It’s not the most popular airplane in 2025. Despite the narrowbody shortage that’s been in effect for years and the shortfall in widebodies identified more recently, the A330neo is not exactly flying off the shelves. We decided to dip into our slide library from this summer to showcase some widebody slides that reveal what we believe to be a good sign for the A330.

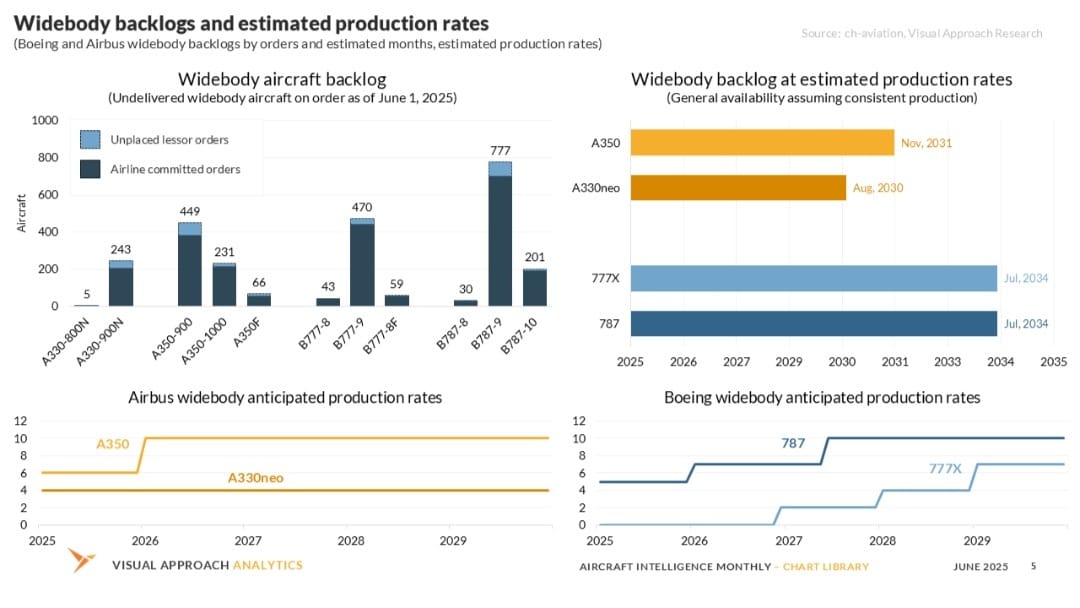

As of December 2025, the A330neo family has amassed 470 total orders. This is less than one-third the number of orders for Airbus’s A350 family at 1,500 orders. Boeing’s 2,300 commitments for Boeing’s 787 are almost five times that of the A330neo.

Why, then, are we suddenly publishing a newsletter extoling the virtues of the mid-sized widebody that represents barely 11% of the market?

We think the airplane may be a bit overlooked, particularly as the industry continues searching for the yet-to-exist middle-of-market aircraft. Hear us out.

First, the bad news. The A330neo’s Trent 7000 engine has not been performing to expectations. Compared to the prior generation Trent 700, the 7000 has suffered from poor reliability and low time-on-wing. Operators of Trent 700-powered A330ceo aircraft are used to 6,000 cycles before it must come off wing. The Trent 7000 has seen closer to only 1,000 cycles during its early years.

By our math, that’s… less. But things are improving. Rolls has introduced durability enhancements with extended LLP limits, as well as a new Direct Accumulation Count (DAC) program. The DAC allows for extended limits on life-limited parts based on performance data from each engine. This will further extend interval times, potentially exceeding 4,000 cycles.

Still not there, but considering new generation narrowbody engines are not even close to meeting half of prior technology intervals, the Trent 7000 is actually - depressingly - ahead of the curve. Of course, then we have to consider that the Trent 700 wasn’t always the superstar in durability it is today, offering indirect evidence of future improvements to the 7000.

All told, we think the negativity on the Trent 7000 engine is a bit over-baked. It’s not the 6,000 cycles its predecessor could achieve, but it's nowhere near the perception of 1,000 cycles the industry remembers.

Why, then do we like the A330neo?

Because it’s cheap. New A330-900s are delivering today near the $120 million range. Not pocket change, but consider the alternative: A350s are exceeding $170 million, and the popular 787-9 is going out the door above $160 million.

Now, consider what the still-mythical middle-of-market (MoM) aircraft would sell for. Back-of-the-napkin, if we assume a 220-seat three-class aircraft with a 6,000-mile range, $100 million in 2025 dollars is a reasonable number.

The step from an A330-900 to a similar-sized 787-9 would cost you about 30% more in ownership costs for no material increase in capacity and about 10% incremental range. Yet, for only 20% more than whatever the MoM will be, you get almost 30% more capacity and 20% more range from the A330neo. The significant boost in cargo capacity is gravy.

Then, of course, the new MoM aircraft does not yet exist and will be destined for inevitable teething pains largely (hopefully) in the rear-view mirror for the A330neo.

What about the 787-8? While Boeing’s smallest widebody also shares limited popularity with the A330-900 at just over 425 orders, the 787-8 suffers from a different problem: it’s significantly more popular siblings. Production lines are full for the 787, with a heavy skew toward the larger 787-9 and -10 variants. It’s a very successful aircraft, and production capacity is limited. For Boeing, the question is simple: why push a $120 million 787-8 when you have a decade of $160+ million 787-9s to deliver?

Similarly for the A330-800. The room to discount the smaller variant to a point where it is not worth taking the -900 is not there. Airlines would be better off taking the incremental capacity, unless they absolutely needed the additional range of the -800, in which case a discount on the -800 wouldn’t be warranted. The A330-900 works quite well from most airlines’ perspectives as the -900.

Does this mean the A330neo kills the business case for whatever the MoM could be? Absolutely not. But it reframes the context for what we think the A330neo could be. We think there is quite a bit of untapped value in the A330-900 today for airlines considering cost-effective lift.

Pound-for-pound and dollar-for-dollar, the A330neo is probably the best widebody utility for operators to consider today. That hasn’t always been the case. Engine issues aside, until recently, there was a better option for airlines looking to find widebody lift - the A330ceo.

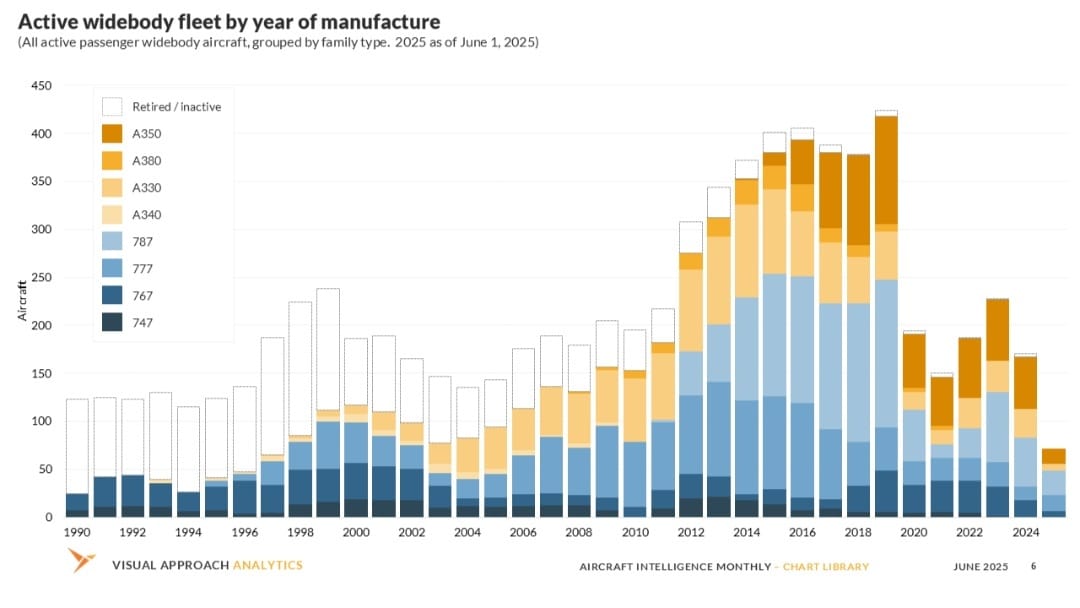

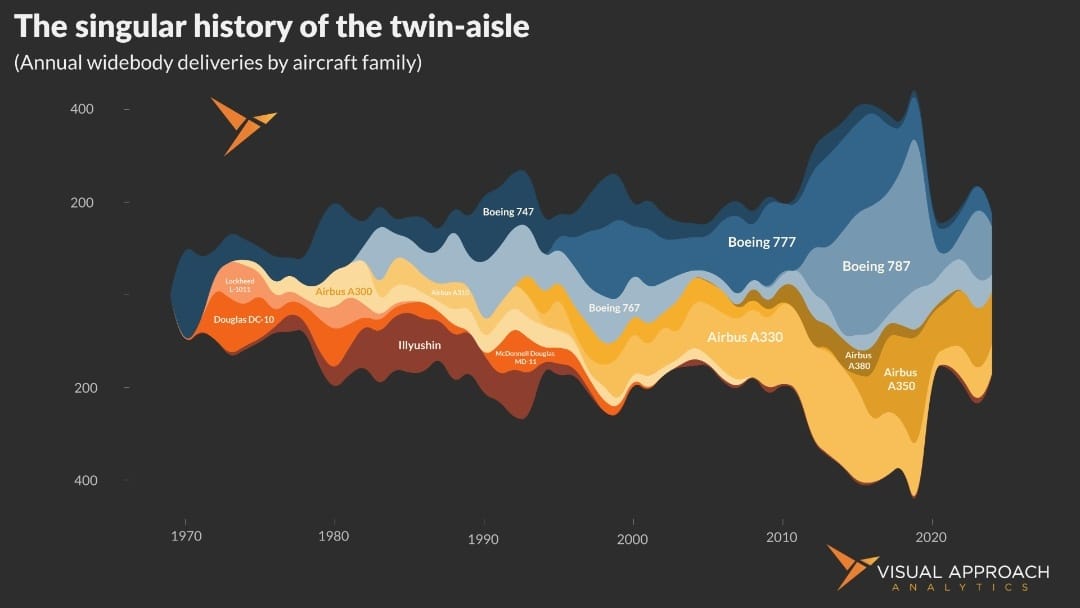

COVID was not kind to the A330ceo, and the market was awash with cheap A330-200 and A330-300 aircraft. In 2021, we identified the type as one of the best contrarian plays alongside the 737-800. The 737-800 won the race, but the A330ceo has come roaring back since. Times have changed. Spurred by stubbornly low new widebody production, the market has absorbed most of the remaining A330ceo aircraft, resolving the oversupply to the point that freighter conversion candidates are becoming hard to find.

Which brings us back to the A330-900 and its single best advantage: production capacity. At only four aircraft per month, the A330neo's production rate still appears to have room for further increases. In a world of unfulfilled widebody demand, low production rates, and full backlogs for the 787 and A350, the A330neo is increasingly standing out as a viable option for airlines.

The A330 may not be the best widebody out there, but it is the most overlooked.

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact