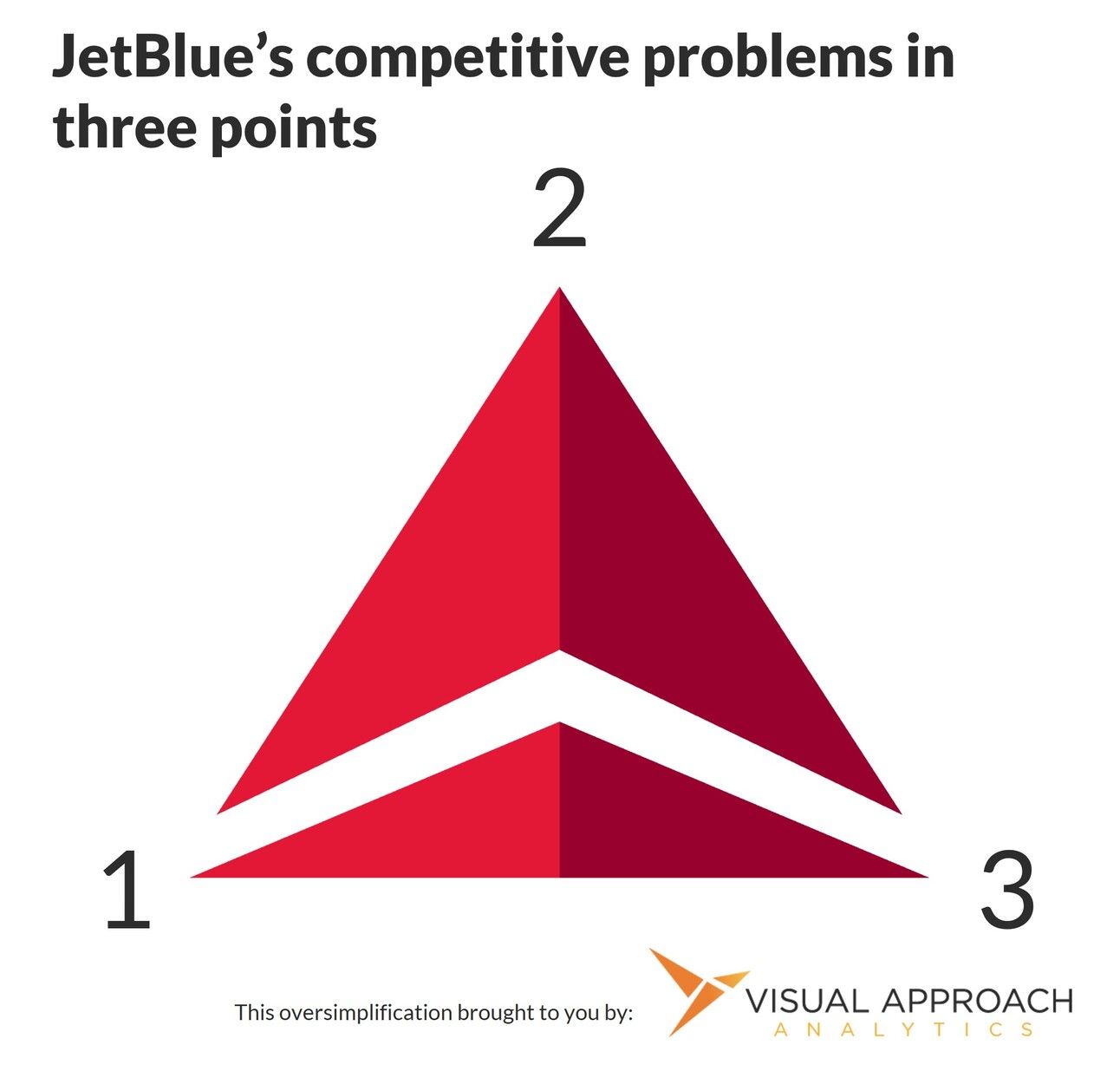

JetBlue has a problem - three of them, actually.

The three problems may be immediately apparent in the chart above. If not, we have provided a zoomed-in version of the competitive landscape, which should help clarify:

We jest… but not really. Delta is a problem for JetBlue.

Before the self-inflicted wounds from the failed Spirit merger, JetBlue was already dealing with a problem. Being limited primarily to the East Coast brings the benefit of operating a network along some of the busiest corridors in the world. Then again, those busy corridors have also attracted the growth of one of the most powerful airlines in the world: Delta Air Lines.

It is from this context we reconsider some of JetBlue’s strategic decisions over the past few years. Los Angeles expansion, transatlantic service, NEA, Spirit merger: not great options (although the NEA is still arguably a good strategic move; It just wasn’t… you know… legal).

But if the objective is to escape Delta’s seemingly unstoppable growing influence in the Northeast, you start to see a semblance of rationale. JetBlue needs a way out from under Delta.

Delta has long been JetBlue’s largest competitor. But it wasn’t until 2014 that the Widget started to refocus on the Northeast's potential. Not even the American network combined with the Northeast-heavy US Airways network was able to rival the extreme - and growing - exposure to Delta’s network.

Once averaging 40% of the network’s seats deployed to monopoly routes, JetBlue now retains only 12%. More than five times the number of seats deployed without competition are deployed directly into the face of Delta.

And Delta is winning - at least over the past decade.

During a JP Morgan conference, Mark Streeter informally polled a largely New York-based group of investors on how many had airline-branded credit cards with one of the big three airlines. Over three-quarters of the room raised their hand.

When asked how many held a JetBlue-branded card, fewer than 2% raised their hand. (To the one brave soul who raised their hand for the Spirit-branded card - we salute you.)

The informal poll served its purpose. In JetBlue’s own backyard, more corporate investors held competing credit cards than JetBlue’s.

This brings us back to JetBlue’s challenge of being stuck on the East Coast. Once upon a time, it was considered a risk to legacy airlines if they saw a large overlap with low-cost carriers. Delta, too, has long been criticized for its reliance on the Northeast-Southeast traffic flow. Only things appear different now.

Delta appears to have turned dangerous exposure on the East Coast into a bonafide advantage. Is it the legacy exposure to low-cost carriers that we should be watching, or low-cost exposure to the legacy airlines?

“None of you seem to understand. I’m not locked up in here with you. You’re locked up in here with me.”

Pop quiz, hot shot:

We’ve looked at JetBlue’s top competitors by overlapping markets, but what about Delta?

The answer is but a click away → Answer.

Research published this week

We have been in a research publishing frenzy the past week. Here are some of the analyses you may have missed if you’re not a subscriber to Visual Approach Research:

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact