Tariffs on the import of aircraft and components from the European Union are officially gone. As a part of the trade deal between the U.S. and Europe, the aerospace industry was granted the highest exception from tariffs - complete exclusion.

This week, we decided to offer a peek into our premium research and how we’ve been tracking tariffs since this winter. Three analyses, in particular, are thankfully now outdated with the new tariffs, but were incredibly valuable to organizations looking to understand how the tariffs were being applied and what it meant for their business. In our own sigh of relief, we’re excited to put most of the tariff drama behind us.

Most. not all.

This isn’t the end of tariffs for aviation - at least not yet. Some of Airbus’s A220s are still built in Canada, and most notably, all of Embraer’s aircraft are built in Brazil, where the Trump administration just threatened an increase in the tariff rate to 50%.

Still, the exclusion of Toulouse and Hamburg-built aircraft brings a huge sigh of relief for Airbus and U.S. airlines, which depend on Airbus aircraft. Delta, United, and American all have Airbus aircraft inbound, along with JetBlue, Spirit, and Frontier.

Of those, Delta has been most creative with its don’t-pay-tariffs plan. An A350 delivered this spring to Delta Air Lines, but was not imported to the U.S., rather to Japan, where it flew from Delta’s NRT base to U.S. destinations. Most recently, the airline took delivery of two A321neos, only to park them in Toulouse and import the engines. Since the engines are originally built in the U.S., no tariff was due.

We’ve been tracking the drama of tariffs with the industry since January. Conversations at the Dublin conference this winter were full of “what ifs” on tariffs. By ISTAT in March, the prospect of U.S. airlines paying for deliveries was very real.

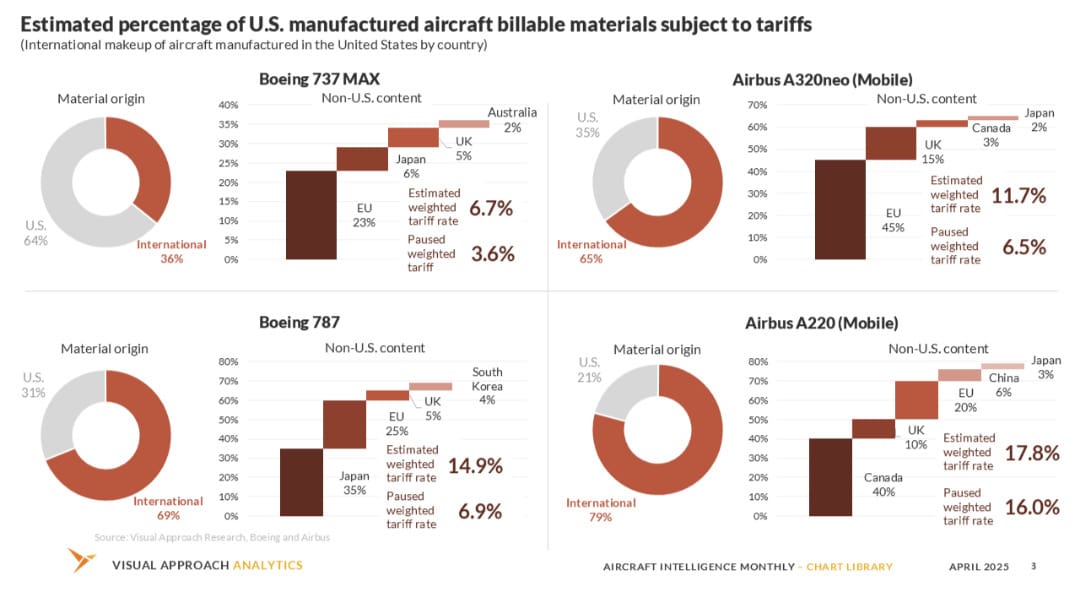

Our first research on likely tariff calculations was published in April. Conversations with airlines and lessors showed that the tariffs due would come down to the individual customs agents assigned to the airline. With no precedent yet set, each airline entered separate negotiations with its respective customs agent.

We also published research in April that proposed U.S. content would be credited to any imported aircraft, a policy that was already in use in other tariff-paying industries, and one that quickly applied to aviation. We received confirmation from airlines that this was the case in April, as some aircraft were imported with tariffs paid.

In April, we also published an analysis on the number of Airbus aircraft with production capacity within the U.S., but were still assembled and delivered from Europe. Keep this in mind, because our expectation was that these aircraft would largely not deliver as long as tariffs were due. Now, consider our surprise at the industry's surprise when Boeing deliveries were catching up to (and eventually passing) Airbus. Considering how many U.S.-bound aircraft were still built in Europe, the Airbus slowdown was expected.

Now, get ready for the catch-up.

And now, here we are at the end of July with tariffs on European-made aircraft and components going away. What does this mean for Boeing? Not much, really. It’s Airbus and the U.S. airlines that get the reprieve. It’s hard to call it a win when arbitrary punishment is repealed and things return to status quo, but Airbus is better today than it was last week.

But that leaves the smaller aircraft, notably Embraer, as the big loser. Tariffs on Embraer aircraft remain and have been paid, according to conversations with some of our airline clients. The latest threat to increase tariffs on Brazil to 50% is a real problem for Embraer, especially now.

(A late correction, Embraer has been excluded from the 50% tariffs, but appears to still be impacted by the original tariffs.)

Before, the concept of tariffs for importing aircraft was an industry problem. Now Embraer is largely on its own - and Embraer relies on U.S. airlines. In a recent analysis, we found that 95% of Embraer’s E175s delivered in the past 10 years were delivered to U.S. airlines. Embraer delivers more than just the E175, though the program has been critical in smoothing production rates, especially during downturns. As demand for the E2 continues to increase, the overall share is shifting away from the U.S. and the E175, but not entirely. SkyWest Airlines just placed an order for 60 E175 aircraft at the Paris airshow with purchase rights for another 50. U.S. airlines still want the E175, and tariff rates for Embraer are moving in the opposite direction from Airbus.

The tariff drama isn’t over. Brazil’s tariff fate will play out in the third act. The problem for Embraer is that most people left during the second intermission.

Research published this week

Ok, new plan: Rather than flying first class to Iceland, maybe it’s best to just buy Icelandair.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact