August has arrived, and the 2024 story for the U.S. airlines has already been written: The shift to premium.

Last week, Southwest announced their switch to assigned seating with a premium-ish cabin. Frontier offers the option to keep the middle seat open and a premium bundle. Spirit also offers more premium seat selection and bundled options.

The reason for the switch is clear: airlines offering premium options are making more money (or any money, as the case may be).

This recent shift to premium has generated many questions about the future of travel demand in the United States. Top among those: Is demand for low-fare travel dead?

Keeping to our contrarian roots in analysis, hearing these questions piqued our interest. Are fewer people interested in booking discount flights, or is there missing context?

The quick answer is “no”. Low-fare demand isn’t dead.

In fact, one could argue that low-fare demand is up. Over one-third more domestic U.S. travelers fly on ULCCs today than in 2019.

Consider that for a moment.

As a quick point in comparison, Spirit Airlines reported 7.8 million passenger segments in Q1 2019. In Q1 2024, that number is over 10.8 million.

That is an impressive jump in the number of people flying Spirit alone. Now add Allegiant, Frontier, Sun Country, as well as new entrant, Avelo.

But what about fares?

It’s a fare question (get it?). The number of passengers may be up an incredible amount, but if the airlines have had to reduce fares to get it, is it really demand?

Using Spirit’s Q1 as a proxy, fares are kind of down, but not really.

Considering base fare plus ancillary fees, the average amount a passenger paid $117 to fly on Spirit in Q1 2019.

In Q1 2024? $117.

Of course, Spirit is set to report Q2 numbers shortly, and already warnings of lower all-in revenues per passenger are lower. But still. As of Q1, a time when stories of the decimation of the domestic low-fare demand was in full swing, Spirit was up 38% in traffic for the same fare.

What’s Spirit’s problem, then?

Costs - we’ll get back to those shortly.

The point is clear: U.S. domestic passengers still want low-fare service. In fact, more do in 2024 than in 2019—a lot more—and they’re paying the same amount.

So why are we hearing that demand for discount service in the U.S. is dead?

Because there is quite a bit of confusion between lack of demand and too much capacity.

You’ve read our warnings for over a year now. This is what it looks like. The airlines overdid it.

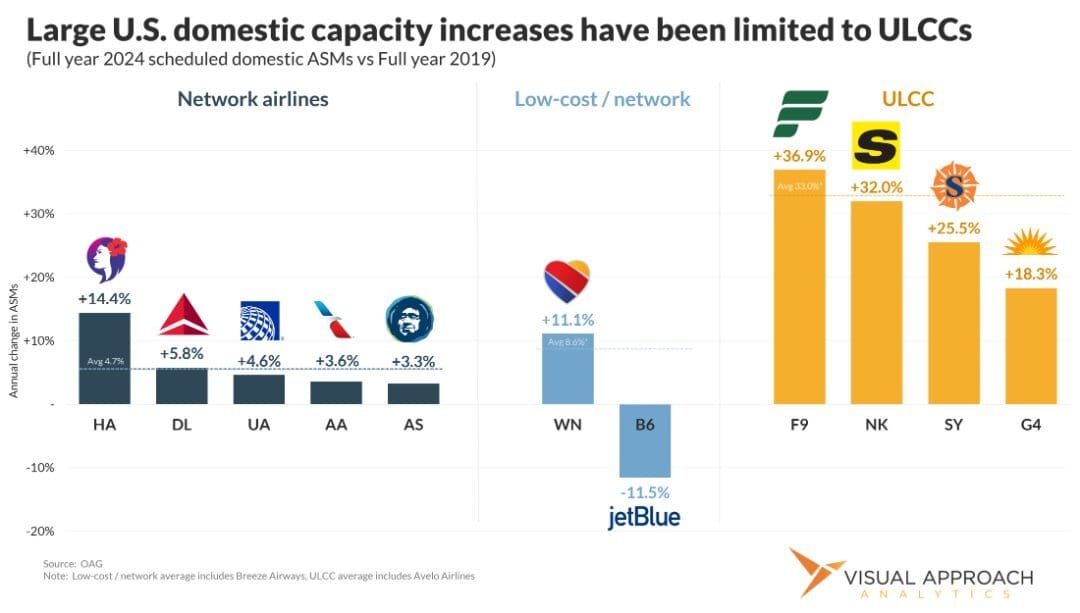

Since 2019, ULCC capacity within the U.S. has increased 33%. Domestic network airline capacity, on the other hand, has increased by 4.7%.

Guess where the premium seats are. (hint: Think more 4%, than 33%).

Demand for low fares in the United States is up. Way up. Low-fare capacity in the United States has just kind of gone haywire.

The question on premium demand is quite interesting. On one hand, despite the shift toward premium by nearly all airlines, growth in premium seats has been slow.

Using the network airlines' ASMs as a proxy for premium seat growth, total capacity has increased by less than 5% since 2019. The disconnect between premium capacity growth and low-fare capacity growth is already staggering.

However, there may be a similar increase in premium demand we see on the low-fare side, just without the capacity to accommodate. Why? COVID.

Consider a major theme that came out of the workforce during COVID. Retirements.

According to the St. Louis Federal Reserve, almost three million additional American workers retired during COVID. That’s about 2% of the working population in the United States in addition to those who normally retire.

Three million additional people retiring. Guess what retired people tend to have? Money. (granted, we are making an assumption that they retired because they felt they had sufficient money to do so.)

More people with more money looking to spend it doing things retired people do. Travel, is very high on that list.

In fact, during Delta’s Q2 earnings, Ed Bastian made several comments supporting this phenomenon, as well. The increase in retired travelers willing to spend on premium travel has boosted premium demand.

While there are no signs that low-fare demand has slowed, there are signs that premium demand has increased.

Why are ULCCs struggling?

Remember those costs we mentioned earlier?

Demand for low-fare travel within the United States is significantly higher today than it was in 2019. Unfortunately, the ULCCs have supplied sufficient seats to absorb all of that extra demand (and then some) - and they have more on the way.

The problem comes in that the ULCCs have all added significant costs to add that capacity.

Spirit has increased its overall number of passengers by 38% since 2019. To do so, unit costs have increased by 38%.

In case you missed that, we’ll repeat: Unit costs have increased 38%.

CASM has increased from 7.8 cents in Q1 2019 to 10.8 cents in Q1 2024.

Overall costs have increased by 92% — to carry 38% more people.

See the problem?

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact