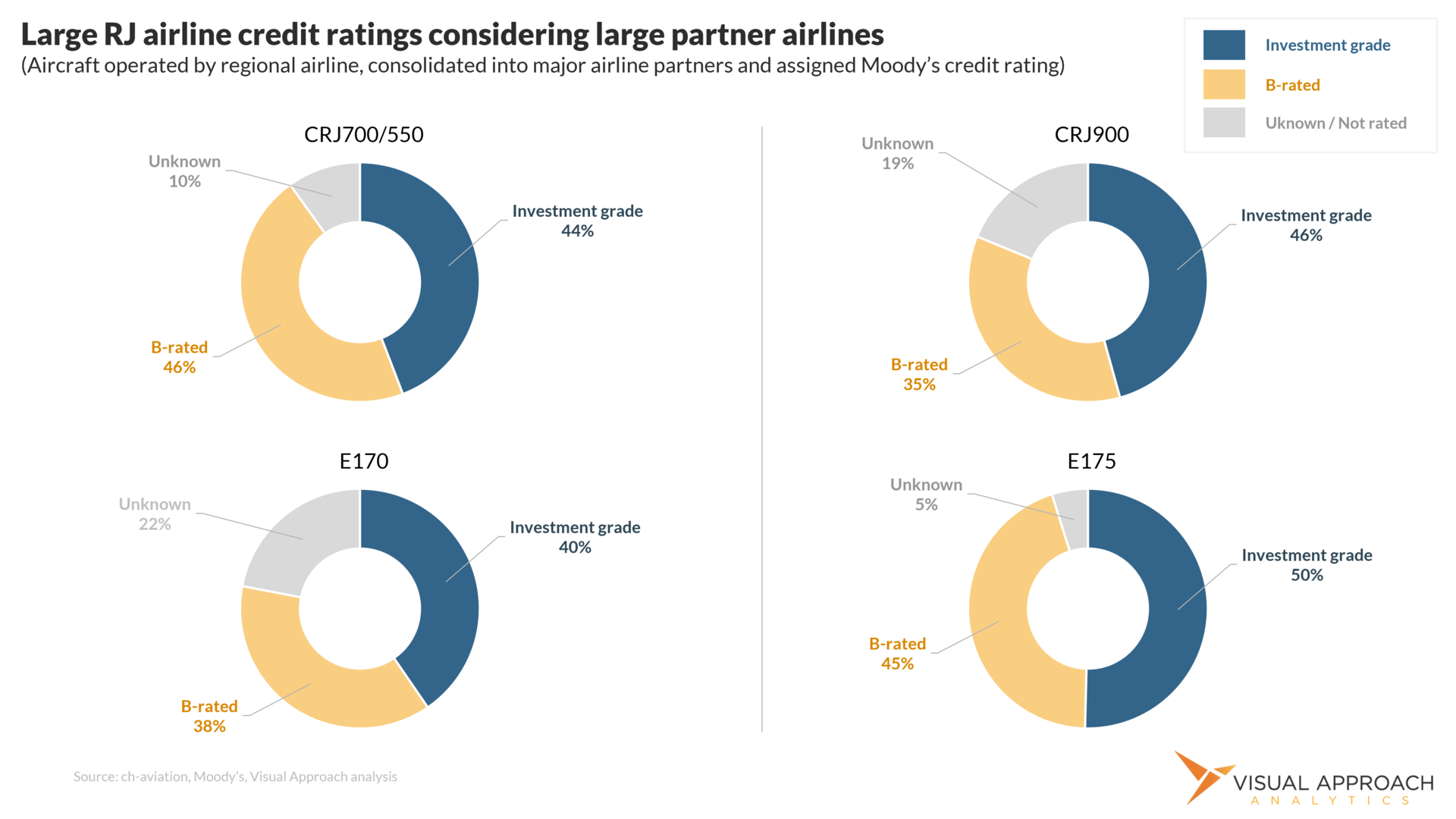

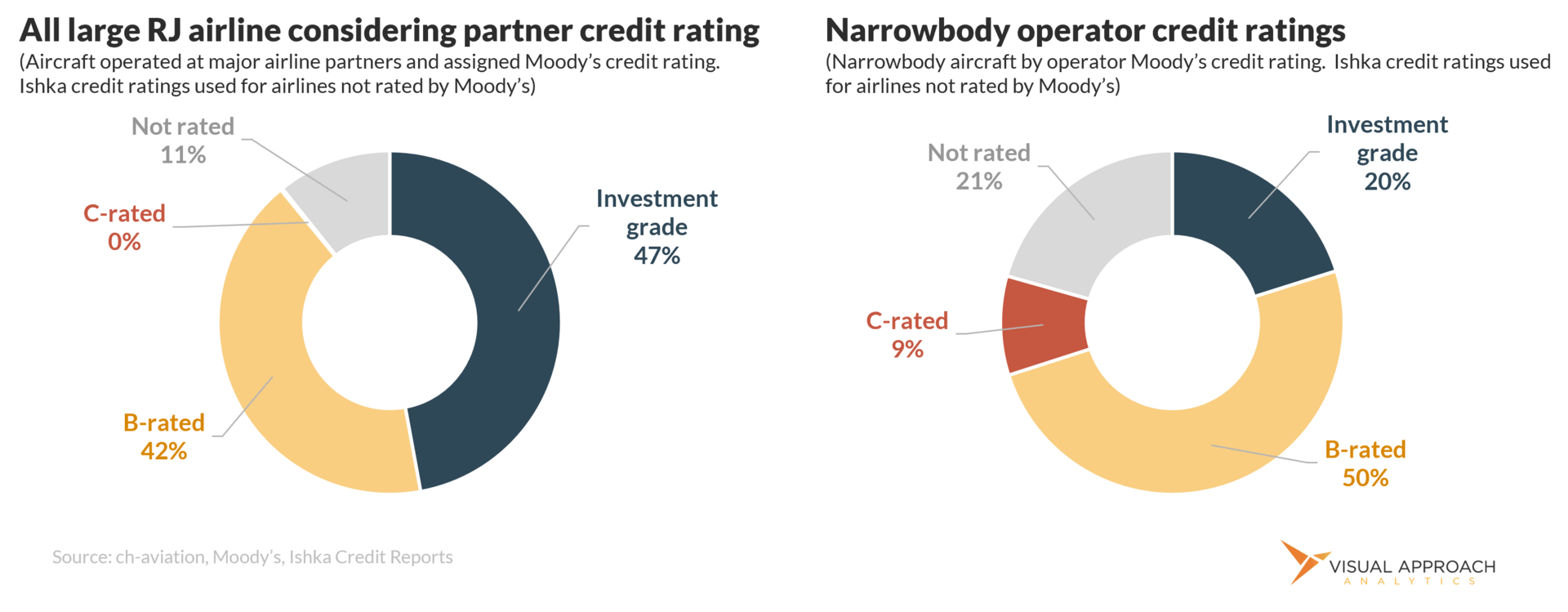

But, as it applies to the large regional jet partners, airline credits are higher than the industry average. Nearly 50% of the large RJ fleet operates for major airline partners with investment-grade credit ratings.

Both Delta Air Lines and United Airlines represent a large portion of the overall fleet, and both have been granted investment-grade ratings of Baa or greater by Moody’s. In Europe, airlines with fleets of large regional jets include Lufthansa, LOT Polish Airlines, and Air France / KLM. All three have investment-grade ratings, and all three require large regional jet capacity (LOT Polish Airlines has not been issued a corporate credit rating but relies on the sovereign rating of Poland).

Even the quality of the B-rated airlines stands out. American Airlines, Air Canada, and Alaska Airlines make up the vast majority of regional aircraft operating for non-investment-grade airlines, and yet all three are considered top-tier airlines.

Alaska Airlines, for instance, operates 89 E175 aircraft with a rating of Ba1 – just below investment grade status. Yet, Alaska has been an investment-grade airline up until its recent purchase of Hawaiian Airlines. As Alaska Airlines continues the integration, the expectation is of a return to investment grade.

This distribution of credit risk among the regional jet fleet is better put into context when comparing it with the massive narrowbody fleet. Considered the gold standard for low fleet concentration and credit profiles, the Airbus A320 and Boeing 737 families are found across the globe. With market sizes ten times greater than the regional market, the narrowbody sector is often considered the safest sector for investment.

Indeed, the narrowbody defines an incredibly strong sector. Slightly over 20% of A320 and 737 aircraft are operated by airlines considered investment grade. Fewer than 10% of the aircraft are at airlines with a Caa rating or lower, and 21% are at airlines too small to drive a rating.

And yet, if we consider operator credit ratings as a reliable measure of risk, the regional jet handily outperforms the standard narrowbody market. More than twice the portion of the regional jet fleet is operated at airline partners with investment-grade ratings compared to the narrowbody market. Less than 0.2% of the large regional jet fleet is operated at airlines with a Caa or lower rating compared to 9% of the narrowbody fleet. Comparatively, only 11% of large regional jets are operated by airline partners not rated, compared to 21% of the narrowbody fleet.

Notably, any narrowbody aircraft operated at a subsidiary airline was granted the credit rating of the parent company for this analysis, identical to the method used in assigning credit ratings to regional jet partner airlines.

It is from this standard of the narrowbody market that we can regain context of the extreme levels of managed risk within which the large regional jet is operating. The risk of the narrowbody asset is an incredibly well-managed sector. From the operator risk standpoint, operator risk for the large regional jet is lower, yet.

When combined, the unique differences of both the risk of redelivery and the context of the major airline as a stakeholder in the regional partners' risk profile generate a unique view of risk in the large regional jet market.

This is not to say the large regional jet represents no risk, rather that many of the factors used in defining its risk are interconnected in ways not present in larger aircraft fleets. This presents a nuanced approach to assessing large regional jet risk.

From our perspective, when considering the operators of large regional jets for risk and reward with the full context of how the risk may play out, the end result is a measurable reduction of risk.

For a segment viewed as high risk / high reward, the value comes from understanding the fundamental nature of the risk itself. For large regional jets, applying the dynamics of the narrowbody market simply overestimates the downside, ultimately resulting in a remarkably stable market unexplored.

Falko is a leading aircraft lessor and asset manager focused on the 70 – 130 seat aircraft segment and is one of the longest-standing lessors and managers of aircraft of this size globally.

If you are interested in learning more about investing in small commercial aircraft, please contact Falko’s Investor Relations team at [email protected]. For further information about Falko, visit their website or follow them on LinkedIn.

For a PDF download of this analysis, you can find it here: https://app.visualapproach.io/research/the-regional-jet-risk-paradox-how-high-concentration-masks-hidden-stability

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!