Things aren’t great for Spirit.

Still.

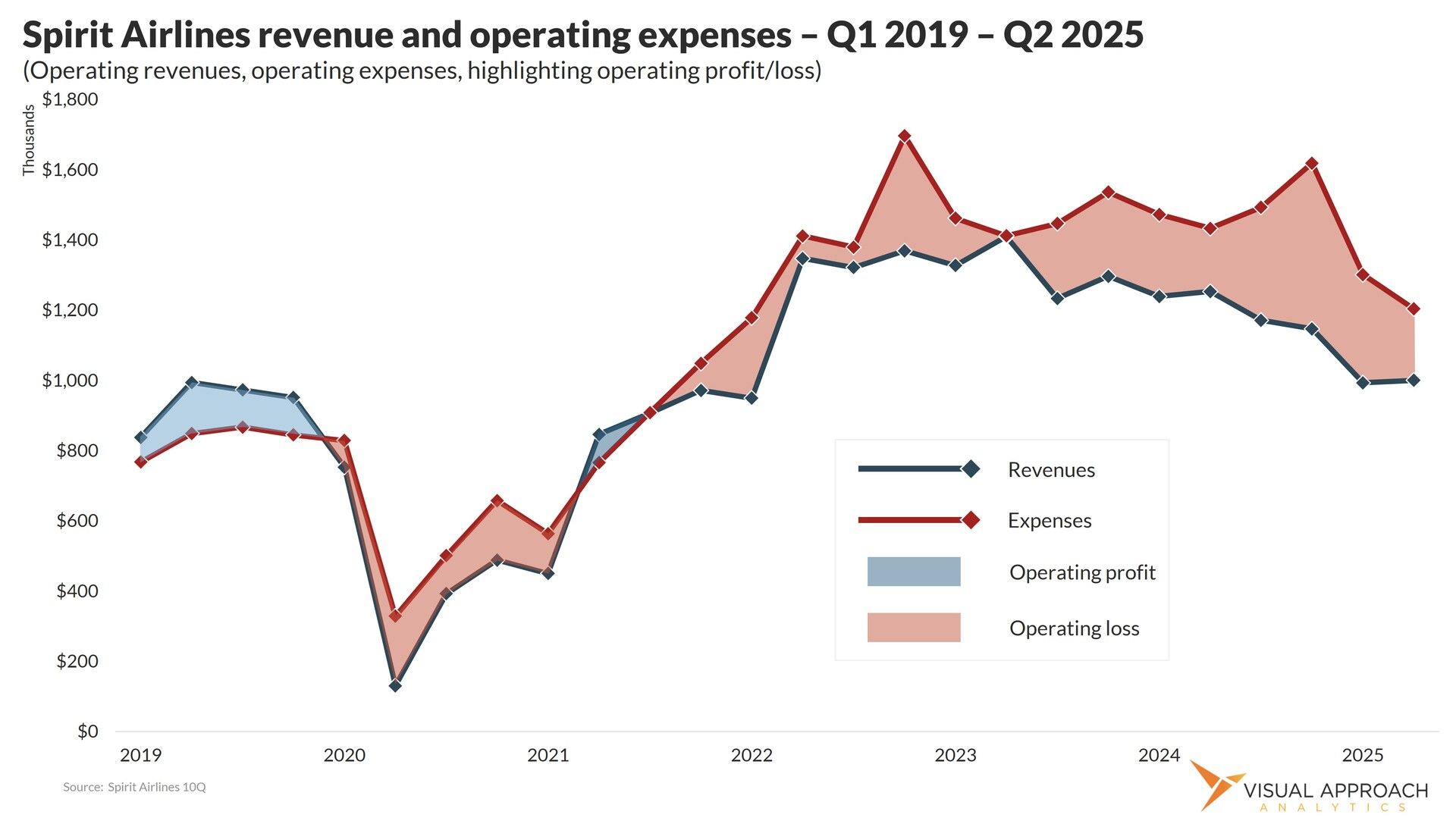

The rapid-fire bankruptcy last winter looks to be coming back to bite Spirit shareholders and creditors. What entered Chapter 11 as an airline with a loyalty bond due, unsustainable growth, and broken economics, exited as an airline with more debt, unsustainable growth, and still broken economics.

The idea that Spirit would protect its bondholders ahead of a buyout offer from Frontier has not worked. Some would even say it backfired.

As a result, Spirit has issued some strong language in its latest 10Q reporting about its ability to continue existing.

“Because of the uncertainty of successfully completing the initiatives to comply with the minimum liquidity covenants and of the outcome of discussions with Company stakeholders, management has concluded there is substantial doubt as to the Company’s ability to continue as a going concern within 12 months from the date these financial statements are issued.”

Bonus points for clarity.

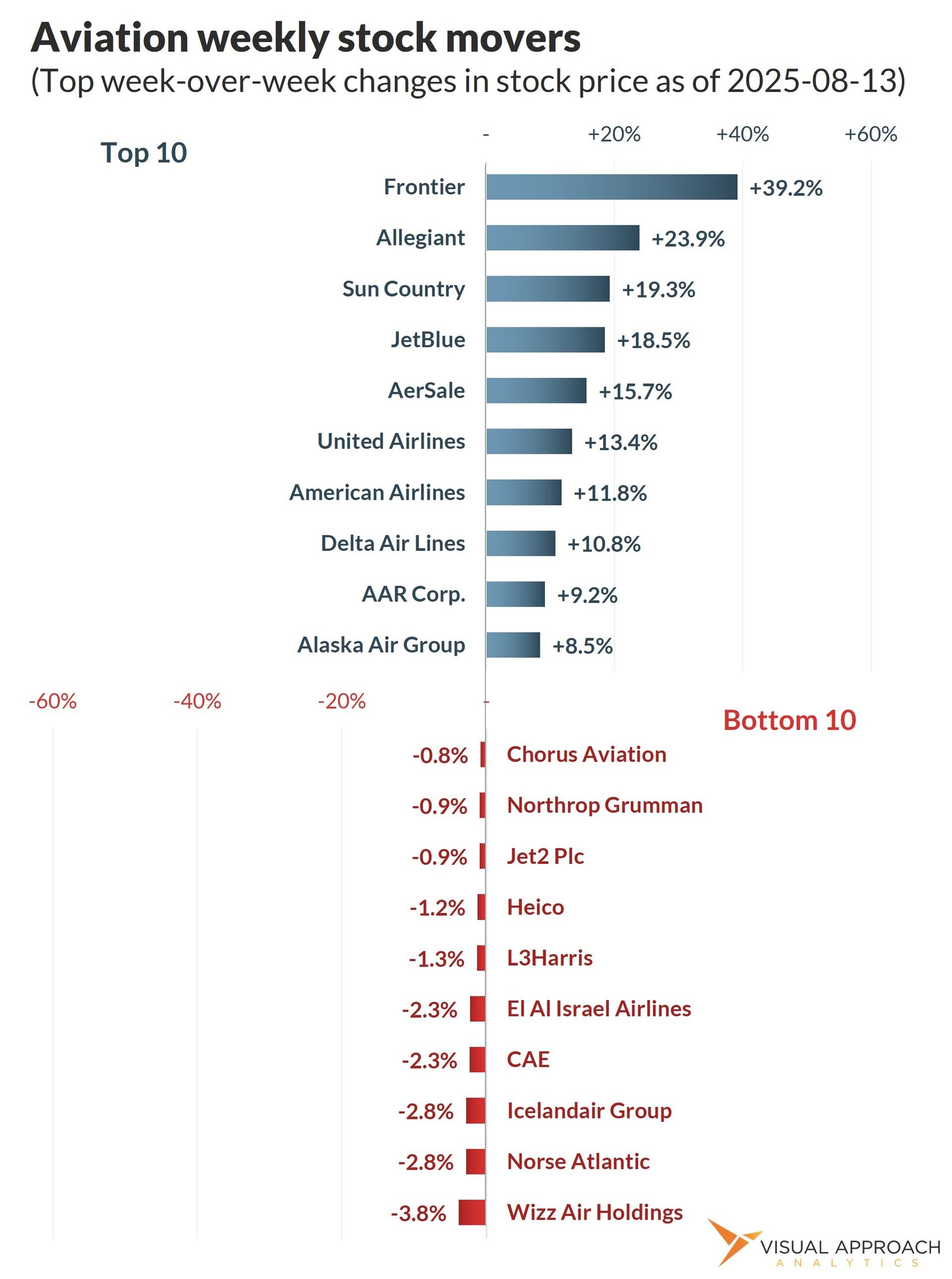

As a result, almost every other U.S. airline stock was up double digits over the week. Which leads us to consider who the winners in a full-on Spirit Airlines exit would be.

For context, the U.S. market has not seen a Chapter 7 exit of this magnitude in a very long time - perhaps 30 years. So who would walk away as the big winners?

Here are the rules of the hypothetical:

First, we assume the airline just ends. That’s still about a 50/50 chance in our view, but one that creates the cleanest scenario for our hypothetical. This is the traditional airline shutdown case where creditors fight over remaining assets, customers are left hanging, and yellow tails start stacking up across the country.

Second, we assume the Fort Lauderdale gates are up for grabs. We don’t know if this will be the case, necessarily, but we consider the FLL presence the most valuable asset for somebody to extract.

1. Southwest Airlines

Southwest represents the highest level of overlap with Spirit. That’s because of Florida. But that overlap has been very painful for Southwest. The elimination of a competitor on so many routes would certainly benefit the airline to a level far greater than any of its recent culture-shifting changes have done.

2. Breeze Airways

Hear us out: Breeze is an airline looking for a home to place its relentless delivery stream of aircraft. Without Spirit, that list of opportunities grows exponentially. We’re not certain it bumps the airline to profitability, but we suspect the shift to the airline’s network would be seismic.

How seismic? Consider that Avelo exited the breakeven-at-best Burbank market. With a week, Breeze redeployed aircraft to fill in the gaps. The market has been demonstrated to be not great at best, but sometimes not great is good enough.

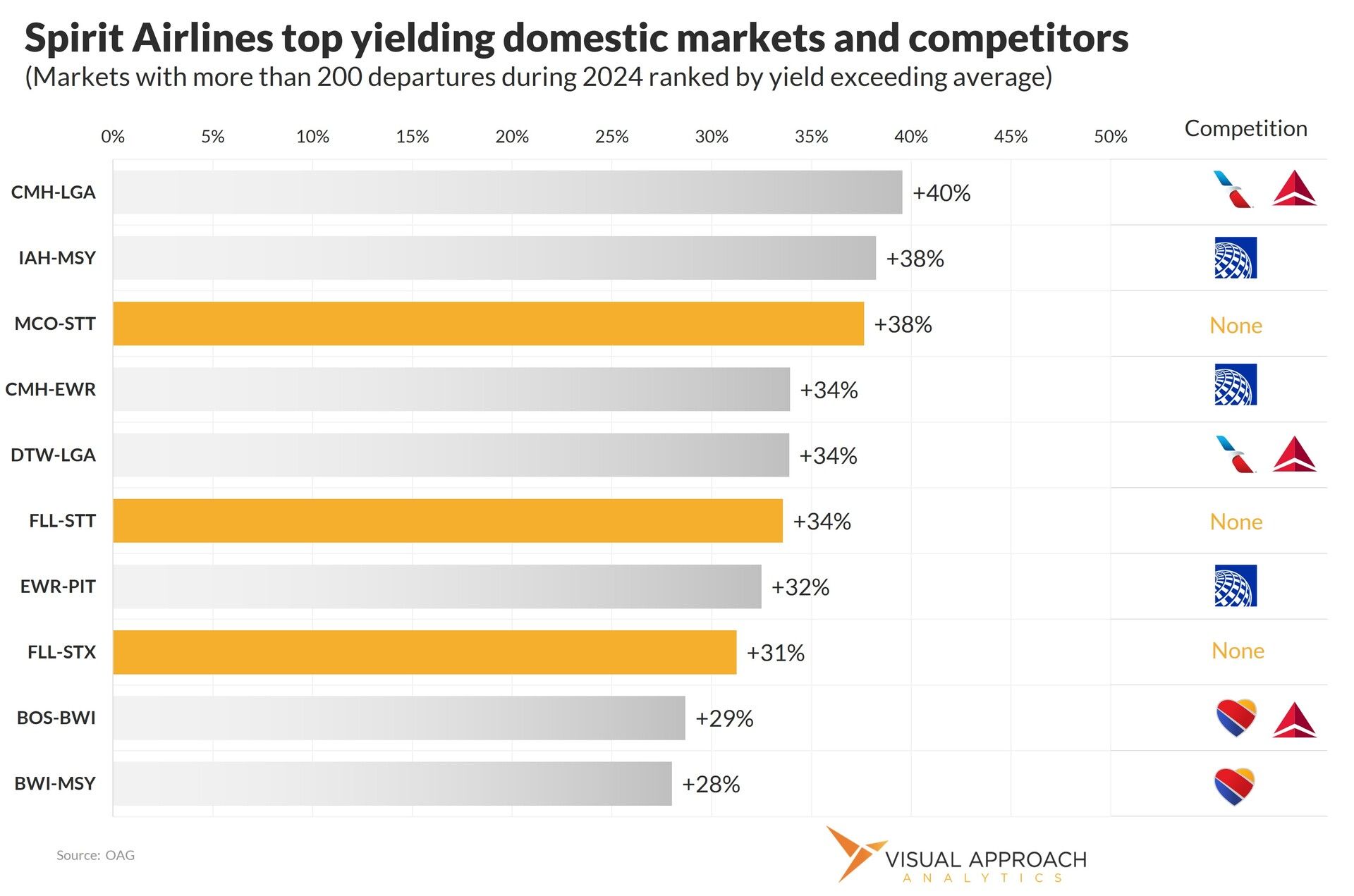

And Spirit has some great markets. Looking at the top 10 yield out-performers for Spirit’s domestic network, it would be a gold rush into these markets. Breeze would certainly be an active player in that rush.

Without Spirit, the opportunities open overnight for Breeze. Pound-for-pound, Breeze should probably be at number 1.

3. JetBlue Airways

JetBlue does not share much overlap with Spirit, except for FLL southbound. JetBlue is the only other low-cost airline with a significant Caribbean presence, both out of Fort Lauderdale and Orlando. Even though limited overlap exists, the Latin American market would open up, and JetBlue would be the prime candidate to take advantage of it.

4. Frontier Airlines

Down the list, Frontier would definitely still benefit. Just the overall exit of capacity from Spirit would open significant opportunities for Spirit. While Spirit’s aircraft utilization dropped below 8 hours a day, Frontiers was also suppressed around 10. The airline is having similar problems as Spirit, just with more cash. Frontier’s once-reliance on Denver has shifted to the East Coast, where, you guessed it, Spirit deploys the majority of its capacity.

Yet risks are also highest for Frontier. That risk? That someone comes in to buy Spirit, and the capacity doesn’t leave.

Dark horses

United Airlines

I continue to maintain that no airline is as hungry for a South Florida hub as United. Swallowing Spirit is still a large pill to swallow for United, not from a debt perspective, but from an employee perspective. Seniority lists would need to be merged, which always gets ugly. Additionally, the gates it has versus the gates it needs in Fort Lauderdale are not in the same place. United would still need to exit T1 to access the room vacated by Spirit across the parking garages in T4. Much cleaner for JetBlue, but you know, in the words of Judge Young, “To those dedicated customers of Spirit, this one's for you.”

Sun Country

We’ve been talking about Fort Lauderdale, but don’t forget about Detroit. Sun Country has proven that an airline can be built around a single Delta-dominated hub, even if challenged to grow beyond. There is a copy-paste argument for Sun Country in DTW.

Allegiant

By network philosophy, Allegiant and Spirit do not go head-to-head on many routes, but they do compete in several markets. This is largely due to Allegiant’s use of secondary airports while Spirit focused on the primary. But Allegiant still has a large presence in Florida and Las Vegas that touches Spirit, opening opportunities in the gold rush.

Avelo

Probably the most misunderstood airline in the U.S., Avelo is highly opportunistic, if limited in size. An exit of Spirit would certainly benefit the airline, likely pushing it into consistently profitable territory. Even though attention has been on the New Haven gem for Avelo, the airline operates to many other markets out of Florida. Avelo would be a very active player in the gold rush.

What about the others?

Look, American, Delta, and United will benefit even in a do-nothing scenario. Capacity leaving the market benefits everyone, and Spirit was most active as a spill carrier in the past few years. That means overlapping many of the legacy airlines to take the passengers that the big three priced out of the market.

But it will mean more pricing power at the lower end of the fare spectrum for the legacy airlines. Note, however, that attention for these airlines has been at the top of the fare spectrum, hence why we don’t believe the benefits will be as substantial. Unless one of them swallows the airline and gains access to the Fort Lauderdale gates (ahem… United).

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact