The origins of Delta Air Lines and the 787 stretch back to when it was still widely known as the Dreamliner. A launch order was placed by Northwest Airlines for 18 787-8s in 2005, the same year Boeing switched from the 7E7 nomenclature to the 787 — the same year the beautiful raked tail design morphed into the standard version of today.

It was a long time ago.

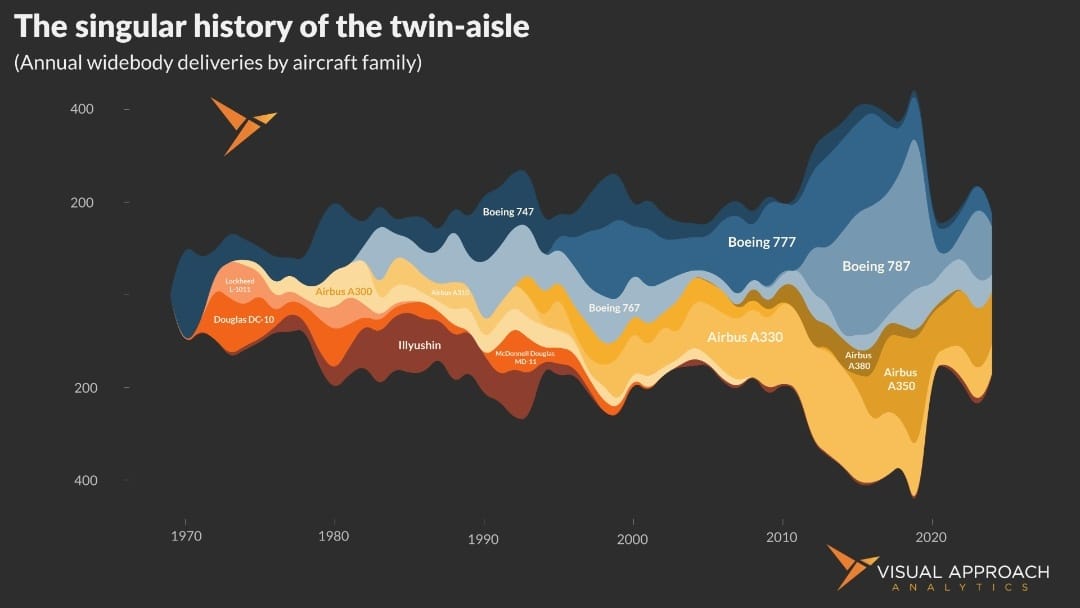

Of course, Northwest would eventually become Delta after the two airlines filed for bankruptcy protection on the same day that year. Following the eventual merger, the new Delta deferred the 787 order to twenty-twenty-never. Since, the airline has committed to 103 widebody aircraft from Airbus, including 39 A330neos, 40 A350-900, and a 2024 order for 20 A350-1000s. The order for 18 787-8s was ultimately cancelled in 2016.

Of course, after the merger, Delta never wanted those 787s. Granted, things had changed. The DC-10s Northwest operated in that segment were no longer without a natural replacement. Delta’s large fleet of 767-300ERs was the better replacement, particularly considering the… ahem… challenges that emerged from the 787 program after the 2005 launch.

But, as much as Delta didn’t need the 787 in 2016, things have changed. Firstly, the 787-10 is not the 787-8. Delta does not need a long-range, thin-market-widebody, but it could use a larger widebody that trades capacity for extra range — particularly with the 767-400 needing some resolution next decade.

Secondly, note the “next decade” from the paragraph above. Backlogs are full for widebody aircraft, a trend we’ve been discussing with our clients for quite some time. Orders beget orders. Even with Delta’s leverage to negotiate favorable delivery positions, it still must wait. Put another way, at some point, the backlog's length requires you to place an order lest you be left without the needed aircraft in the back half of the 2030s.

Thirdly, Delta has made it very clear that it considers its ability to order from both OEMs as a strategic advantage. This order should be no surprise. It is not a strategic shift for the airline. In fact, it’s perfectly in line with its explicit strategy of fleet management.

But wait a minute; a U.S. airline makes a large pre-EIS order for widebodies only to merge with another airline and defer the order into oblivion… This sounds oddly familiar.

In 2009, United Airlines placed an order for 25 A350-900. In 2013, after Continental Airlines merged with United, the order was put on the back burner, deferring it to a Delta 787-matching twenty-twenty-never, but increasing the order size to 35. Again in 2017, the order was further deferred, trading time for additional aircraft.

Kind of.

In what is a glimpse for us into new aircraft purchase agreement negotiations, United was happy to allow Airbus to increase the order size in exchange for infinite deferrals. In effect, Airbus could make the order size whatever they wanted for an order that United would never take.

Indeed, United would go on to secure orders for another 183 787s, the bulk of which were made since 2022. United operates no Airbus widebody aircraft.

In the words of late telemarketing great, Ron Popeil, “But wait, there’s more!”

United’s now 45-aircraft A350 “order” nobody wanted, that's been inflating with deferrals, becomes very interesting. Delta’s recent foray into the 787, combined with a lack of backlog availability and an insatiable tit-for-tat desire, brings the A350 back to the discussion.

While the 787-10 order may not have been the origin of renewed interest by United in the A350, it certainly creates an itch to be scratched. But Airbus is itchy for a deal, too. A real deal - not another deferral into twenty-forty-never for another 10 paper airplanes.

Which brings us back to Delta and the 787-10 order. A tactical win for Boeing, to be certain. But what appears to be a coming commitment by United for A350s could be a huge strategic win for Airbus (likely closer to the original 25 aircraft rather than the inflationary 45 if we’re guessing).

Consider this: Delta Air Lines will become the seventh operator of the 787 in North America. United would become the second A350 operator in North America.

Strategically, assuming the two deals are linked by competitive forces or simply by ego, Airbus would get the better end of this exchange.

Which leads us to the ultimate lesson from this new dynamic - defer, defer, defer.

Sometimes kicking the can works — even if it does take 21 years, two bankruptcies, a merger, a near-industry-ending pandemic, and a subsequent supply chain crisis.

If you would like to read more and get a taste of our succinct analysis, we have made our recent Market Insight on the topic publicly available. You can view the premium document here: Delta 787-10 order matches widebody strategy - boosts A350 prospects.

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact