The rise of the ultra-low cost airline has given way to the rise of the… well… airline. Internet searches for “cheap flights” have been in steady decline, even as the low cost sector continues to increase. Meanwhile, searches for “business class” and “premium economy” have experienced impressive increases.

Interestingly, global search volumes for premium travel offerings have increased over the same period. Indexing volumes to January 2019 shows that interest in “Business class” and “Premium economy” have recovered beyond 2019 levels, while interest in “Cheap flights” continues its decline.

Of course, it could be that there just aren’t anymore cheap flights available for which to search. #inflation2023 But, the decline has been consistent and long coming. Does this mean the world’s travelers are no longer interested in saving money to travel? Not at all. In fact, total search volumes for “cheap flights” remains triple the next highest class - business.

But the internet search trend is pointing more toward premium options. That online interest is not equal around the globe. Singapore and Australia both top the lists of countries making premium airfare searches per capita. Which makes sense. The two countries have historic airlines focused on long-haul premium service.

This remains a very inexact science, subject to a plethora of caveats. First, it relies on the English language. For countries where business class or premium economy is called something else, well, it will be called something else. Another challenge is that the global jetsetter has learned better ways to search for cheap flights other than simply typing in “cheap flights.”

Regardless the shift away from explicitly cheap flights, the shift to premium options certainly aligns with booking trends.

Forecasting the US airline overshoot - It was good while it lasted

US airlines are starting to warn of missed profit forecasts. Yesterday, both American and Spirit updated their Q3 guidance, slashing expected operating margins for the summer months on higher costs. Of course, those higher costs weren’t exactly a surprise, particularly since most of those came at a new pilot contract negotiated and (hopefully) budgeted for by American.

But Frontier Airlines said the quiet part out loud by disclosing in an 8-K filing that “In recent weeks, sales have been trending below historical seasonality patterns.”

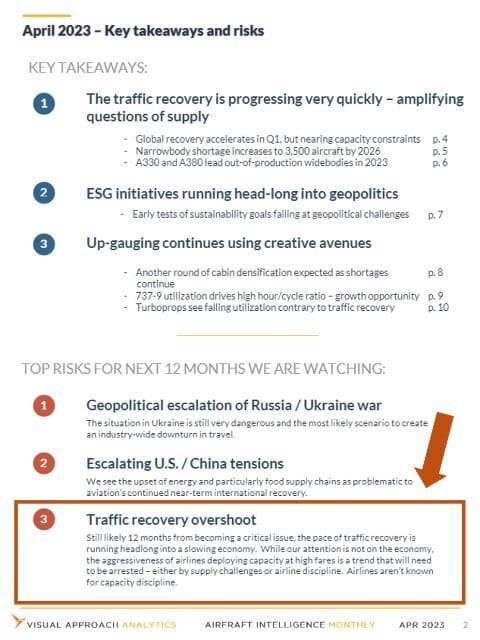

Subscribers of our Aircraft Intelligence Monthly were warned of this setup as recently as April, 2023.

Seriously. Five months ago. Look:

We watch aircraft and traffic trends closely, so this was no surprise. The U.S. airlines, in particular are adding 15%-20% capacity over 2022, much of it domestic, while signs continue to point to economic headwinds.

We forecast to our research subscribers that at some point, airlines will do what airlines do - overdo it. That was April. In July, we warned again with an analysis titled “US dominance of order books could lead to capacity overshoot in 2024.”

While we appreciate the requests from journalists for comments on the surprise downward guidance by the airlines, our response isn’t exactly quotable: “What surprise?”

You get the point. We saw it coming, good forecasting, our subscribers had a five month head-start, blah blah blah. The important thing is that this leads to two logical questions any inquisitive follower of the industry will ask:

If you saw the risk of the U.S. overshoot as early as April, what are you warning of today?

and

How do I subscribe?

Well, it’s a good thing you asked. In fact, just this week we published our September research through the Aircraft Intelligence Monthly. What is next on our radar?

China

Not so much, travel to China will frustrate the few airlines that fly there. It’s more China as an economy could trigger the next global recession very, very quickly with devastating effects.

So, yeah. Roses and rainbows.

For the intrepid reader of our newsletter who makes it this far down the text, we offer a gift, of sorts. The six analyses covered in our September research:

China to US exports plummet - Mexico replaces but stability at risk

757-200PF market largely focused on three players

LHR noise fees disproportionately affecting A321

Air India leveraging Russia to boost India-North America market share

Narrowbody lease rates diverging by seat gauge

Turboprop market stalls on recovery

As for your second question: You can learn more and subscribe to our research here: Aircraft Intelligence Monthly

Be on the lookout, however. We are imminently launching our new website offering you direct access to our analysis and research. Like imminently imminent. (Tomorrow)

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contac