Remember summer 2023? We’ve made our July 2023 research available publicly.

Passengers were returning. Fares were at record highs. Talk of the aircraft shortage was mainstream.

In the U.S., the pilot shortage was in full swing, with record contract raises being signed. The need for pilots and planes drove the odd combination of JetBlue and Spirit. What could go wrong?

Meanwhile, economic sentiment Interest rates were high, matched only by recession fears.

We may slip into a recession, but at least the airlines will be safe, right?

Imagine the pushback we received when our forecasts showed the opposite. Our clients were surprised to hear the economy was just fine, but airlines were not.

(It wouldn’t be the first time our analysis was given the “contrarian” title, nor would it be the last. Whether a compliment or a veiled insult, we assumed the former and decided to own it.)

Here we are a year later. First, what hasn’t changed: Interest rates are still high. The economy was just fine, and expectations of an imminent recession are still plentiful.

What has changed? JetBlue / Spirit is now JetBlue and Spirit. Rather than needing each other for the aircraft and pilots, both airlines have deferred orders, and Spirit is talking furloughs.

The word “overcapacity” no longer receives eye rolls when we say it; it is now the leading question we hear from clients.

In fact, softening fares are being observed in markets well beyond the U.S. with transatlantic and European softness, as well as the first signs of fares beginning their reversion to normal in Southeast Asia.

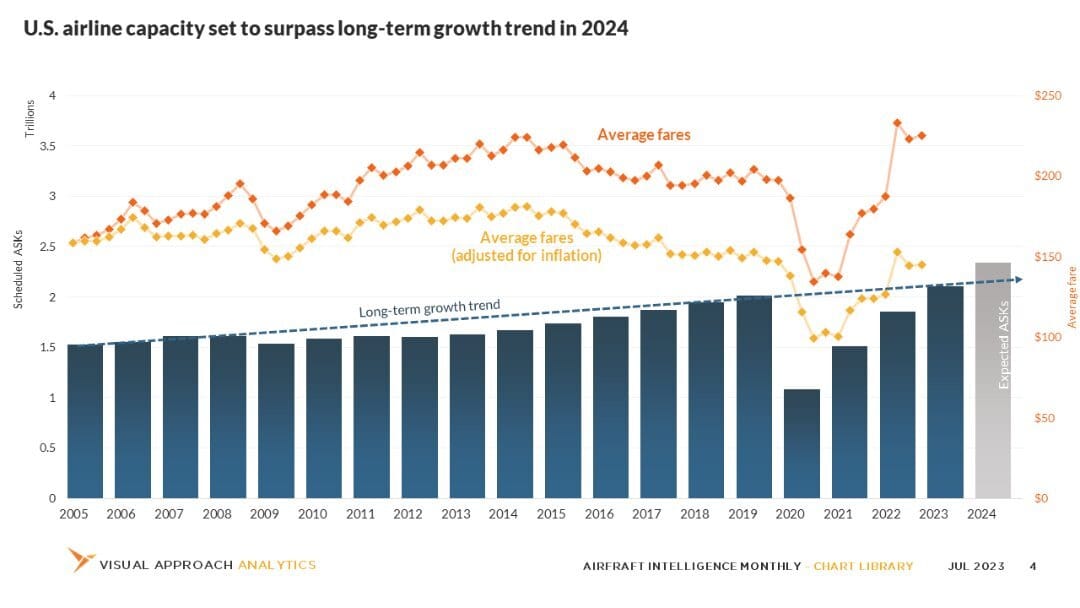

Looking back to summer 2023, the signs of overcorrection seemed obvious to us. We published a warning about the U.S. airlines in our July report prior to Q2 earnings. You can read it here.

Granted, we didn’t think things would shift as quickly as they did.

We expected serious financial difficulties to arrive in 2027, yet Spirit has made waves for a potential 2025 showdown with debt holders. Early signs of overshoot in other regions have arrived sooner than expected.

The reason for the overshoot is simple: In order to get out of a hole, you need to work harder to fill it in. In the same vane, once you’re back to ground level, if you don’t slow down, you’ll overdo it.

It’s that slowing-down-so-you-don’t-overdo-it part the industry is approaching very quickly. For those who drew their new trend lines much steeper during the COVID recovery, slowing growth will be a huge surprise.

Those who drew their trend lines well before the pandemic will notice this is all very natural and (keyword) expected.

We’re not perfect with our forecasts. If we were, this free newsletter would be written from the beach — if at all.

But we are bold in our predictions, even if they inevitably receive pushback. Our focus isn’t on the prediction but on the reasoning behind it. The value to our clients isn’t in seeing the future; it’s in being the first to know how changes will affect the trajectory.

We call that edge. It starts with a contrarian analysis, identifies a trigger point, and then gives our clients a head start on taking action while others try to figure out what it all means.

Over the past four years since we started Visual Approach Analytics, we’ve made some bold predictions. Not all were hits, but the vast majority were — much more than I remember, anyway.

We’re making many more and discussing them with our clients today.

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact