Meh.

I’ve been told by my teenage kids that’s the appropriate word to use.

Not great. Not terrible.

Meh.

The acquisition of Sun Country Airlines by Allegiant Air was announced over the weekend. My first thought was “What a win for Sun Country.” The more I look into it, the more that first thought has become a bit obsessive.

The emails have been arriving asking what I think about the merger. The only word that comes to mind is “meh.”

From Sun Country’s perspective, this is great. The airline has tried everything over the years to escape from Minneapolis. Nothing worked. To be fair, nothing worked, in part, because the airline has been run well enough to know when to stop trying. And as much as other markets have not worked, MSP definitely has.

After decades of trying, what do you do if you’re Sun Country? How about sell for a premium?

Like I said, what a win for Sun Country.

Now for the Allegiant part.

Look, this acquisition isn’t a disaster. If any airline were to make a merger work with Sun Country, it was probably Allegiant (or Southwest). The two airlines are now run similarly in their lower-utilization, leisure airline styles. Cultures are similar, balance sheets are relatively strong, and the two airlines have been well run.

But… I mean… meh.

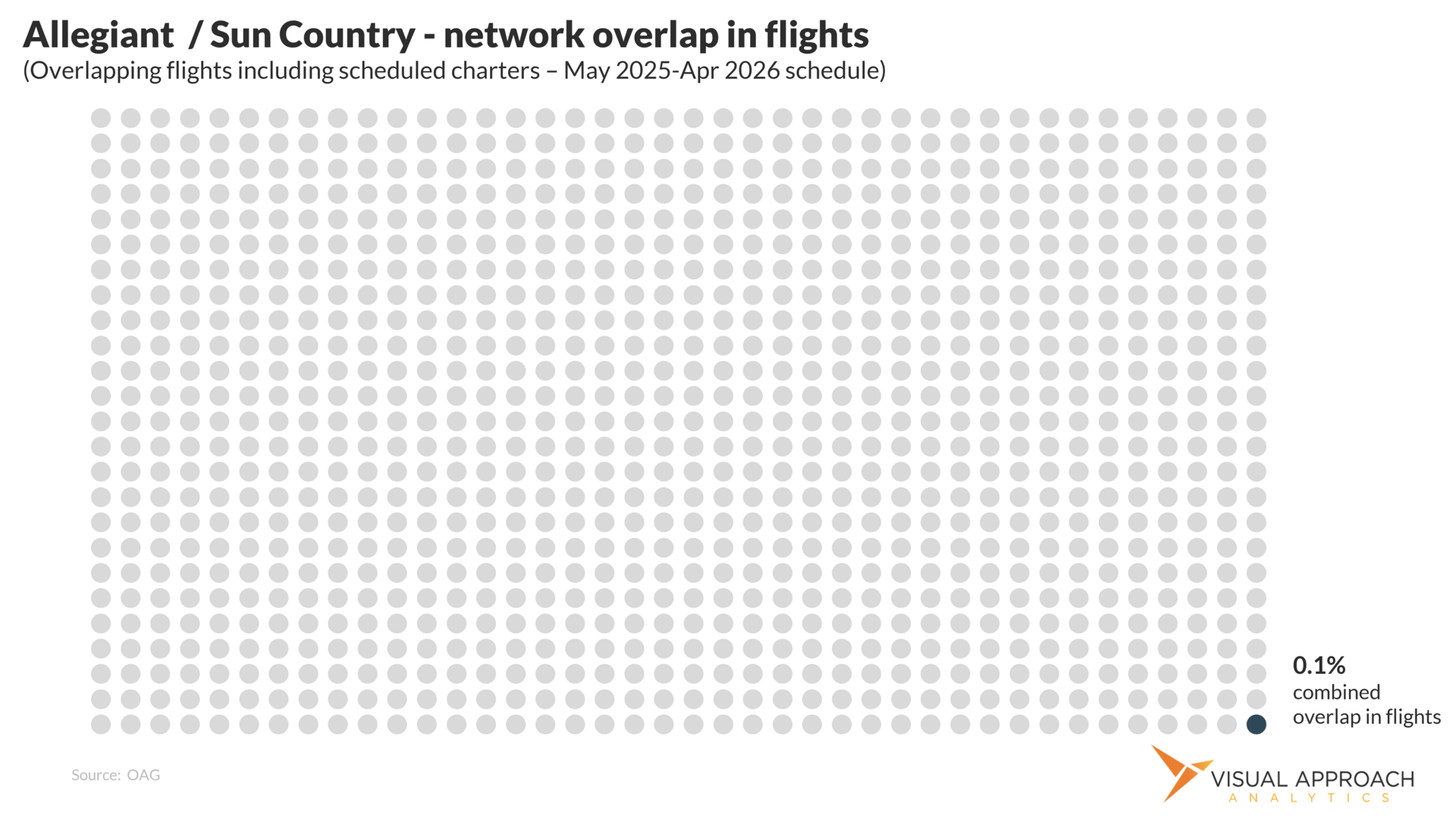

I cannot consider this merger as a consolidation. As complementary as the two networks appear, they don’t actually complement each other. In fact, they don’t interact at all.

The two airlines compete on one route - sometimes. Appleton, WI to Ft. Myers, FL. Seasonally. Beyond that, nothing. For Allegiant’s current customers, this opens nothing. For Sun Country’s current customers, this opens nothing. That’s not a bug, it’s a feature. It’s how point-to-point airlines work, particularly these two. No connections. I take you from cold places to warm places, and the sum total of each remains the same.

Similarly, there is no real consolidation. It’s hard to consider the two airlines as competitors with no overlap. Allegiant bought immediate access to the MSP market - for $1.5 billion.

Then we start to get into the challenges. Sun Country is an all-737NG fleet. Allegiant is an A320ceo fleet with a new batch of 737 MAXs arriving. Complexity added. The Amazon flying is good, but not the hedge the market seems to think. It’s a very low margin base that provides scale to Sun Country. How big can an airline get before low-margin CPA flying for Amazon becomes less diversification and more distraction?

Then there are the pilots. Sun Country's contractual pay rates are about 30% higher than Allegiant's. That number doesn’t reflect all costs, though, as Allegiant is currently in negotiations and has been offering retention bonuses to pilots for more than a year. But this would lock in pilot cost increases.

Maybe.

The negotiations between Allegiant and its pilots have been quite contentious. While the Sun Country contract provides significantly more lucrative rates, there is no guarantee that it will be enough for the Allegiant pilots.

Yet, what was originally considered a problem of increased pilot costs as a result of the merger, could, in fact, be a way to keep costs lower than they would otherwise be. Key word being “attempt.”

From an industry perspective, the merger is a bit of a nothing burger. It’s a staple of two airlines together - sum of the parts. Nothing changes for the airlines competing with Allegiant and Sun Country. Except for one key area: charter.

Sun Country and Allegiant are fierce competitors in the charter space. It’s not a highly visible market, but one that will certainly bring advantages in the merger.

But there are additional risks. The MSP passenger has proven loyal to Sun Country over the decades. While they are expected to welcome their new Allegiant partners, this does open the opportunity for Delta to pick away at some of that loyalty.

Also, mergers tend to get messy. In addition to the price paid, we will start to see special merger-associated costs appear on Allegiant’s income statement. $1.5 billion won’t be the final cost to add MSP to the network.

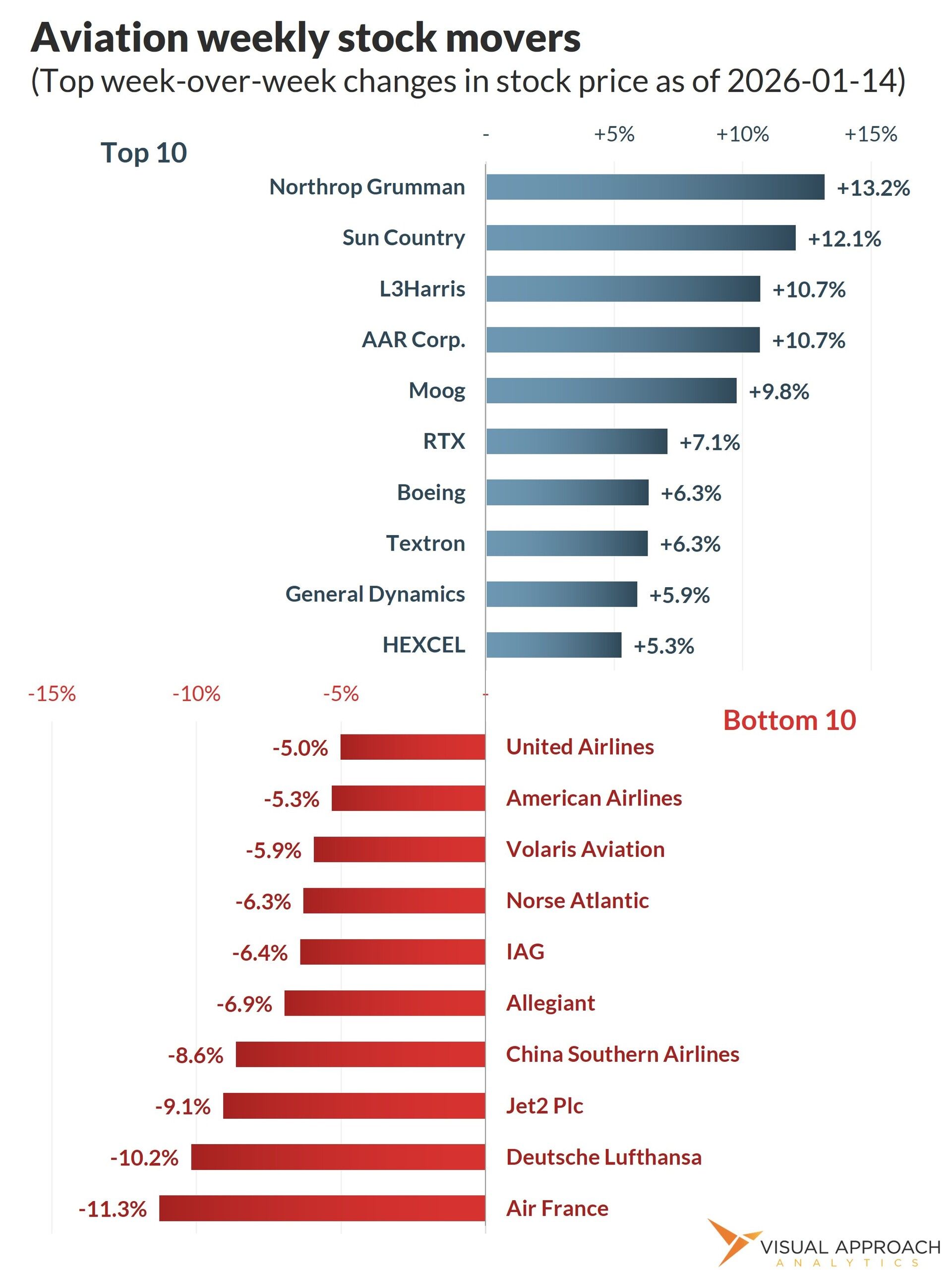

And yet, it’s not a bad deal, either. The timing of the shift in attention from Sunseeker to Sun Country is interesting. Additionally, the merger appears to be considered positively in the eyes of Wall Street (we think due to overestimating the value of the Amazon flying, but you do you).

And that is what benefits Allegiant most in this merger. A two-year free pass to get through the pilot cost increases and shift to new aircraft economics to wait and see what falls out in the meantime (ahem, Spirit… and whatever comes next).

Add all that together - the pilot situation, the stuck Sun Country network, low-margin Amazon flying, a post-Sunseeker grand strategy - and you end up with one clear conclusion:

meh.

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact