Q3 is in the books, and the big three U.S. airlines are 2-1 - two profitable to one unprofitable, that is.

Delta and United earned a healthy profit. American? Not so much.

The question that was posed to us this week was, “Why?” What is Delta and United doing that American is not?

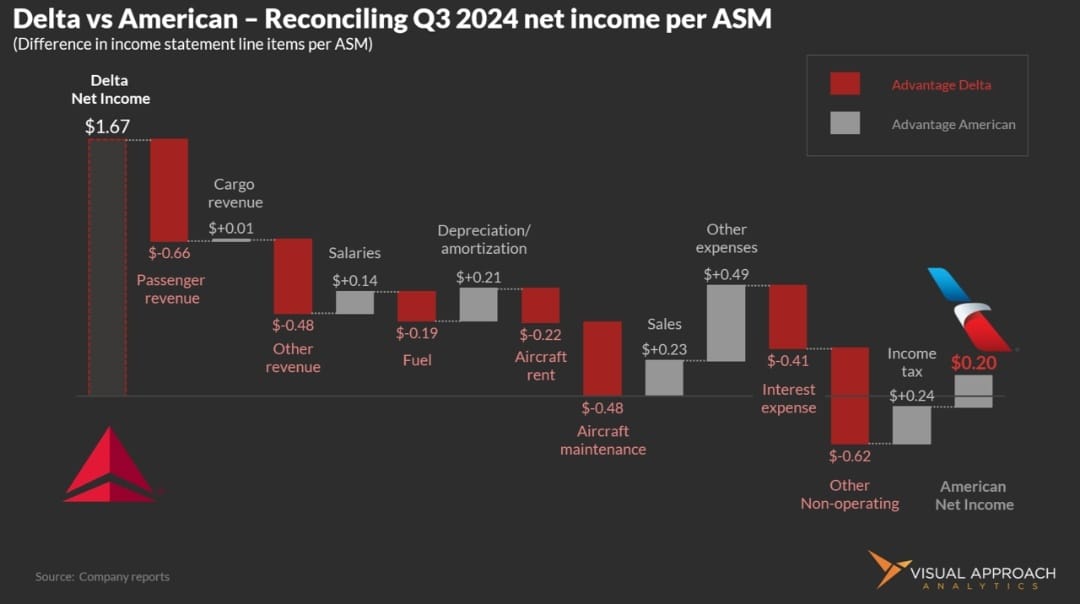

To answer this, we decided to look at simple earnings. Of course, that quickly falls apart when you consider the networks of the airlines are not the same, and as such, the direct comparisons are difficult. With similar capacity levels and stage length, Delta is the closest.

It’s not necessarily typical to look at an airline’s net income from a per-ASM basis, yet here we are. The reason is simple: we wanted to make the comparison as close as possible, even if it means creating a metric nobody looks at in other comparisons. The reconciliation requires a balance, after all.

In the direct comparison, if revenues per ASM were higher for Delta, it was advantage Delta, moving down the chart closer to the lower American number. The opposite was true for expenses. If American had lower salary costs per ASM (as it did) it was advantage American, and it moved the chart away from the final number.

The usual suspects quickly emerged. Even without the refinery (and associated refinery costs), Delta strongly outperforms American on a revenue basis. The majority of the $1.87 per ASM net profit difference between the two airlines was a result of passenger and other revenues.

Notably, Delta’s increased sales distribution costs are higher due to higher revenues… or, are Delta’s revenues higher because of increased sales distribution costs? Remember that American gutted their corporate sales team last year - a decision that saved money but saved money that was directly a result of bringing in revenues.

Further into expenses, American has a substantial advantage in salaries and other operating costs. Notable is the profit sharing for Delta, which falls in the “other” category for our purposes.

Of course, America’s fleet management is in stark contrast to that of Delta. The heavy reliance on leased aircraft drives rental costs higher, but depreciation and amortization expenses lower. Fair enough.

But then there are the interest payments, many of which exist to pay for American’s rather large debt load.

(Delta also benefited from some mark-to-market gains on strategic investments (such as Aeromexico, LATAM, Air France-KLM, etc.) to the tune of $350 million this quarter, a number that is reflected in the Delta advantage in other non-operating income. While we could have stopped at EBIT and the operating profit to exclude such items, we wanted to make sure the increased interest payments for American were considered.)

It’s an unorthodox look, but a look nonetheless. In the end, American’s challenges appear to be split between two key items. Two-thirds of the shortfall to Delta can roughly be attributed to underperforming revenues, while the last third relates to fleet management.

Our take is the meaningful challenges remain in the revenue. Sure, American has a high debt load, something the airline has managed for years (at least since Doug Parker claimed the airline would never lose money again).

But the shortfall in revenue is concerning. The airline's move to save on sales distribution costs last year certainly looks problematic. The bad news is that if this is a reason for the mismatch, it could be a decade before the airline is able to build back that capability to address the revenue disadvantage.

The worse news is that if this isn’t the reason, they need to find it. Q3 should be the good quarter.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact