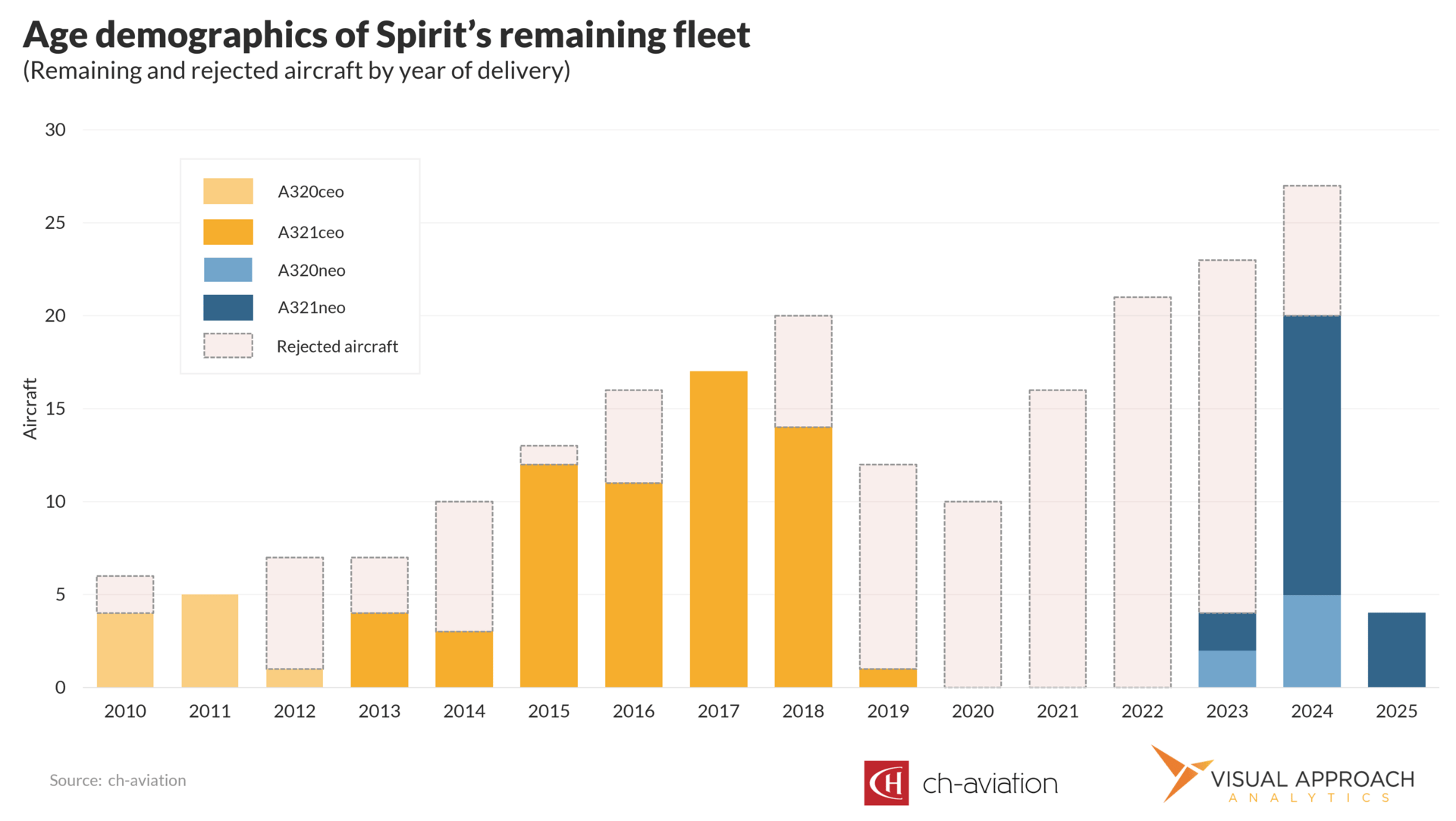

Spirit just rejected a good portion of its fleet. While it wasn’t the entirety of the NEO fleet, it was the lion’s share. Taking deliveries since 2016, all NEO aircraft delivered prior to August, 2023 have been rejected.

A320neo, A321neo, it doesn’t matter. If it has anything to do with potentially contaminated powdered metal, it’s out.

But it wasn’t just GTF-powered NEOs that were rejected. Eight A320 and eleven A321 aircraft, all V-powered CEOs, have also been sent back to the lessors. Why?

We don’t know for certain, though we can offer some factors that may have sent some aircraft back, while others remain in the fleet and on leases.

The first potential reason Spirit may have chosen not to reject an aircraft is that they simply like the lease. It may have recently been renegotiated, or perhaps the older leases were written to a still-satisfactory level.

More than likely, however, it comes down to maintenance return conditions. If you’ll remember back to last decade - way back when Spirit was seeing double-digit returns - the idea of a Spirit bankruptcy was very small. It stands to reason that Spirit would have been able to negotiate leases with a bit more leverage than it has today.

Regardless, aircraft maintenance is expensive today. Engine shop visits and overhauls are even more expensive. If Spirit is looking down the barrel at a potential $15 million or greater maintenance bill to keep the aircraft operating, and it can be sent back to the lessor as-is through the bankruptcy rejection process… Here are the keys. You can find your airplane in Phoenix.

On the other hand, if the aircraft is on a favorable maintenance program or flush with available hours to the next check, it stays.

Remember, too, that Spirit has a sizeable owned fleet, as well, that will be subject to maintenance checks at the same intervals. In fact, of the 57 aircraft Spirit controls, all are of the CEO variety, and 19 are parked. That means it remains likely that some of those aircraft will not return.

The new math for Spirit’s fleet is 53 aircraft remaining on leases, plus 57 owned aircraft, minus 19 owned aircraft that are currently parked - plus or minus some stored aircraft that could be reactivated or vice-versa.

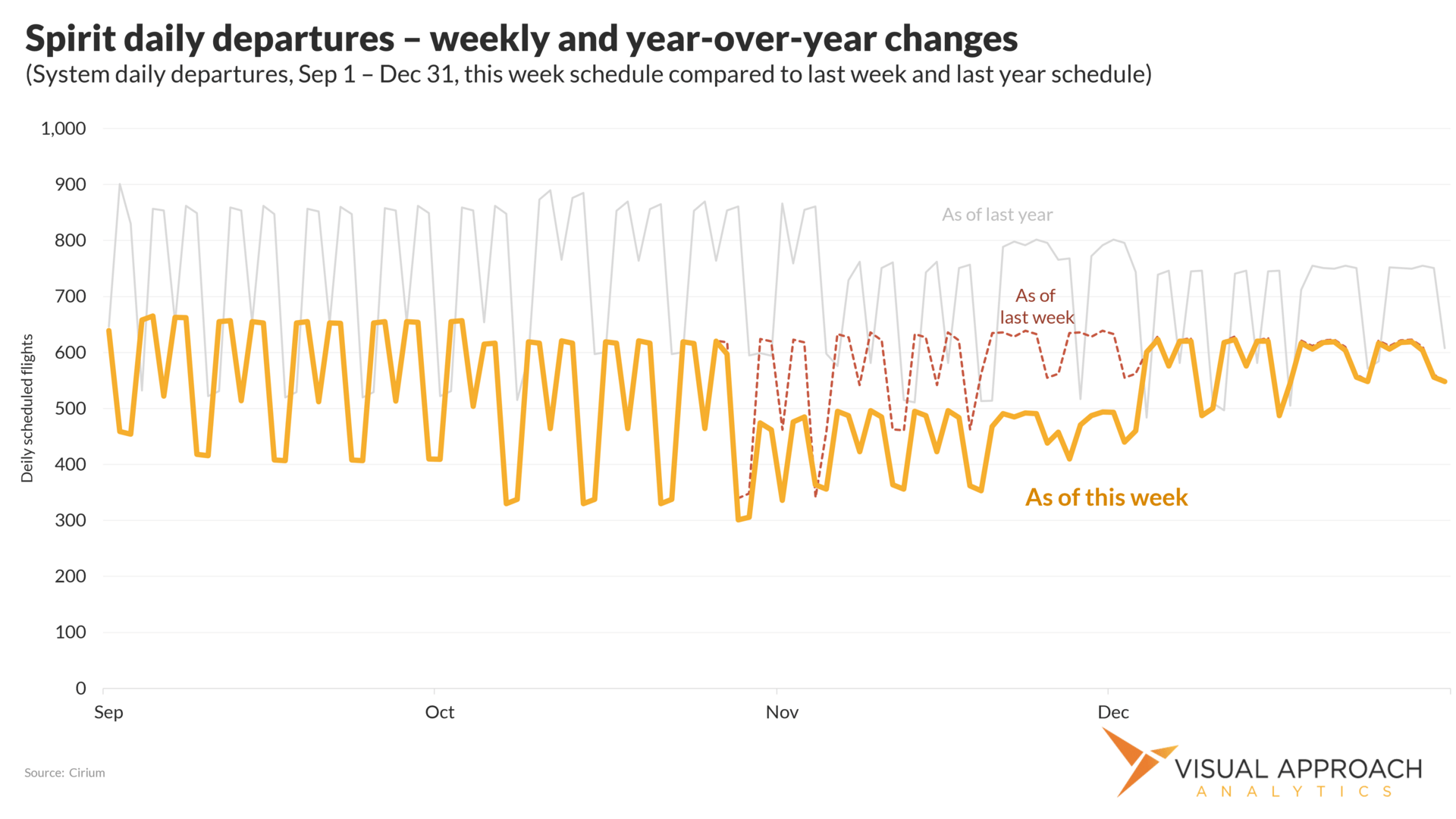

Spirit’s fleet will be less than half of its former self. Does that mean Spirit we should expect the Spirit schedule to be cut by another 50%?

No, and here’s why: Many of those aircraft rejected were already on the ground. If they were NEOs, they were waiting inspections on the GTF engines. That means a check was being written to each lessor once a month for rentals on aircraft that could not be flown. That also means the airline was already much smaller in network breadth, even if the number of yellow aircraft was substantially higher.

Published in last week’s Cranky Network Weekly, you can see how Spirit’s daily schedule compares to last year, and the recent cuts it just made. During the recently cut period, Spirit has pulled an additional 22% of its schedule - a substantial number, but one that already reflected the parked aircraft. Compared to last year, scheduled flights are down 38%. A more substantial cut, but still not representative of the change in fleet size. Remember that many of the A320neo aircraft awaiting GTF inspections were on the ground then, as well.

Which leads us back to the fleet itself, and the gap that has emerged between Spirit’s ongoing CEO and NEO fleets. The last CEO arrived at Spirit in early 2019, while the first retained NEO arrived in late 2023. The split is substantial.

And yet, not all CEO aircraft to stay in Spirit’s fleet are owned. As mentioned previously, some leases on older aircraft have been retained (though we don’t know the time remaining).

This has split Spirit’s fleet into two buckets we like to call “Here’s why you should buy us now,” and “Here’s why you’ll be happy to have us in the future.”

The CEO fleet is valuable, particularly in a sale scenario. But last we checked, Airbus’s production rate on the A320ceo family was zero. Not to mention many of the new deliveries are still on the way (many of which had been promised to AerCap through pre-arranged sale-lease-back deals).

The idea of shrinking to profitability may not be impossible - shrinking to less than half your former self is drastic enough to leave room for surprises, but it would still be a surprise. But Spirit is now bite-sized. A big bite, yes, but a manageable one.

And thus, the Spirit fleet gap remains. If not for shrinking to profitability or for creating a digestible airline for someone else, then for a very good third reason: the aircraft that would have fit in that gap all have bum engines.

Either way, here we are.

Podcast with Subodh Karnik

Our latest podcast resurrects the names of Continental Micronesia, Northwest Airlines, Delta Express, Air Jamaica, ExpressJet, and Aha!

Subodh Karnik has a unique, deep, and broad experience in U.S. (and Jamaican) aviation. Half the conversation scratches the nostalgic itch of the crazy times. The other half applies his experience and perspective to the currently crazy times.

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact