Player three has entered the game.

Barely a week after Embraer announced an order for 50 E195-E2 aircraft with Avelo Airlines, the Brazilian manufacturer signed another 24 with LATAM.

Not to overlook Avelo, but LATAM is a big deal. Embraer originally sold E190s to four large Latin American airlines in the prior two decades: Aeromexico, Copa, TACA, and Azul. Notably absent were Lan Chile and TAM Airlines (the LA and TAM in LATAM). Of the four original big Latin American airlines, only Aeromexico and Azul still operate the type, and of those, only Azul has committed to the E2. Since, Mexicana has been resurrected as an airline and placed an order for E2s, and Embraer’s white whale of LATAM has finally made the switch.

Notably, however, is that both Lan and TAM had long been Airbus narrowbody operators before they joined forces and placed follow-on NEO orders. The airline never placed an order for the home team manufacturer - that is, until September 2025.

The dominance of Airbus in the narrowbody fleet at LATAM has finally been broken. Score one for the home team. But why?

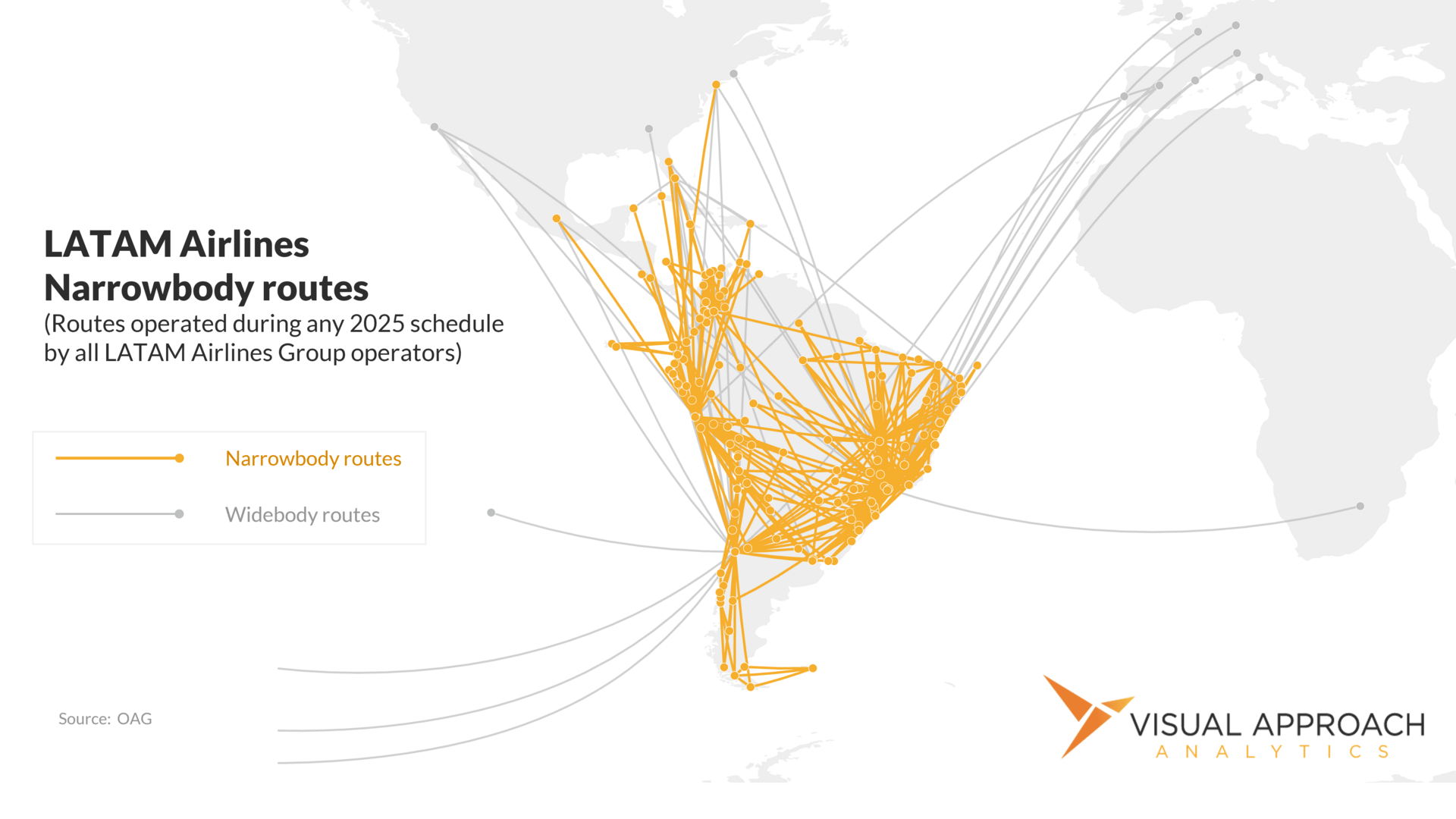

For one, LATAM has not been interested in regional jets.

It still isn’t. If ever there was an exclamation point at the end of “The E195-E2 is a narrowbody,” this is it.

But Airbus has a problem — it sold most of its positions. At some point, availability becomes a powerful factor, and Embraer has that availability. In fact, it was a factor we highlighted last year that was likely to lead to a rush of E2 orders: 2024/2025 expected to bring strong orders for Embraer’s E2.

At LATAM, Airbus also lacks a competitive aircraft that is common with the LATAM fleet. The A220 may start with an “A” and end with a “20”, but it’s definitely not common with the A320. LATAM needs A319 replacements - about 40 of them over the next 15 years. That puts the E2 on an even playing field with what Airbus could bring to bear, right in Embraer’s backyard.

And so, while we give Airbus a pass for not pulling LATAM into its A220 customer base or having the availability to keep the airline purely A320 on the narrowbody side, it was still unsuccessful in defending against Embraer.

For all the concern from industry players that Embraer couldn’t compete against Boeing and Airbus, we finally have proof that independence can be an asset, not just an obstacle to overcome.

But this deal was not consummated due to mistakes at Airbus (that we know of, anyway). This is a strategic win by Embraer, and it should be recognized as such. The word that comes to mind is “hunger.” This is important, and a key moment for the industry. You don’t have to be big to succeed.

During a previous life selling CSeries (the one, true name of the A220), the team was offered countless unsolicited pieces of advice: in order to beat the big players, you had to think like the big players.

I wholeheartedly disagree. If you think and act like Boeing and Airbus, you’ll be as good as Boeing and Airbus, with less scale, higher costs, less financial and political backing, and fewer overall resources. End result: you lose.

Embraer seems to have figured this out. The Brazilian manufacturer is no longer playing the role of leader in the regional jet market, but rather that of an underdog in the narrowbody market. Game on.

It’s a role that Airbus used to play. It’s one that Airbus simply can’t play today - it’s been far too successful.

But we are hearing frustration from some airlines that they can’t seem to get the attention of Airbus. Meanwhile, Embraer shows up in force.

What about Boeing, you ask? Boeing isn’t exactly flush with narrowbody availability, either. However, Boeing appears to have taken a slice of humble pie - an oddly positive side-effect of the airframer’s challenges over the past six years.

Additionally, consider that Embraer aims to deliver approximately 7% of the total narrow-body aircraft each year. Success for Embraer looks very different from success for Airbus or Boeing. But it’s still a success, and this one came at the expense of the giant.

It feels like things have changed in the narrowbody space. But this change wasn’t created by Airbus or Boeing. This change is Embraer’s. The Brazilian manufacturer is on a roll, and if rumors hold true, it’s not about to stop.

Podcast with Ryan Goepel, President of Global X

How does a charter and ACMI airline consider aircraft age when sourcing aircraft?

Our latest podcast talks fleet management with Ryan Goepel of Global X (aka, Global Crossing Airlines). We discuss target vintages for A320ceo aircraft based on the mission, as well as the A321P2F, and where it fits in the global fleet today.

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact