ATR held its U.S. connectivity summit in Washington, DC this week. The theme of the event was, “Hey, remember all those flights there used to be in North America? We can do that.”

Indeed, looking back at historical schedules, over 560 city pairs within 1,000 miles that appeared in the 2005 schedule are no longer there. If we go back to the 90s, it approaches 1,000.

The $13 trillion U.S. economy in 2005 has grown to $30 trillion in 2025, doubling in size, yet still shedding routes. Why?

One major shift happened in the past two decades: Six network airlines became three. The brands of U.S. Airways, Northwest Airlines, and Continental Airlines have disappeared with much of their networks. Hubs that used to connect cities now no longer hold hub status. Many of those appear in the Midwest and include names such as Cincinnati, Memphis, Pittsburgh, St. Louis, and Cleveland.

Look closely enough and you’ll see many of the red lines converging on those former hubs. A clearer differentiation to notice is the line that runs down the middle of the country. West of the line that runs from Minneapolis, Kansas City, Dallas, and Houston has relatively fewer lost routes (notably, this area also has relatively fewer residents). However, Portland, Oregon, appears to be the outlier, having lost some short-haul service as the Portland hub was downsized over the years.

The question posed by ATR this week is how many of these old routes can be reactivated, or new routes found. To be certain, North America has also gained many new routes over the years, particularly longer-haul markets that tend to touch Las Vegas, NV, Mesa, AZ, and Sanford, FL. However, at the same time, connectivity across the country has been steadily declining.

The loss of 562 city pairs resulted in over 770,000 annual flights that used to take place, now… not. That may sound like a lot, but it’s less than two flights per day each way on the lost routes.

The question remains whether those routes that were viable are still viable today. While it feels like everything requires a connecting flight, connecting itineraries are significantly lower today than in 2005. Why? More people are driving to the mega-hubs, sometimes up to four hours. Drive four hours to an airport and you’re not going to take a one-hour flight. Bigger aircraft flown on fewer flights further limits connections, but also limits recovery options.

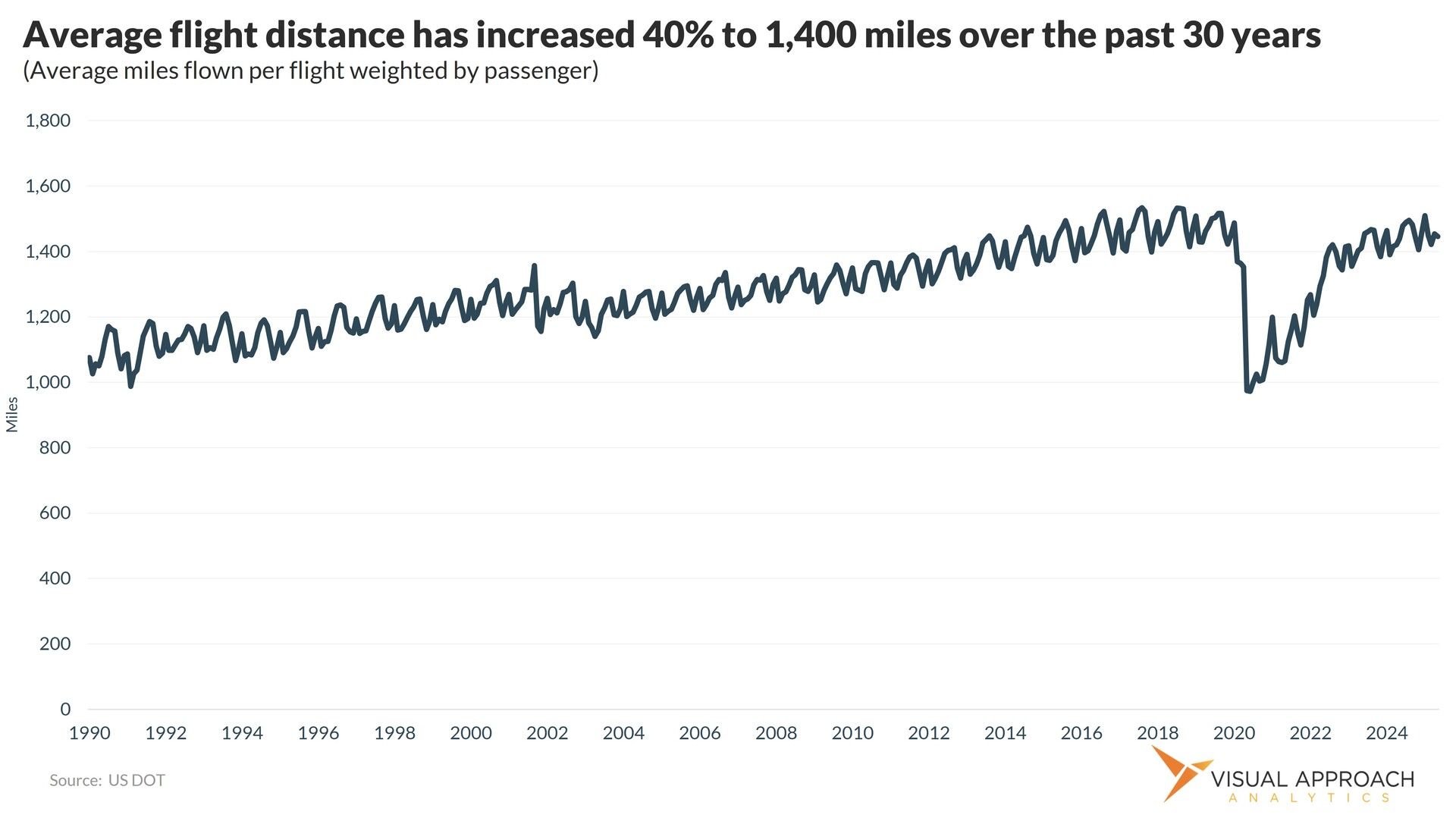

And so stage lengths increase. Aircraft sizes increase. Small cities lose air service, but when they do have air service, the local citizens aren’t exactly turning out in droves.

The market both follows the demand and abhors a vacuum. Which is it? Is the demand leaving or is a vacuum forming?

There is no grand conclusion. This isn’t a call to action to save short-haul, small community aviation, necessarily. It’s more of an open question as to whether the American public even wants it.

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact