Spirit is in trouble. Buy why?

While there is no shortage of opinion on the viability of the Spirit business model, this isn’t what we’re talking about.

Spirit is losing money. However, other airlines have been losing more money for longer, even with worse operating margins. So why is Spirit suddenly staring down the barrel of a potential Chapter 11 filing?

Debt?

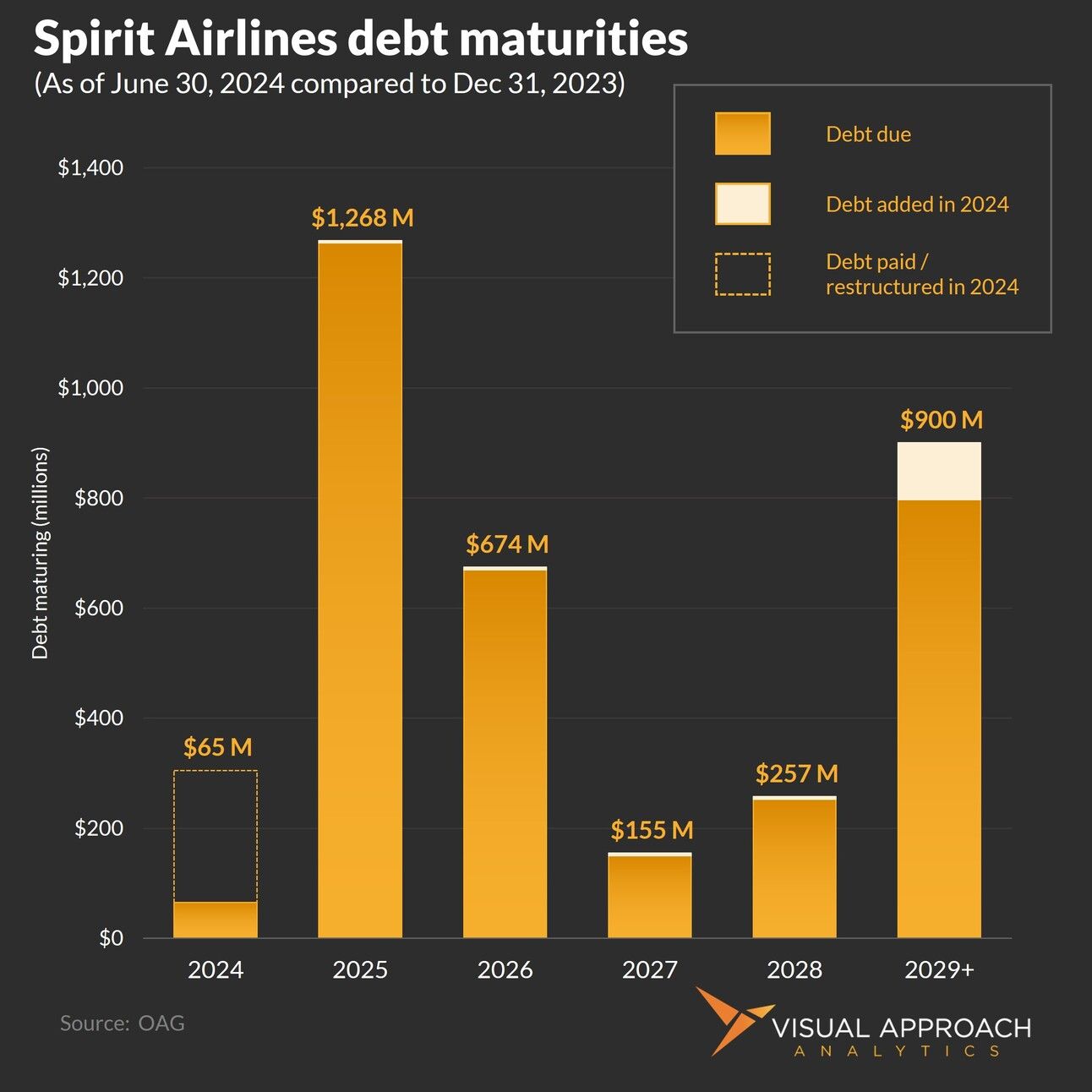

The answer you’ve probably heard is debt. Spirit has a $1.1 billion bill due next October. This “secured” debt was originally issued in September 2020 — a time when things were, well, different.

(We include “secured” in quotes because this debt is backed by the Spirit Airlines loyalty program. The debate on how secure a loyalty program is in the case of an airline bankruptcy is quite active. Our take: not-so-much. In our opinion, the debt is effectively unsecured, even if brand assets are locked away in a bankruptcy-remote account in the Cayman Islands. Why the Cayman Islands? Because Switzerland is a bit far, and Panama has those pesky Papers.

So, secured, yes. But by what value is still an open question.)

In 2023, Spirit paid $93 million in interest to the $1.1 billion bond due on October 2025, but the $1.1 billion in principal is still outstanding. In short, Spirit must find $1.1 billion by October of next year or default on the bond.

But the outstanding debt isn’t due for another 12 months - October 2025. It doesn’t answer our question of why Spirit was staring at a deadline for bankruptcy in October 2024.

Enter the true keeper of the keys to the kingdom: credit cards.

Credit cards

Spirit has a problem with credit cards, just not the traditional problem.

When you buy anything with a credit card, the credit card company fronts you the money and then sends it to the business from which you bought something. But what if that company goes away before you get what you bought? It received the money from the credit card company, but you never received what you purchased.

In short, the credit card company is on the hook for the money.

Not a big problem with most transactions. But with an airline, you could be paying for a flight that doesn’t depart for many months. The risk of an airline filing for bankruptcy in those months, leaving the credit card company with millions in potential refunds, is a material risk.

The alternative is for the credit card company to hold onto your money until you fly. Good for the credit card company but bad for the airline. They don’t receive the cash until after you fly the flight. This is called a “hold-back”. The credit card company holds back the cash until you deliver the service.

In order to keep cash flowing to airlines and still protect the credit card companies, an agreement is negotiated. Oversimplified, that agreement says an airline will get its cash as long as it meets financial conditions that make the credit card companies comfortable they won’t get stuck with the bill. If those financial conditions are not met, credit card companies start hanging onto the cash (credit, actually, but you get the idea).

It’s accounting’s fault… kinda

Spirit Airlines currently has the ability to cover its debt until next October. The bondholders waiting for their $1.1 billion check next year are still getting paid. They’re probably a bit nervous about the October check, but everything is still on time. No default. No need for bankruptcy.

HOWEVER, the time remaining until that debt payment is due just crossed the 12-month mark. That matters — Like Chapter-11-bankruptcy-filing matters.

On any balance sheet, both current and non-current liabilities exist. The two are what you would expect: current liabilities are those due in the near term, while non-current are more long-term.

What determines if a liability is current or non-current? 12 months. The $1.1 billion debt repayment due next October just passed the 12-month mark, switching it from non-current to current.

So what? It was always there. Nothing actually changed. The same amount that was due last month is still due. Instead of waiting 12 months for their payment, the bondholders are now waiting 11 months.

But Spirit’s current liabilities just increased by $1.1 billion, materially changing metrics that would determine an airline’s chance of going away — the same type of metrics that would be closely followed (and negotiated) by a credit card company.

Badabing-badaboom, debt changes from being due 12 months to 11 months out, numbers move from the noncurrent to current liabilities column, conditions are triggered, credit card companies hang onto cash, and the airline goes from a steady cash flow to almost zero overnight.

What happens next?

If you’ll turn your textbooks to chapter 11…

But it didn’t happen

Spirit negotiated, but with whom?

The credit card companies.

Sure, the credit card companies wanted better comfort on the coming $1.1 billion debt, so they pressured Spirit to negotiate with the bondholders. In the end, though, the negotiation was ultimately with the credit card companies.

The result? “Ok, we’ll give you two months to figure it out before we start holding your cash.” The new date for the credit card holdbacks is December 23, 2024.

That’s the latest deadline the credit card companies have agreed to give Spirit to resolve the debt problems and bring the airline’s current liabilities back into alignment with the agreed metrics. It can be negotiated again. Or, the credit card companies can force Spirit to file by hanging on to ticket revenues booked after that date.

The key point is that the group currently holding the gun aimed at Spirit’s head is the credit card companies, not the bondholders. The bondholders are still 11 months away, dragging their own cannon aimed at Spirit - but not quite there yet.

What next?

Spirit will continue to negotiate with the credit card companies. Either the airline will find a solution to the wall of credit card hold-backs that will otherwise start at that date, it will pay off or refinance the $1.1 billion debt, or it will file.

However, consider what the risk to credit card companies really is. The transition of the debt payment to current liabilities that could trigger the credit card holdbacks is referencing debt due in October. Spirit is currently only booking flights through May 21st, 2025. There is no cash coming from passengers for flights after the debt deadline.

But Spirit could file early, anyway. In that case, the airline would almost certainly continue to operate, reducing the risk of mass refunds for the credit card companies. The risk would be there but minimal.

That leaves a looming cliff arriving on December 23. Between the airline, the bondholders, and the credit card companies, it appears the credit card companies have the least to lose but the most power to force a filing.

The chance of that date being pushed is high, but so is the chance of Spirit arriving on that date with an order from a bankruptcy judge telling the credit card companies to continue releasing Spirit’s cash as passengers book.

Two months is a long time. Spirit could come to an agreement to refinance the debt in that time. Spirit could use that time to continue negotiating with the credit card companies to soften holdbacks to a palatable level or delay further. Or Spirit could spend the next two months planning for an orderly Chapter 11 process, one with a pre-planned exit.

What would that pre-planned bankruptcy look like? We offer our predictions in the form of needlessly cryptic color theory:

What happens when you mix yellow, green, and indigo?

You get more green.

That about sums it up.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact