It’s been a minute since we’ve been asked about the impacts of cost convergence at the U.S. ultra-low-cost carriers. The idea is simple: U.S. legacy airlines have been able to close the cost gap with the ULCCs, erasing the low-fare airline cost advantage.

Only, that’s not what’s happening.

To be certain, costs have risen at the low-cost airlines, especially Spirit. (Since Frontier didn’t start reporting data until 2021, we have to assume the costs would be similar to Spirit’s in 2019.)

In Q3 2025, CASM for Spirit was up 30.5% from Q3 2019. Assuming similar 2019 costs to Spirit, Frontier's costs increased by 22.5%. Big moves.

However, the legacy airlines’ costs have also increased. Delta 36.9%, United 19.9%, and American 4.5% (While American may look great, it is the exception that proves the new rule. We’ll get back to American in a bit.)

When considering overall moves in CASM, the legacy airlines increased Q3 CASM by three cents compared to 2019. Frontier and Spirit are up two cents.

Forgive us for stating the obvious here, but we are actually looking at cost divergence between the legacy and ULCC airlines, not convergence.

Kind of.

Legacy airlines have added more overall costs to their unit costs than ULCC; however, on a relative basis, ULCC costs have risen at a higher rate. The distinction both matters and it doesn’t.

It matters because the discussion of whether the market reacts to relative changes in costs or absolute changes in costs is an active and valid topic.

But, it also doesn’t matter because of this:

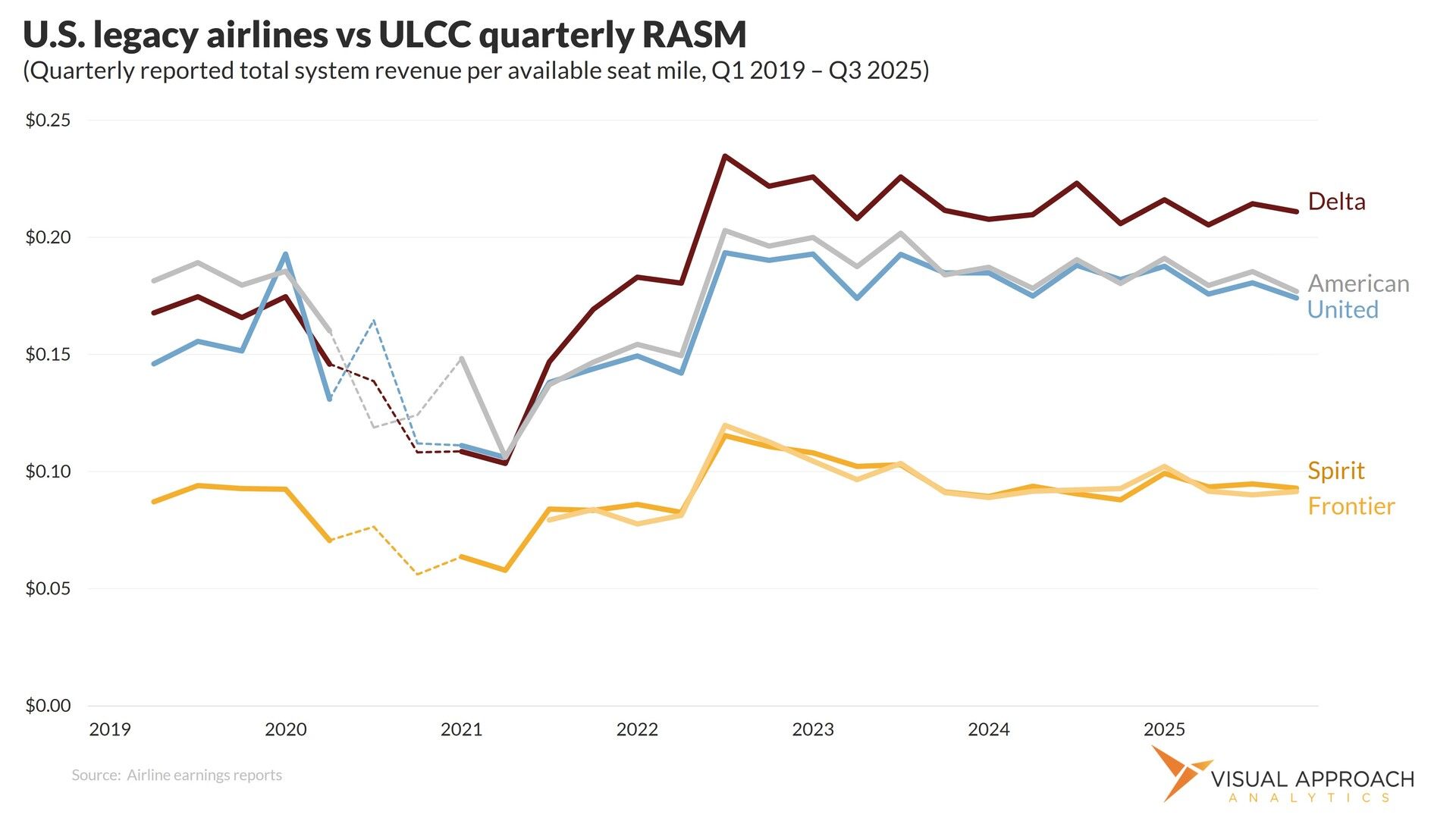

All this debate around cost convergence continues to overlook the obvious (to us, at least). The problem isn’t cost convergence, it’s revenue divergence.

Legacy unit revenues are up 15% on average. ULCC unit revenues are down 0.5%

Now THAT is a gap - and one that is widening.

Why?

Our theory is that there has been a bit too much focus on cost convergence, and not enough on revenue divergence.

The ULCCs are known for having a laser focus on costs. Costs went up. The problem is that the ULCCs know (or are addicted to the idea) that the most reliable way to lower costs is to grow, and to do so with bigger airplanes. Essentially, to lower costs per ASM, you can either reduce costs or increase ASMs.

Reducing costs is hard.

Increasing ASMs is much easier - bigger airplanes, and more of them.

This is how a cost problem becomes a revenue problem.

At first, it worked. The U.S. was short capacity, and the A321neos being placed in large legacy hubs were filling because the legacy airlines didn’t have enough seats…

Until they did.

Q: What happens to spill carriers when there is no spill?

A: Yields fall

Which brings us back to American and the exception that proves the rule.

American has been very successful in managing unit costs. They are up only 4.5%. Based on the cost-centric idea of the industry, American is killing it! Right?

Right…!?

A first glance at this chart shows a bit of a red herring. What’s Spirit and Frontier’s problem? It’s the big yellow bars, right?

No. It’s the lack of dark blue bars, and American is the key to unlocking the story.

Unit costs are up. They are up more at legacy airlines than at the ULCC airlines, but on a similar relative basis.

But unit revenues are flat - slightly down, actually. Yes, more people are flying ULCC airlines today than they did in 2019. Demand is still there - Just not as much demand as supply.

Which begs the next question we’re continually asked by our clients: If we were at the ULCCs today, what would we do about it?

It’s simple, really. If we were Spirit, find a buyer.

If we were Frontier, be that buyer.

Tick tock.

Research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact