In-fo-dem-ic (noun) - an excessive amount of information about a problem that is typically unreliable, spreads rapidly, and makes a solution more difficult to achieve.

No, there is no indication that Frontier is preparing a pre-emptive bankruptcy filing.

It has been the recurring theme over the past two weeks. Over countless meetings with investors and lessors, the question of whether rumors of Frontier’s pre-emptive filing were true was persistent — too persistent.

There were several variations, but the crux is this: Frontier could file a pre-emptive bankruptcy to clear the books and combine with Spirit to emerge as a lean ULCC powerhouse.

Uh, no.

For the record, here was our answer repeated several dozen times: There are no good reasons for Frontier to file a pre-emptive bankruptcy.

First and foremost, bankruptcy stinks. Ask any leader who has been through the Chapter 11 process to protect their company, and they will agree. It’s not a “tool” to get what you want. It’s a last resort.

Of course, airlines have filed earlier than expected - notably SAS in 2022 and American Airlines in 2011. There are reasons to do this. The best is to engage in the inevitable while there is still some furniture left unburned to rearrange. If you know the cash burn and there are no potential inflection points on the horizon, it makes sense.

Take American in 2011, for example. The airline was the only legacy airline that had not filed for Chapter 11. Delta, Northwest, United, Continental (twice), U.S. Airways (twice), TWA, Pan Am, Braniff, Eastern… you get the idea. American had structural problems that would not (arguably could not) be resolved without the Chapter 11 process.

Now let’s consider Frontier. The airline is losing money, but the runway is long. Most importantly, Frontier is staring down an imminent, critical inflection point: its top competitor may soon disappear.

The game of chicken that Frontier has been playing by considering merging with Spirit to avoid the disaster of someone else buying them now largely looks past. It is likely that the gameboard in front of Frontier could shift in its favor in the near term.

So why file? For those who play Texas Hold’em, this is akin to folding on the flop when no bet has been made. Just wait and see what cards get flipped.

For those who don’t play Texas Hold’em, it’s like throwing away Christmas presents before they are opened to avoid finding out what’s inside. There is just no good reason.

Further, let’s consider the downsides. For that, we’ll revisit American’s bankruptcy filing. The American management team that emerged from Chapter 11 was not the same one that entered. During the process, a hostile(ish) bid was made by U.S. Airways (recently “rescued” in the same manner by America West). The American name persisted, but the management that filed in 2011 lost control.

Again, no reason for Frontier to roll the existential dice for… well for what exactly?

Then consider the evidence of Frontier’s new CEO, Jimmy Dempsey, making the rounds in Dublin, only to be constantly peppered with questions of bankruptcy. While we were not privy to any of those meetings, the reported response was entirely as expected: "Um, no.”

(Though we did hear that after endless pushing, the frustrated answer became “would I lie to you?”, which didn’t exactly instill the confidence intended. Yet, how many answers to the same implied question “are you lying?” could you withstand before ending up at the same exhausted place?)

So to answer the question for the 100th and hopefully final time, no, we do not think Frontier is preparing a pre-emptive bankruptcy filing.

The origins of the Frontier rumor

We aren’t media. Despite the endless unsolicited “tips” we receive from motivated people who seem to enjoy tipping the scales, we just don’t care. We deal in research, and that only involves verifiable data.

But the rumor mill isn’t entirely without merit. Rather than believing and chasing down the rumors, time is better spent understanding their origins. From here, you can pick out the motivations and fears that likely led to the current situation, but also find some small nuggets of truth that always exist. No matter how crazy, no infodemic spreads as quickly as it does without some truth (for a disturbingly relevant and recent example, see: Pizzagate).

As far as we can tell, there were two distinct origins of the Frontier bankruptcy rumor: Late schedules and legal scuttlebutt.

Late schedules

The first involved an article published January 15th from ABC27 in Harrisburg, PA, written by aviation reporters Seth Kaplan and George Stockburger.

The article correctly noted that Frontier Airlines had no schedules on file beyond April 13th. Why? It’s a good question. Without schedules filed, passengers couldn’t purchase tickets beyond April 13th - only 88 days away.

Frontier would eventually file its schedules on Jan 22nd, but would only extend its schedule through May 20th, where the limit still sits. Still, the rumor mill had been set in motion just before the biggest annual gathering of investors, creditors, and lessors would take place in Dublin.

There are sufficient reasons for Frontier to have been late in filing its schedule. None of them includes bankruptcy.

The simplest reason the two are unrelated is that bankruptcy doesn’t affect schedules. The idea of a Chapter 11 filing is to continue business as usual while providing protection from creditors. Whether a schedule is filed or not wouldn’t indicate bankruptcy. Taking this one step further, if the idea was to file before any creditors learned of it, why would they tell the scheduling team?

And yet, Frontier’s late schedule was odd. The next step led us to ask if there were any other reasons for a late filing. Sure enough, there were.

Firstly, the vast majority of Frontier’s bookings happen within 30 days. This is typical of a ULCC. While some people were certainly considering travel after April 13th, the number was small.

Secondly, remember that inflection point we talked about with Frontier’s top competitor potentially exiting stage right? If that happens, Frontier would certainly want to change its schedules. It may not be the only reason for a late filing, but it would be a reason.

And sometimes schedules get behind. Frontier is notorious for late schedule changes, a trend we’ve noticed after following the North American airlines each week for the past six years through Cranky Network Weekly. It may be strange that the airline wouldn’t have schedules extended beyond 88 days, but not necessarily anything out of character.

Regardless, late or missing schedules are not an indication of a pending bankruptcy. And yet, this seemed to set off a fury of speculation

Legal scuttlebutt

Despite the relatively simple schedule explanation, there appeared to be two sources for the bankruptcy rumors. Apparently, separate rumors were flying within the legal community that Frontier was exploring a filing.

This one is harder. For one, there is no evidence to support or refute this claim. Instead, we consider the possibilities. Frontier may be exploring the outer edges of all options, including the merits of a much later filing, but that is entirely different from the implications powering the infodemic. But what does that mean, exactly? It makes sense that any airline would consider the entire spectrum of possibilities, regardless of how unlikely or distant in time.

Don’t get us wrong. We’re not suggesting Frontier is doing any planning for bankruptcy, rather that it’s far more likely that the entire spectrum of possibilities was mentioned at a time when the market was already primed for any hint of the word.

Another reason for pause is to consider just how discrete the legal community is. If the Frontier team were planning a bankruptcy, I would not expect any hints to arrive from the legal community. It would come from the creditors or within the airline. It remains more likely that Frontier had no reason to be discreet about bankruptcy plans because there were no bankruptcy plans to be discreet about. Then, see above about how an innocent mention into a primed rumor mill ignites the wildfire.

Likely story

Here is where we sit: No, Frontier is not preparing a pre-emptive bankruptcy filing. We’ve been wrong before, but we just don’t see any reason to file, and plenty not to. Furthermore, we can trace the more likely misunderstanding to the two identified origins.

From there, the conditions were right for a wildfire. Lessors and investors, many of whom had recently been burned by Spirit returns, were especially twitchy. When you get a bunch of twitchy people together in one place with rumors coincident around two sources and a CEO change, the resultant wildfire of rumors is to be expected - an infodemic.

But…

… we still subscribe to the nugget of truth theory. For those who’ve made it this far through the newsletter, allow me to offer a soft explanation that makes sense.

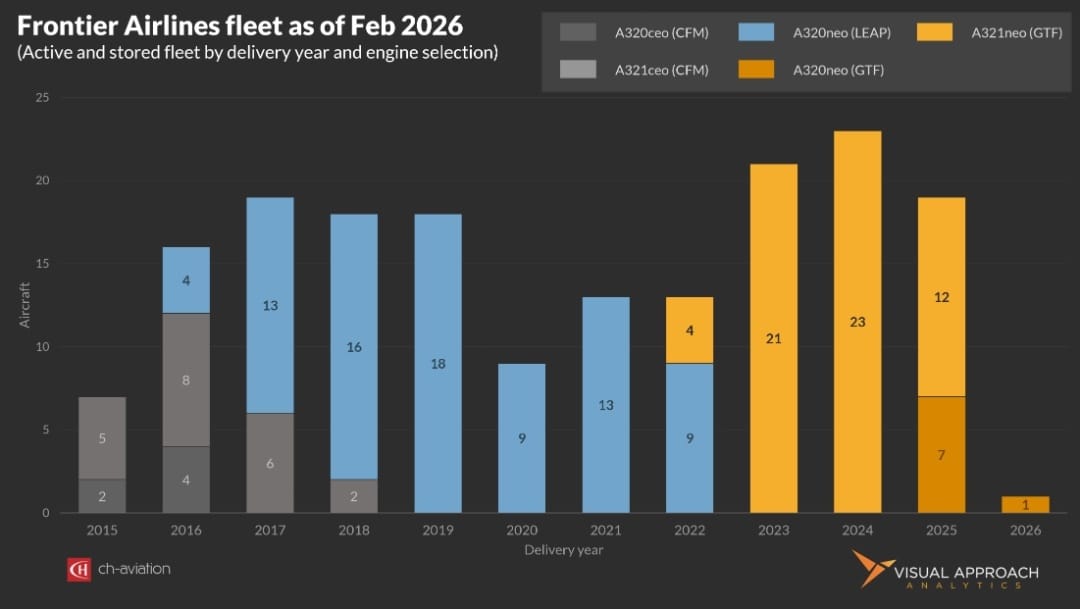

The data does suggest there could be a fleet move inbound for the airline. Not a bankruptcy filing by any stretch, but a fleet shift that could have quietly and incorrectly fueled the rumors already debunked. There are rational moves to make, and the data and motives align with the airline and lessors - the precise type of win-win you would expect from a rational airline.

More importantly, any shift in fleet would be the final piece of the puzzle for us in the bankruptcy infodemic. All the best rumors start with a nugget of truth, and aircraft movement would certainly provide that. Still, sans any announcements, there remains one clear explanation for the bankruptcy rumors that doesn’t involve bankruptcy: an infodemic.

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact