It’s the great mover of economies. Literally.

Oil has long been the resource of choice for powering moving things—transportation, as it were.

The reason is quite simple: Refined oil is packed with energy, largely stable, the center of its own massive logistics network, portable, and oh-so plentiful.

(It also happens to be a major contributor of CO2 emissions and slowly warming the planet toward the unknown, so… there’s that.)

As one could expect, the growth of economies would be a result of increased oil consumption. However, our recent analysis of regional trends in oil consumption and economic growth suggests that is not always the case.

The big growth story over the past several decades has been Asia. Similarly, the big growth story in oil consumption has been Asia. Since 2000, the Asian super-continent (along with Oceania) has increased oil consumption by an average of 2.5% per year.

However, we offer both Europe and North America as alternatives to the narrative that economies need growth in oil consumption to continue growth. Both regions house fully developed economies, and growth has come with only a 0.3% annual increase in oil consumption for North America and 0.1% for Europe.

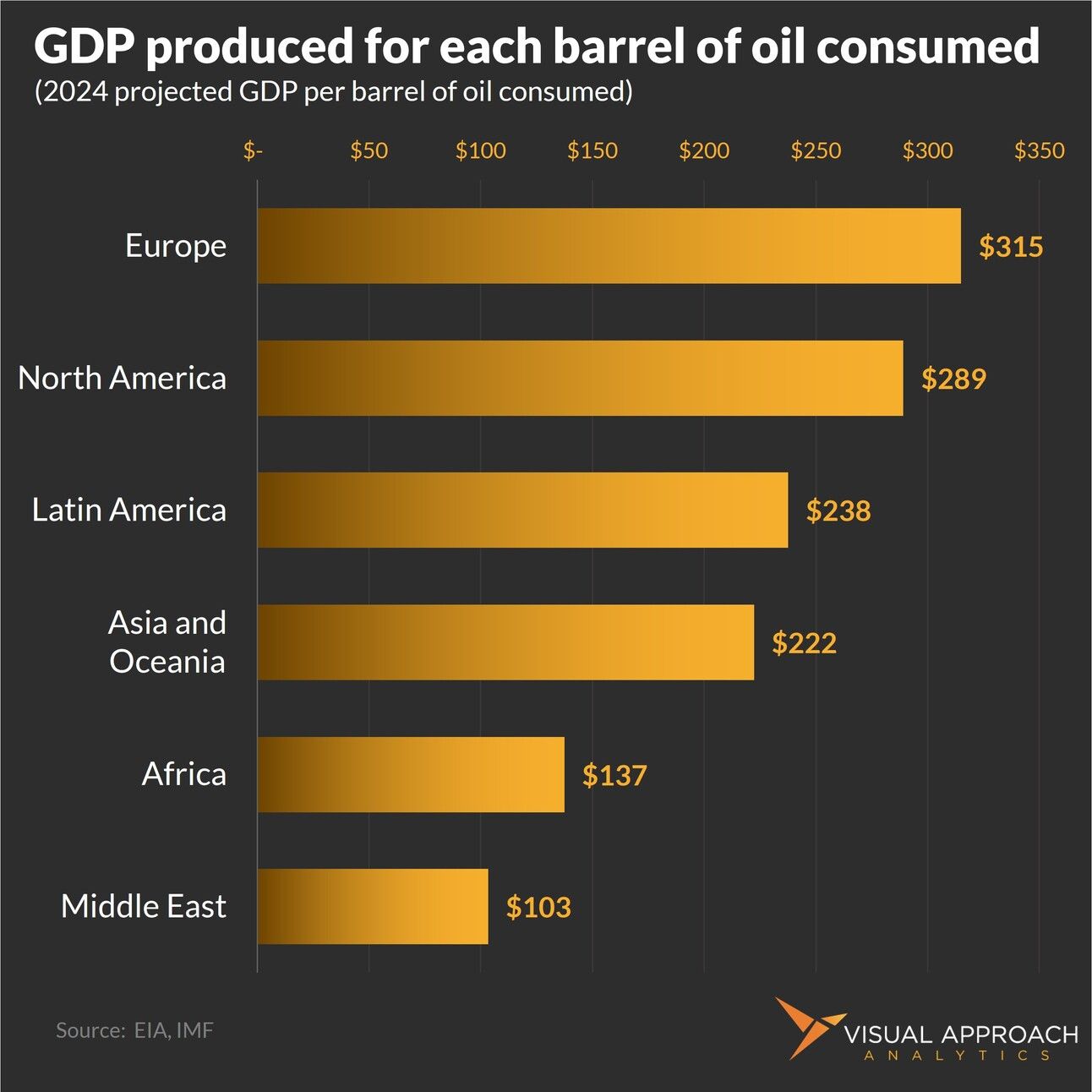

This offers a new metric - at least new to us. GDP to oil consumption ratio. In other words, how much economic output was produced on 1 barrel of oil.

Considering oil’s dominance in Middle Eastern economies, it should come as no surprise that the region consumes nearly one barrel for each $103 the regional economy produces. For reference, oil is currently about $70/barrel.

As the regional economies develop and shift from agriculture to manufacturing to service, they no longer require such oil consumption. Europe and North America produce $315 and $289 of GDP for each barrel of oil consumed, respectively.

Of course, electrification of transportation has a lot to do with this metric, and the shift to electric rail and EVs helps maintain it. But consider that North America and Europe are also the largest aviation regions in the world, and the once-assumed dirty relationship between the economic benefits and the global warming downsides is not as clear-cut.

Then come the social benefits - or the S of ESG. Another topic entirely.

Still, the overall trend of developing economies has been continual economic growth without matching oil consumption. Progress, by any measurement.

Our research published this week:

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact