Spirit and JetBlue, we hardly knew you.

Since the merger was blocked by a federal judge two weeks ago, we have been reading through the decision with great interest and the occasional head scratch.

Ok, slightly more than the occasional head scratch.

Still, lawyers and judges, we are not. The decision was appropriately based on the competitive and legal dynamics of the Clayton Antitrust Act of 1914. But, we are avid consumers of data.

If you’re waiting to read that we think the data shows the judge got the decision wrong, you’ll finish this analysis disappointed. What is notable to us is not the decision’s interpretation of the data available, rather the unique timing.

Many arguments were made during the case and repeated in the decision regarding Spirit as a disrupter, the inability of airlines to backfill Spirit's capacity quickly enough once JetBlue takes over, and the potential monopoly-ish future of key markets. Closing arguments were made in mid-December, while the judge made his decision on January 16, 2024. This matters because Q3 2023 DOT data laying out domestic traffic and fares was released on January 2, 2024 - weeks after the closing arguments.

Why does this matter? Because everything changed in Q3 2023. The strength and ability to disrupt that Judge Young repeats so often in the ruling is evident in the data… until Q3 2023.

Of course, we know the market turned south in a hurry, fares plummeted, and the leisure markets on which JetBlue and Spirit most likely compete were heavily impacted. To be certain, this isn’t because of anything JetBlue and Spirit did. It hit all airlines in these markets.

But the high fares suffered by customers in Q2 largely melted away by Q3. We started to see some signs of this as early as July 2023, but the true impact on a market-by-market basis was not evident until the data was published in January 2024.

In fact, LGA, MIA, and SJU domestic Q3 fares were below 2019 levels. Four years of record inflation and constrained capacity, and fares were… lower!?!?

Even leisure giant Orlando saw fare differences drastically drop between Q2 and Q3 from 14% above 2019 to less than 3%. In fact, in the cities identified by the judge, only Boston fares remain significantly elevated (though it has been Delta Air Lines, rather than JetBlue and Spirit, which has taken advantage of the BOS fares).

Consider, as well, that these numbers compare against the same quarter in 2019 to remove the effects of seasonality, particularly the intense spring months for the Florida markets. Compared to 2019 (or any year, really), Q3 2023 was a bad quarter.

When it comes to potential monopolistic behavior by JetBlue and Spirit on a combined network, we’re left scratching our heads again. Comparing the distribution of capacity on routes with JetBlue and Spirit overlap, we see that both JetBlue and Spirit have remained remarkably stable. Even those markets only served by Spirit and JetBlue and would be considered monopoly markets post-merger have remained steady.

However, all other airlines have seen growth in the overlap markets. Competition has had no problem increasing capacity in markets served by JetBlue and Spirit.

This makes sense. If we consider Spirit as a spill carrier (a theory further bolstered by the drop in Q3 fares - if capacity exceeds demand, there is no spill), then the competitive picture changes. In fact, the entire basic economy fare structure - incorporated by all three large legacy airlines - is aimed directly at offering low-cost seats in markets served by low-cost airlines.

The ability for airlines to backfill Spirit’s flying appeared to carry this incorrect assumption that Spirit just… goes away. Those aircraft will remain, albeit at reduced capacity in the less-dense JetBlue configuration. But, Q3 2023 numbers strongly suggest that extra capacity offered through tight seat pitches on Spirit airplanes was aimed at a now-over-served customer base.

Like we said, things changed in Q3. Did the judge get it wrong? Dunno. Should JetBlue have merged with Spirit in the first place? No.

But things are a-changin’, and the picture painted of Spirit as the savior for light wallets has evolved very quickly. We’re left wondering if the same arguments made to the judge in December could be made again today.

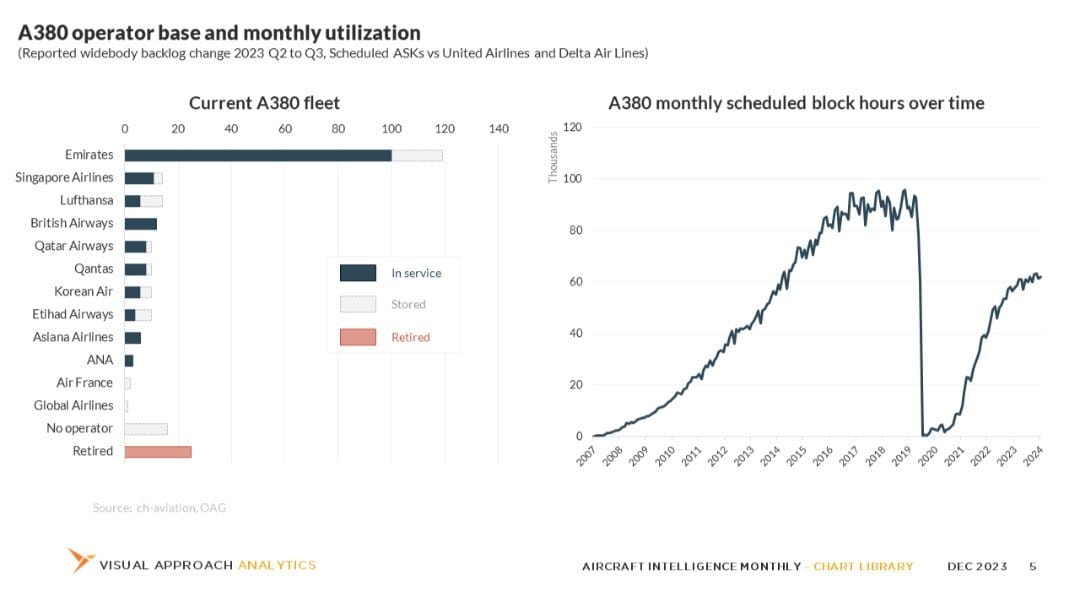

The comeback of the A380 nearing completion

Our latest market insight looks at the A380’s comeback following COVID-19. Once considered DOA during COVID, the A380 has returned to the skies, albeit in fewer numbers.

This premium analysis looks at that comeback and identifies how much room may be remaining for the aircraft. Just as importantly, we look at what this means for the overall widebody space.

This analysis is available to all Visual Approach Research subscribers and can be accessed by our $60/month market insights tier. It was originally published in December 2023 for our corporate subscribers and is now available for individuals at a reduced rate.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact