JetBlue may be the first canary for the U.S. coal mine of air travel.

The airline just warned of delayed profitability, pushing out the expectation of break-even beyond 2025.

Of course, an airline warning of profitability expectations is nothing new. It’s just that those warnings are usually accompanied by a “we just can’t get airplanes fast enough.”

In fairness, Wall Street seemed to buy that line in the past, disregarding the open question of how much demand was available for growth when the airlines couldn’t make money with smaller fleets, overall less supply, and higher pricing power (we’re looking at you, Spirit).

Sure, costs are associated with preparing for aircraft that don’t arrive, but you know what’s more expensive? Preparing for aircraft that will arrive and then paying for those aircraft. Particularly when we had watched demand plateau last year.

But JetBlue is the first to warn of a new potential inflection point in demand - fall bookings.

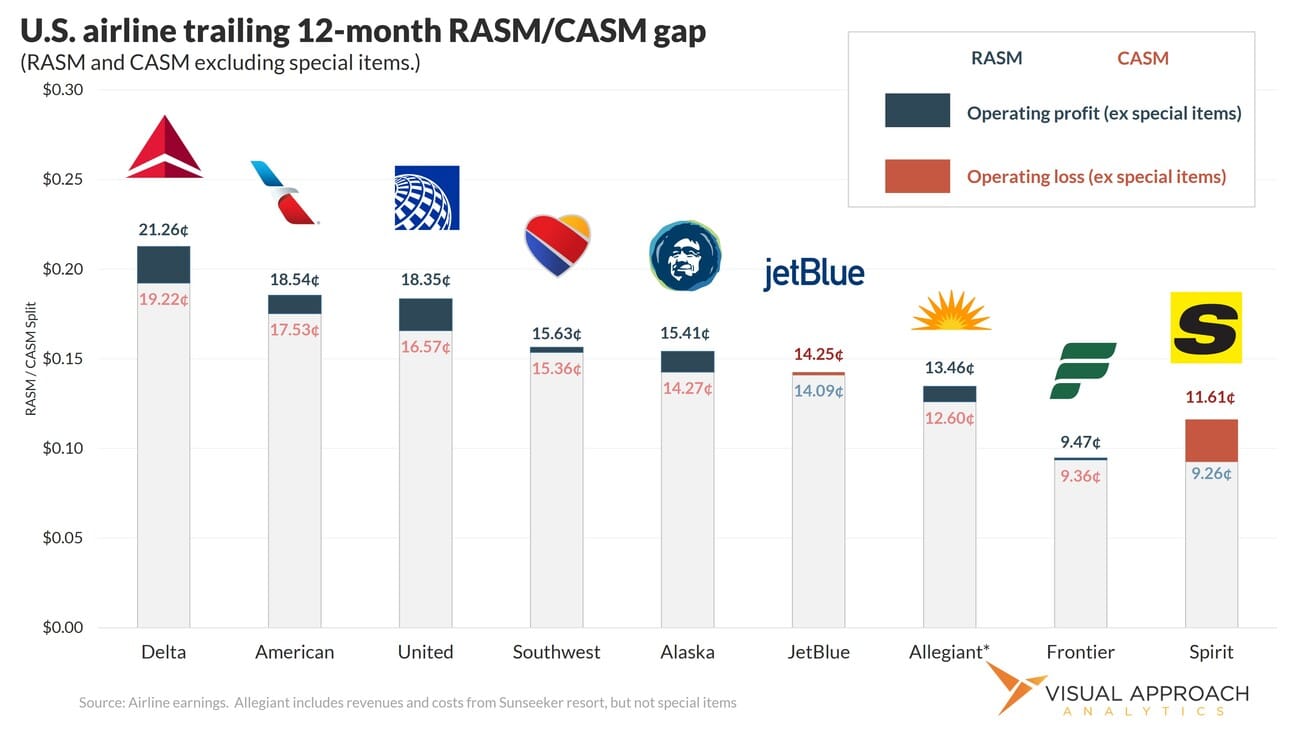

Why did JetBlue warn of this drop in demand? Because they can’t absorb it and still hit profitability targets. JetBlue’s RASM/CASM gap is razor thin, and they're on the wrong side of the razor.

So what? This isn’t an analysis of JetBlue’s problems. The airline sits dutifully in the middle of the pack. This is an analysis of how much demand drop the U.S. market can absorb.

Answer: It’s not much, at least not if profitability is a target (see: JetBlue).

Looking back at the trailing twelve-month difference between RASM and CASM for airlines, it’s a bit narrow.

Why is there suddenly a drop in demand? We don’t know, but we have our hunches. Remember those tariff threats last spring, the majority of which are now taking some sort of effect? Most people expected immediate impacts. Indeed, we did see those immediate impacts from Canada and Mexico.

However, beyond travel decisions made for geopolitical or insult-responding reasons, confidence in the overall economy drives many decisions. That is eroding, but it doesn’t happen overnight.

Now, consider the gap between when passengers book and when they travel. JetBlue is warning of fall bookings, but those bookings are being made now. The summer revenues that are coming in (still disappointing, but not to warning levels) were likely made during the spring. For the U.S. airlines, the relief of strong future summer bookings are shifting into current summer bookings, while the future fall bookings are looking softer than usual.

And it’s not just the U.S. airlines. Lufthansa is warning of a significant drop in demand to the United States in the fall.

When we start to hear multiple reports like this, we take notice. Even though Lufthansa was first, it was JetBlue that counts as the potential canary for us.

How much of a downturn can the U.S. airlines withstand? It depends. Anywhere from none to about 10%. Profit margins are already thin due to a significant rise in costs post-pandemic.

Is a 10% downturn in bookings possible? Sure. Our estimate is probably closer to 5%, but 10% is pretty run-of-the-mill compared to prior years. We don’t expect this to be a sudden crisis.

But this is another inflection point in the post-COVID world. We saw airlines chase demand with higher (much higher) costs, then we saw demand plateau as it returned to normal levels. Now we’re faced with that first real travel downturn - a downturn that appears to be aligned with economic concern in the U.S.

Our published research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact