The options are dwindling if your airline needs airplanes and you don’t already have a place in line.

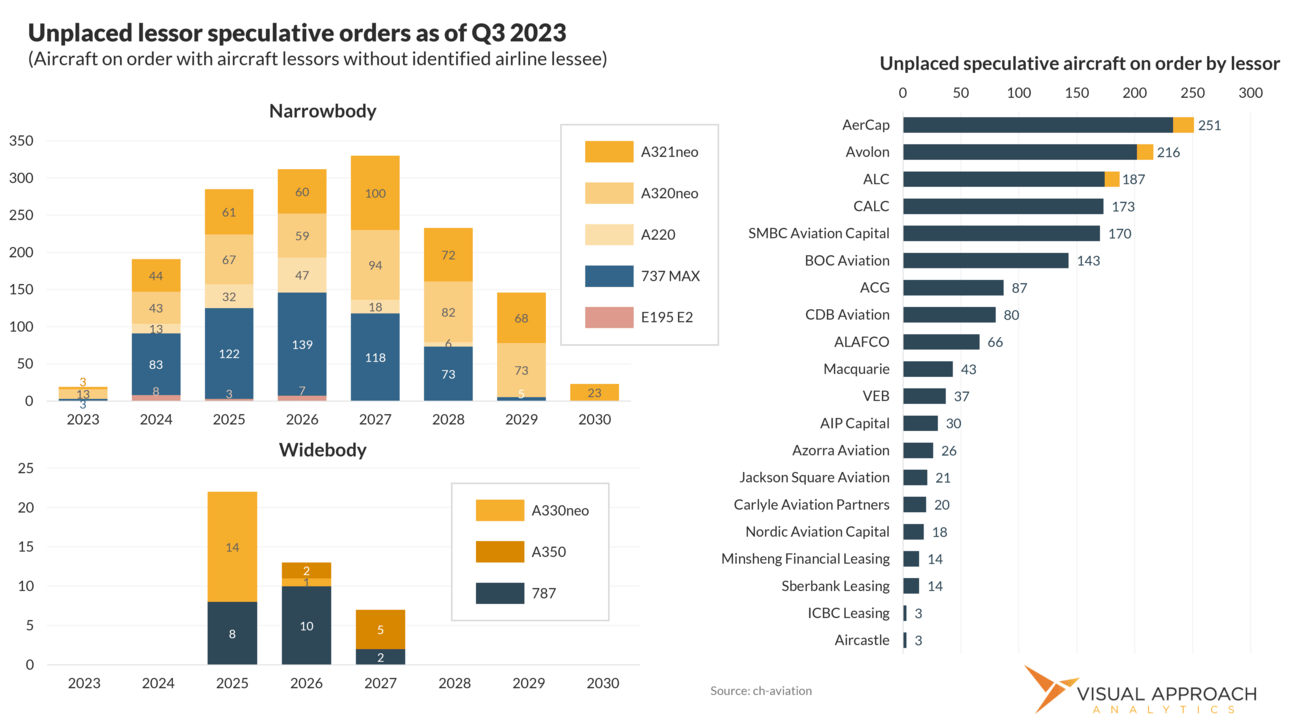

With narrowbody backlogs out past 2030 for both Boeing and Airbus, the ability for an airline to find a new aircraft is largely limited to the aircraft lessors. Indeed, lessors traditionally commit to future deliveries to be placed with the airlines in a shorter timeframe.

These types of orders without lessees are a risk. Since the manufacturer will deliver the aircraft, the clock is ticking for the lessor to find an airline or to enter expensive renegotiations.

However, the traditional challenge of committing to speculative orders is currently reversed. While backlogs are full, the commercial value of a delivery position is higher. Case in point: reference Airbus’s scramble to find available A321neos for United Airlines, which has yet to yield results. This is most likely due to any other airline or lessor with delivery positions wanting a premium for the scarce delivery positions while United wants to pay a discount. The difference - almost certainly to be borne by Airbus - shows just how valuable the delivery positions are. For a lessor, valuable delivery positions are… well… valuable.

However, it’s not as simple as just getting in line for lessors. With the line currently stretching out beyond 2032, eight years is a very long line. As early deposits are paid reserving the slots, that cash is largely locked up for the time period, unable to be put to work for nearly a decade.

But, the more challenging problem is escalation. While cousins, escalation and inflation are not the same. As time progresses, the price of an aircraft yet to be delivered increases. For lessors staring down an eight-year delivery backlog, the aircraft negotiated in 2024 could end up being much more expensive by 2032.

How much more expensive? If escalation drops back down to a tepid 2% (to match U.S. Fed inflation targets), the aircraft will deliver in 2032 at a 17% higher price than agreed to in 2024. At 3% - the delivery price would increase by 27%. For comparison, lessors tend to have returns of approximately 10%.

Consider that new aircraft values are more impacted by production rates and airline demand than inflation and escalation. (This conclusion is a result of analysis conducted with our clients.) Further, consider that 2024 is experiencing the deepest shortage of narrowbodies in recent history. Prices are high now, escalating from already elevated levels.

Both Airbus and Boeing have committed to increasing production rates through the rest of the decade. While skeptics remain over their ability to ramp up production at the announced rate, nobody is expecting those rates to drop. More aircraft will be produced in 2024 than in 2023, 2025 than in 2024…

For lessors, there is a risk of committing to an aircraft today that will be overpriced by almost 30% when it is delivered. Of course, this wouldn’t be limited to lessors since all airlines taking delivery at that time would have dealt with the same escalation challenges.

The end result is a lessor new aircraft backlog smaller by percentage than typical and one that has limited long-term positions. Yet, time marches on. By the time 2032 arrives the airline landscape will have shifted yet again. Opportunities to find new deliveries for savvy lessors will present themselves.

In the meantime, speculative lessor orders today for deliveries in the 2030s will require one of two things: A very strong negotiating team or nerves of steel.

One of each is preferred.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact