This week, we showcase a glorious recommendation by one of our subscribers to look at airline fleets over time. What better airline to start with than an airline with a rich history of managing aircraft types?

Delta Air Lines has nearly seen it all. In fact, the airline has seen slightly more than we’ve shown since we limited the fleets to passenger. They flew several freighter aircraft, including the Lockheed L-100 Hurcules and multiple mail-only carriers. We had to stop somewhere.

This research was more time-intensive than expected to go back through Delta’s history. With the help of the Delta Flight Museum and Wikipedia, we found a plethora of information - sometimes competing - but invaluable, nonetheless. Also, we found Shipbucket, which is a wonderful community of ship and aircraft artists whose work is available under the Creative Commons License.

Debates and arguments raged on the best ways to show the different types of aircraft that have graced the skies with the widget. We looked at props versus jets, narrow versus wide, and ultimately settled on the manufacturer. It presents a captivating picture of Delta’s transition through the past from Douglas to Boeing and, most recently, toward Airbus.

Look closely, since this chart was painstakingly researched, hand-drawn, and prone to all the usual oversights. You may call them errors. We call it a scavenger hunt. Let us know what you find.

If you would like a large version of the image (and we mean large. 8,456 × 5,978 large), we’ve set up a form to receive it via email. Simply enter your email, and we will send it over (don’t worry. You won’t be subscribed twice.)

Warning signs from China

Our published research includes the macroeconomic factors affecting the aviation industry. In our upcoming Aircraft Intelligence Monthly, we’ve identified some concerning data both coming from China and not coming from China.

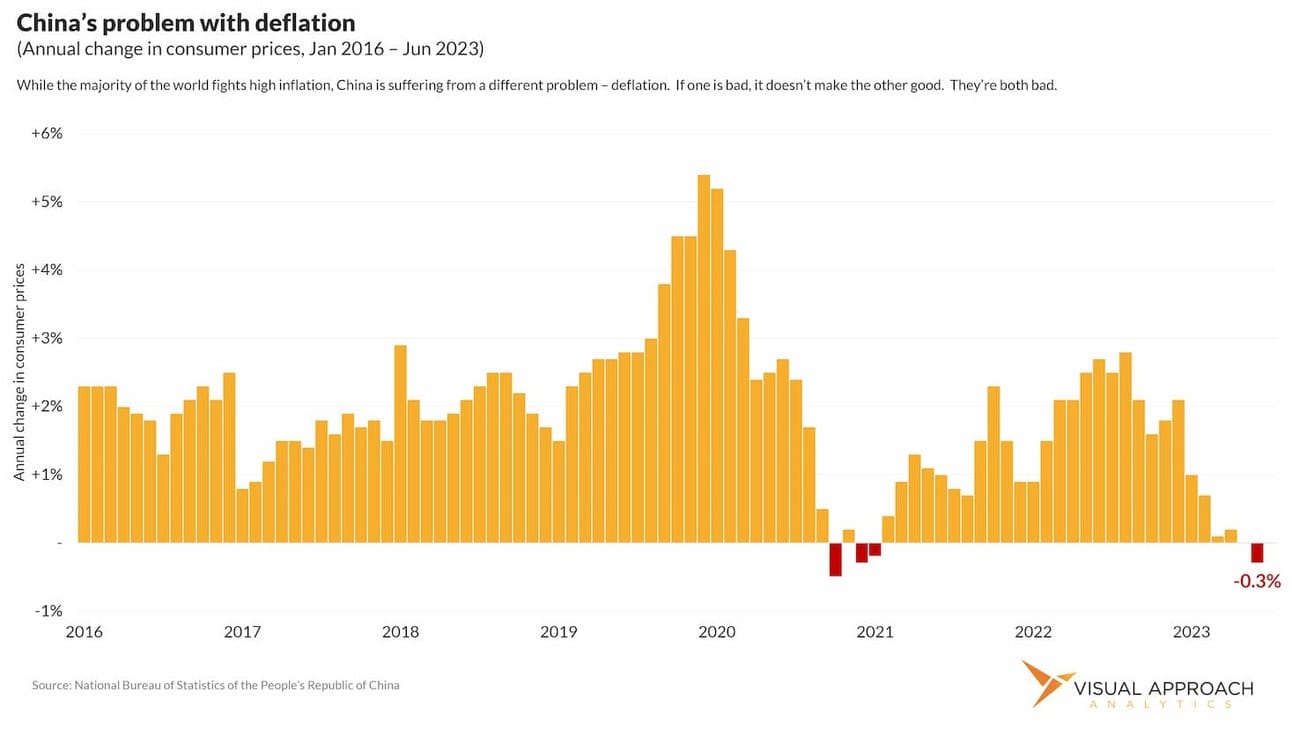

First, the data coming from China: Inflation. Or, in this case, deflation.

China entered a deflationary state as of June 2023, according to data published by the government. This, coupled with a shrinking population and a slew of other warning signs we are following, is cause for concern.

We are watching China closely and with consternation. The world’s second-largest economy is throwing signs of strain too regularly to be a blip. Then, we must consider those signs are being released by a government that’s not exactly known for being forthcoming with bad news.

What about the data not coming from China? Just as concerning, even if the silence is deafening. China stopped reporting the youth unemployment rate after first publishing the data in January 2018. Starting at 11.2% in 2018, the unemployment rate for China’s citizens between 16 and 24 years old rose to 21.3% in June 2023 when the government stopped releasing data.

Yet, there are further concerning factors we are watching for China, particularly as the passenger recovery awaits cooler political heads and an air cargo market continues to struggle. We detail where we see direct challenges for China’s continued growth and which regions are picking up the slack in Visual Approach Research.

Economic challenges return to the risk outlook for global aviation

Today, we published the August edition of the Aircraft Intelligence Monthly. The monthly report focuses on emerging trends and pockets of edge in the commercial aircraft market.

Notable this month is the rise of economic challenges as leading risks to rival the Russia / Ukraine war. Sentiment shifted away from recession, but our models still show a high likelihood of recession in the next few years. That likelihood is beginning to eclipse other geopolitical concerns (namely China and Taiwan).

Learn more about accessing our research through Aircraft Intelligence Monthly and request a free report.

It’s coming… again.

We are already receiving nominations for the 2024 Cranky Network Awards. Airline network planning departments worldwide are making travel plans to the Bay Area in hopes of landing their very own Cranky.

The self-proclaimed greatest collection of airline network planning leaders in the world will once again be in one place watching two suave cohosts hand out awards for the best network planning moves of the year.

One night only. February 22, 2024.

You should do a chart on…

If you could choose one topic you’d like us to dive deeper into, what would it be?

AI-generated chart that shows… well… nothing.

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact us.