Europe appears to have reached the top of the market - right on time.

Last month, Ryanair reported Q1 2025 earnings. Things weren’t great. Costs up 11%. Revenues down 1%. Sound familiar?

(Ryanair’s fiscal year begins April 1 of the prior year, so Q1 2025 equates to Q2 2024 on our calendars).

Most notable of Ryanair’s results was the average fare compared to Q1 2024 - down 15%.

While load factor remains remarkably consistent throughout the year at over 90%, fares fluctuate wildly. (This further shows how revenue management works and how load factor is a poor indicator of financial performance).

Ryanair’s fares were up vs Q4. What gives? Was this a good quarter or a bad quarter?

It was a lousy quarter. What the normal world calls Q1 2024 is a slow quarter for airlines. Q2 is not—normally, anyway.

Ryanair’s fares faltered as too much capacity entered the system, as Ryanair blamed Boeing for not delivering enough capacity. Again. Sound familiar?

It should be noted that Easter arrived on March 31 this year, putting the majority of the holiday’s travel in Ryanair’s Q4 results. But Ryanair also called out “weaker than expected fares” and “more price stimulation than we had previously expected.”

It’s a leisure yield story that’s been playing out in the United States for the past twelve months. Recovery after the pandemic was so strong and leisure-focused that airlines, well, overdid it.

The strength in other markets left some to believe the U.S. was suffering from an early demand downturn, yet overall revenues continued to increase. Capacity and costs increased much faster.

Europe was not immune to the same type of overcapacity. Just as the recovery started for the region roughly 12 months later, so too, it appears, has the overcapacity arrived 12 months later.

Considering all ASKs deployed within Europe, you can see the market has continued rapid growth since mid-2021. Europe crossed 2019 capacity in early 2024 and kept adding. Just like the U.S. did in 2023.

While the economies of Europe have continued to grow, albeit at a significantly slower rate, we also must consider that Ukraine and Russia are now largely excluded from capacity numbers present in 2019. In short 100% in 2024 does not equal 100% in 2019.

But the early arrival of Easter had some impact which offers a bit of a dual-edged sword. On the one hand, Q1 fares were that bad. On the other hand, Q4 fares weren’t that good.

Even so, Ryanair warned of lower fares and challenges stimulating the market.

“But I thought we were in a shortage.”

We are. Welcome to the nuances of capacity deployment.

Many factors are at play - factors we’ve been watching in the U.S. for the past 12 months. Chief among those factors is that more seats are being deployed into fewer markets, suggesting a limit to endless up-gauging.

However, the problem also stems from the growth of low-fare and leisure capacity compared to the rest of the market. That is the case in the Western Hemisphere, and the same appears to be shaping in Europe.

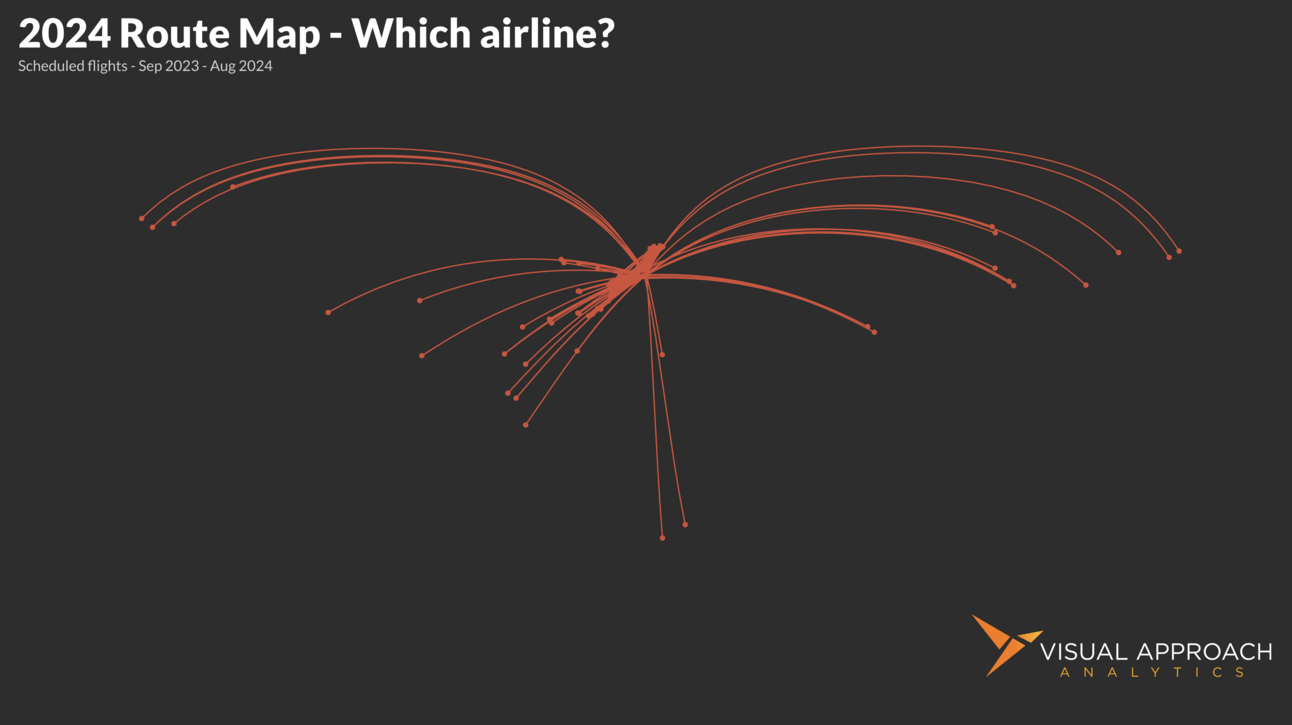

Quiz - Which airline is this?

Feedback from last week’s quiz was that it was too easy. This week, we decided to make it even easier!

A simple route map - without the map.

This route not-so-map shows an airline’s scheduled routes over the past 12 months. Who is it?

You can find the answer here.

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact