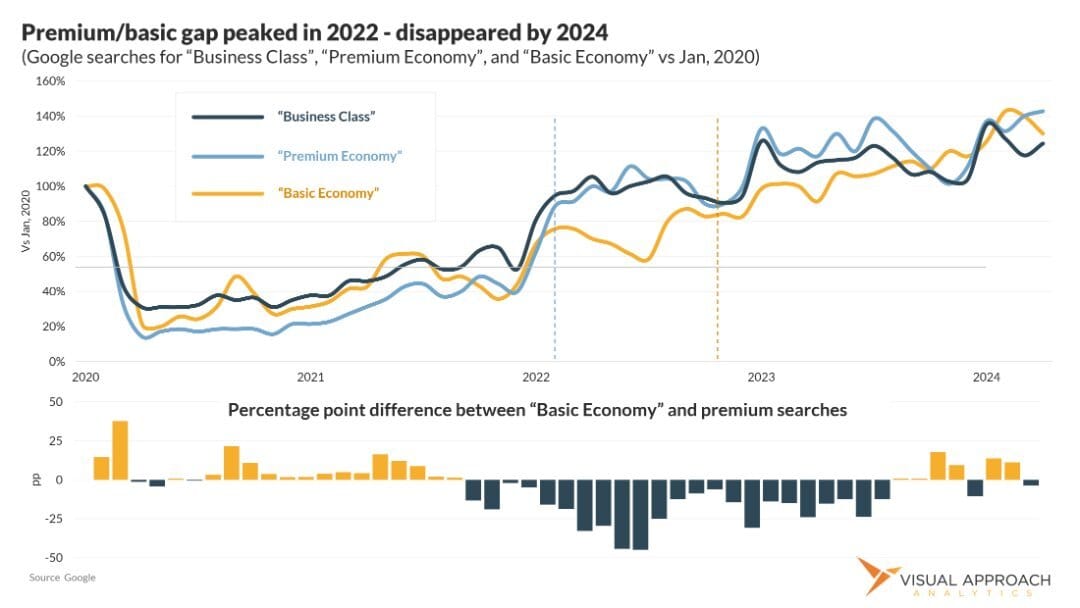

It took a bit, but the surge in premium travel interest appears to have reverted back to good ol’ fashioned economics in the United States.

Internet searches for “Business class” and “Premium economy” grew rapidly during the COVID recovery. Both search terms exceeded pre-pandemic levels by April 2022 - a trend that has been mirrored in airline earnings and fare data.

However, this rapid growth in premium travel interest appears to have plateaued. Instead, “Basic economy” has since caught up to the premium queries.

At first glance, these results may seem contrary to Delta Air Lines’ recent earnings comment of strong premium economy demand, but closer inspection shows similar trends. Premium travel is not down; in fact, it remains at elevated levels. What has changed is the interest in bargain fares - an interest likely often left unsatisfied during the high fares of the prior two years.

The gap in search levels between the premium and discounted searches grew to its largest levels during 2022 and extended through mid-2023. This coincided with a deep pilot shortage in the U.S. and an overall shortage of narrowbody aircraft. The result was high fares - and apparently a shift in interest by travelers to consider premium classes.

However, since the start of Q3 and the overshoot of U.S. capacity, those factors appear to have reverted. While premium travel interest remains elevated, it has returned to the long-term trend of growth, eclipsed by the return of searches for “Basic economy.”

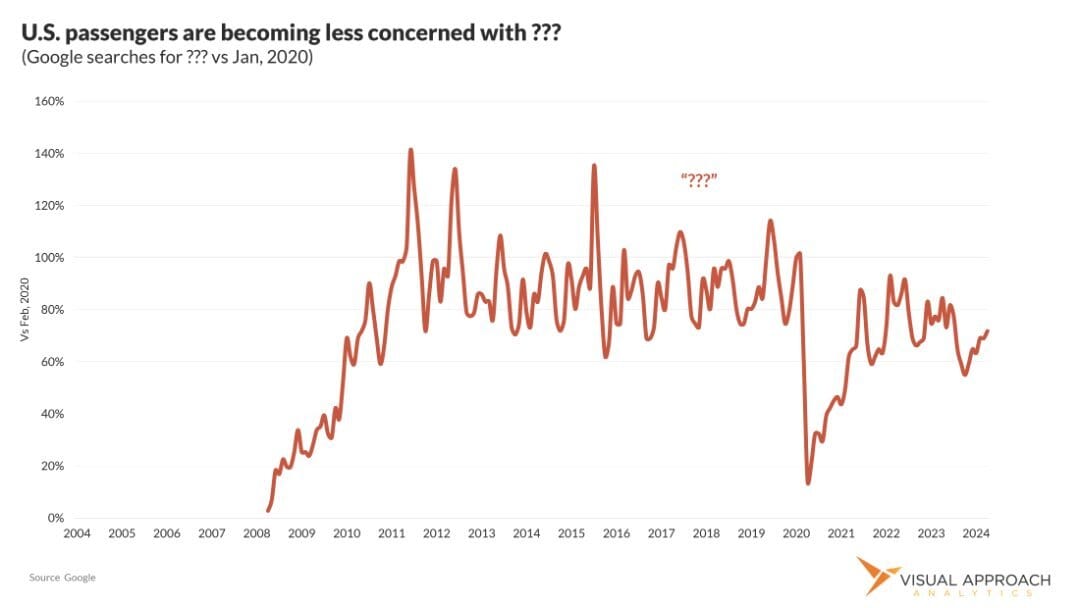

By expanding the timeframe back to 2010, the longer-term trends of this inexact science emerge. Interest in “Premium economy” has grown exponentially since 2010, reverting to the trend in 2024.

“Basic economy” searches barely existed before 2017 when the term entered the traveler's lexicon, with legacy airlines adding the discounted and restrictive fare class.

While this measures internet search interest rather than actual bookings, the trends do align with broader industry reports. If passengers are forced to pay high fares, as they were in 2022 and the first half of 2023, they might as well consider premium fares.

Much like many post-COVID trends, however, this has also begun to revert back to normal. While this may appear a bad omen for the legacy airlines, not all trends have reverted to pre-COVID levels.

Sharp increases in searches for “Airline credit card” show just how much has changed in the legacy airline business models.

We are watching very closely whether these trends revert, as well. Given sufficient seats from which to choose, the American traveler has proven to be cost-conscious. Should capacity continue to increase, we expect the shift away from low frills to rebound.

This doesn’t mean that premium interest will decline, just that customers are once again becoming more cost-conscious with their travel searches. Overall search levels are higher, responding to the overall growth in the market.

Which brings us to another interesting trend we’ve noticed in travel interest. What topic piqued the American traveling public’s interest starting in 2008 but is now just not as interesting?

Research published this week

We have been in a research publishing frenzy the past week. Here are some of the analyses you may have missed if you’re not a subscriber to Visual Approach Research:

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact