The A321XLR operated its first transatlantic flight last week by way of Iberia’s MAD-BOS flight. Along with the arrival of the flight has come renewed excitement about the XLR and the potential of what it can do.

Of course, along with renewed excitement comes our reminder of renewed context.

Is the A321 over-hyped, or will it be a successful variant?

Yes.

(Cheap trick, I know. But if you’ve been reading this newsletter for more than a few weeks, you should have seen that coming. That’s on you.)

Of course, both are true but therein lies the rub: The A321XLR is already successful and has probably already filled a large portion of its potential.

Based on the number of emails and calls we’ve received on the XLR this week, it’s worth an example of how we look at the market for the aircraft.

Starting from the beginning, what exactly is an A321XLR?

The oversimplified answer is a longer-range version of the A321LR - which is a longer-range version of the A321neo. Airbus claims that the XLR will extend another 700 nautical miles beyond the range of the A321LR out to a maximum of 4,700 nm. The OEM has achieved this by designing a new center fuel tank and increasing design weights, among other changes.

The market for a narrowbody that can fly to 4,700 nm is huge. That’s not the A321XLR’s problem.

The XLR’s problem is that the previous variants of the A321neo can do 85% of what the XLR can for cheaper. The XLR market doesn’t extend from 0 to 4,700 nm. It’s the last 15% that matters - 4,000 nm to 4,700 nm.

700 miles is certainly nothing to sneeze at. And it’s not just those markets that sit within 4,000 and 4,700 nm that would be candidates for the XLR. Higher density versions of the XLR will see reduced range yet still incremental improvements over the LR. That’s the market for the XLR.

To be certain, the XLR doesn’t just bring range - it brings range and payload. There are certainly markets within the A321LR’s reach that can move more passengers and bags with an XLR.

The aircraft is an engineering achievement. However, engineering achievements aren’t free, a fact of which Airbus is well aware. The XLR is an expensive aircraft, both to acquire and to operate. The higher weights of the XLR, along with the increased purchase prices (up to $5 million higher than the LR based on our intelligence), create a problem for the XLR.

Simply put, on any route that is within the range of the A321LR, the XLR is suboptimal.

Why, exactly? Weight, pricing, that an LR can theoretically become a neo, but an XLR cannot. Engine wear at higher thrust levels and longer cruise lengths. You know, the usual.

That divides the XLR’s future market into two distinct buckets:

those routes that require an XLR, and

those routes that use an XLR because it’s already in the fleet.

Airlines buy airplanes for number 1, not number 2 - even if the latter proves to be a significant portion of the routes on which the aircraft ultimately operates.

But to consider the market for the XLR, it’s easiest to start with the aircraft most able to operate the routes on which the XLR is likely to serve. Here begins the inevitable comparison between the A321XLR and 757-200.

The 757 is a workhorse.

Originally built as a replacement for the 727, the 757 offered increased capacity and impressive airfield performance. But it wasn’t until the mid-2000s that the 757 found utility in its role as the long-haul narrowbody.

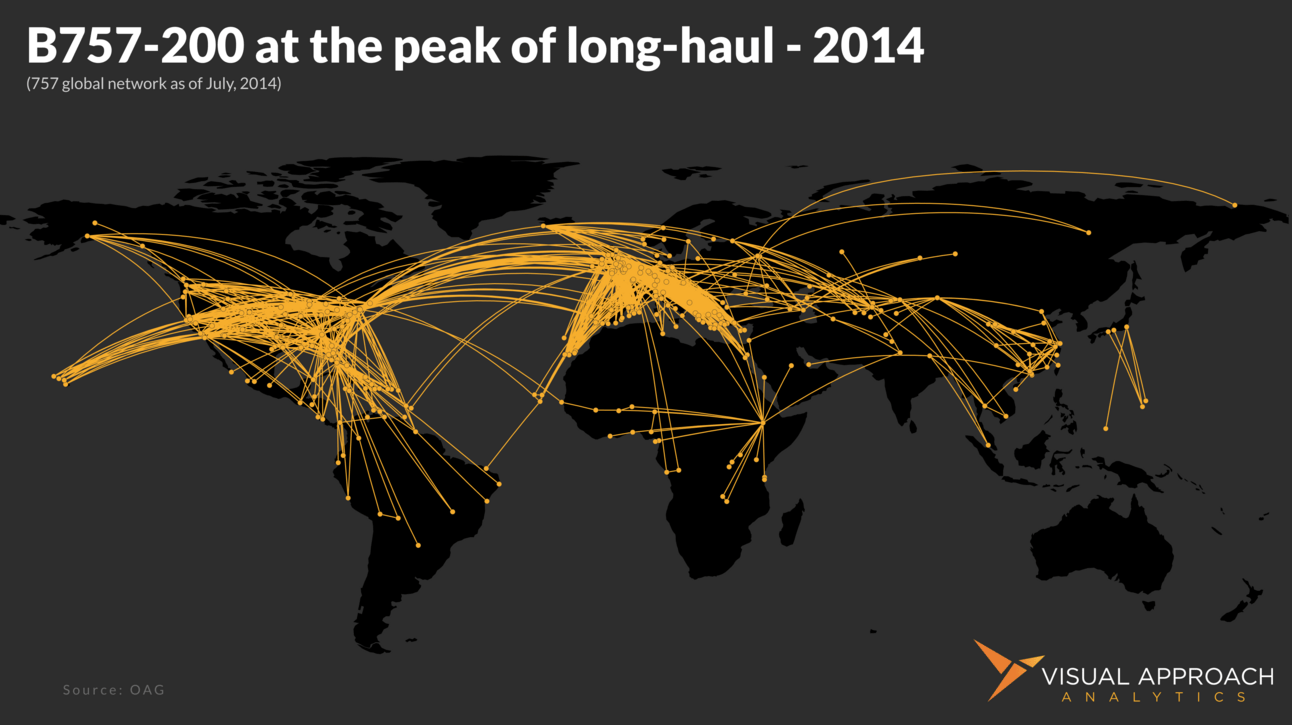

The peak of 757 flying in 2004 saw some long-haul operations beyond 3,000 miles, particularly crossing the Atlantic. Yet, even as overall numbers of the aircraft dwindled in a post-production environment, the shift to long-haul narrowbody flying increased for the 757.

By 2014, 757 numbers had dwindled, but flights were being conducted out to 4,000 nm.

Many long-haul flights were made across the Atlantic or into deep Latin America from North American destinations, while European tour operators found the long-range beneficial to many of the same destinations.

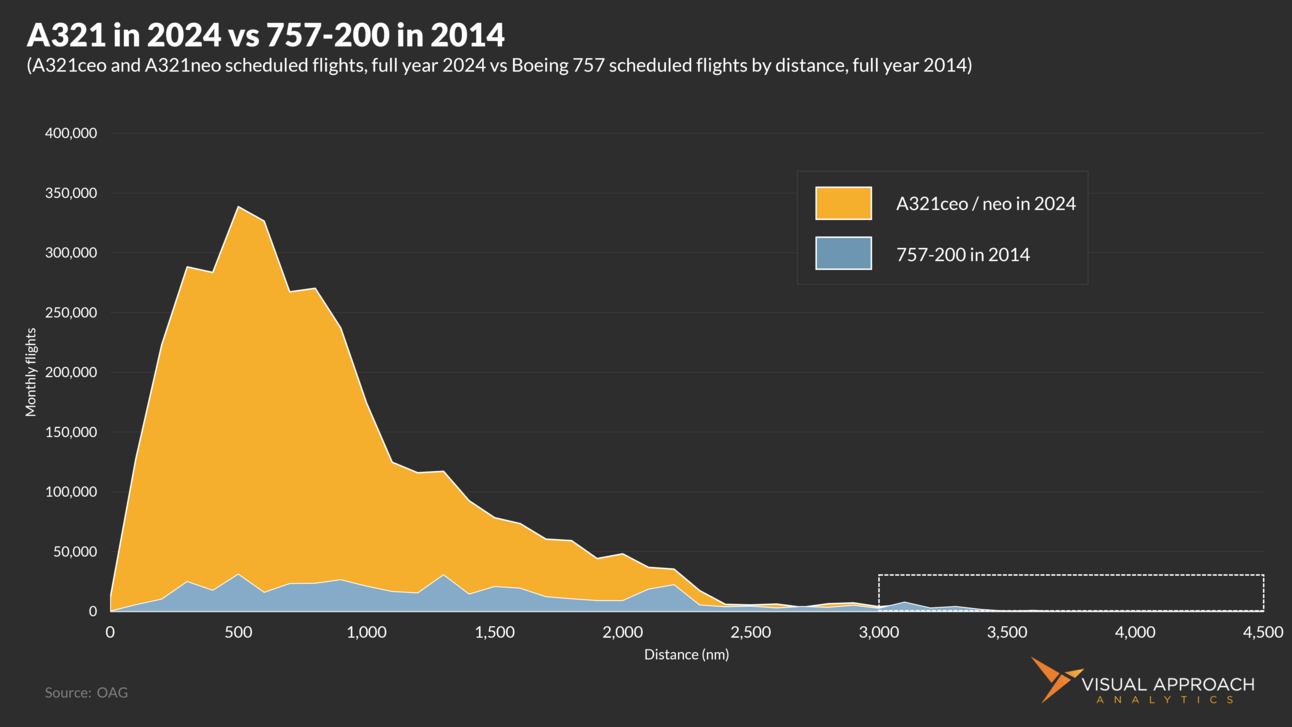

Yet, as much of a long-haul specialist as the 757 was, the vast majority of flights have always been operated within 2,500 miles. Indeed, the very same is true of the A321 market today.

Keeping the axes constant for a sense of scale, the A321 variants operate a very similar profile to the 757 - just more. But the 757-200 held one very key advantage over the A321XLR - it had fewer competitors.

Indeed, no aircraft could do what the 757 could do. The combination of airfield performance and range in a narrowbody aircraft saw no comparison until… well, until the A321neo.

Yet the 757’s advantage over the A321XLR is highlighted by the nonexistence of a very specific competitor - the 757-100.

(Ever heard of it? It was a thing, at least on paper. The original 757-100 was supposed to be a shortened version of the 757-200, but it was far too heavy to make sense. Doesn’t matter. For this hypothetical, we’ll assume it was a lighter, shorter-ranged version of the 757-200.)

The 757-200 never had a more efficient version of itself at shorter ranges. Thus, the 757-200 market extended from 0 to 4,000 nm - a massive market, and all of it.

All told, the 757-200 sold 906 aircraft in passenger configuration. Put another way, the market for a 190-seat aircraft between 0 and 4,000 miles was 906 aircraft twenty-five years ago.

But what would have been the market for the 757 if it had a more fuel-efficient, lighter, more common, cheaper sibling below 3,500 miles that was selling like hotcakes before it arrived?

Consider that less than 1% of all 757 flights operated at the peak of long-haul flying were carried out on flights longer than 3,500 miles (0.2%, to be precise). That same number holds for the A321neo family today.

Comparing the 757’s flying in 2014 with the A321neo and A321LR in 2024, the similarities are obvious. It’s a good market, and more flying could be accomplished down the long tail of long-haul flights. But how much more?

Consider that the 757-200 market beyond 3,000 nautical miles represents only 5% of the total flying the aircraft ultimately achieved. That equates to about 46 757-200”XLR”s.

But the 190-seat market is much, MUCH larger than it was (and growing). The A321neo has exceeded the 6,000 order mark with a backlog that will not entirely deliver until the program hits the 15-year mark. Conservatively, we can assume the market will be 10,000 aircraft.

The 5% long tail of the market is now much larger than 45. By this math, it would be about 500.

Guess how many A321XLRs are currently on order? About 500.

(according to our favorite fleet database, ch-aviation, 463 aircraft have been ordered by airlines or lessors who have found airline homes. A further 33 orders are sitting as future supply on lessor order books that have yet to be matched with demand. That’s not unusual by any standard, but it can be netted out when considering the overall market penetration. In the OEM world, we would consider those aircraft as “half-sold”).

Just to reset the context, 500 aircraft is a MASSIVE success. Airbus has flipped Boeing-only operators as a result (Icelandair being the most recent). It’s just that 500 aircraft are already baked into the world’s expectations.

Several of our models expect the A321XLR to double those numbers, converging around a total fleet of 1,000 aircraft before all is said and done. That’s a very, VERY far cry from the 2,500+ numbers we keep hearing.

Could that number be lower? Absolutely. In fact, the natural market size is about 500 aircraft, and we suspect the XLR will outsell it. But consider that the last XLR order was over a year ago, and net orders in the same period have been negative (Frontier converted out of XLR aircraft, and JetBlue deferred their XLRs deep into the next decade.)

Now consider other challenges the aircraft has by way of galley and lav space. The 321XLR cabin is 70 inches shorter than the 757-200, yet with just as much “stuff” packed in. Rumors of flex galleys with a little too much flex and not enough galley are already spreading through the buying community.

Could the 1,000 number be higher? Also yes. Though probably not in the way you might think.

Remember that the XLR’s chief competitor is the sibling LR. The easiest way to increase the market for the XLR is to stop offering the LR. The second-easiest way is to discount the XLR to remove the economic advantage the LR offers on anything except the extra range worthy of the “X” moniker.

We don’t know what Airbus will do, and we won’t even guess. But what our models show us - regardless of how we slice and dice them - is that the current XLR market is the size of the 757 market at most.

And that’s pretty amazing.

Pop quiz

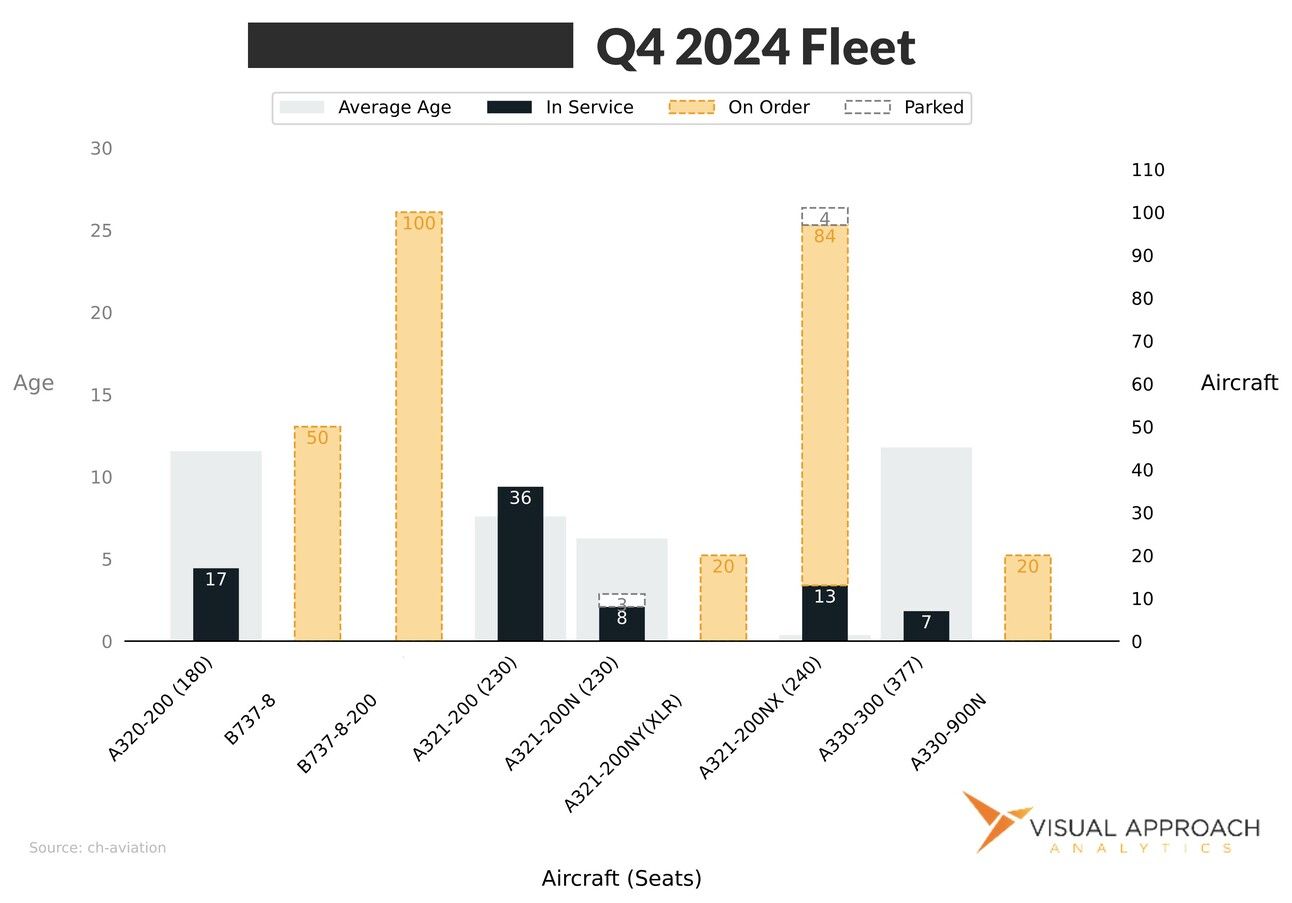

Now that you’re an XLR expert, which airline’s fleet profile is below?

When ready, you can find the answer here.

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact