After a month of wild estimates ranging from flat to down 80%, the final numbers from Statistics Canada show Canadian travel to the U.S. in April was down 20% year-over-year.

The good news: It wasn’t down 80%.

The bad news: 20% is still bad, and it’s getting worse.

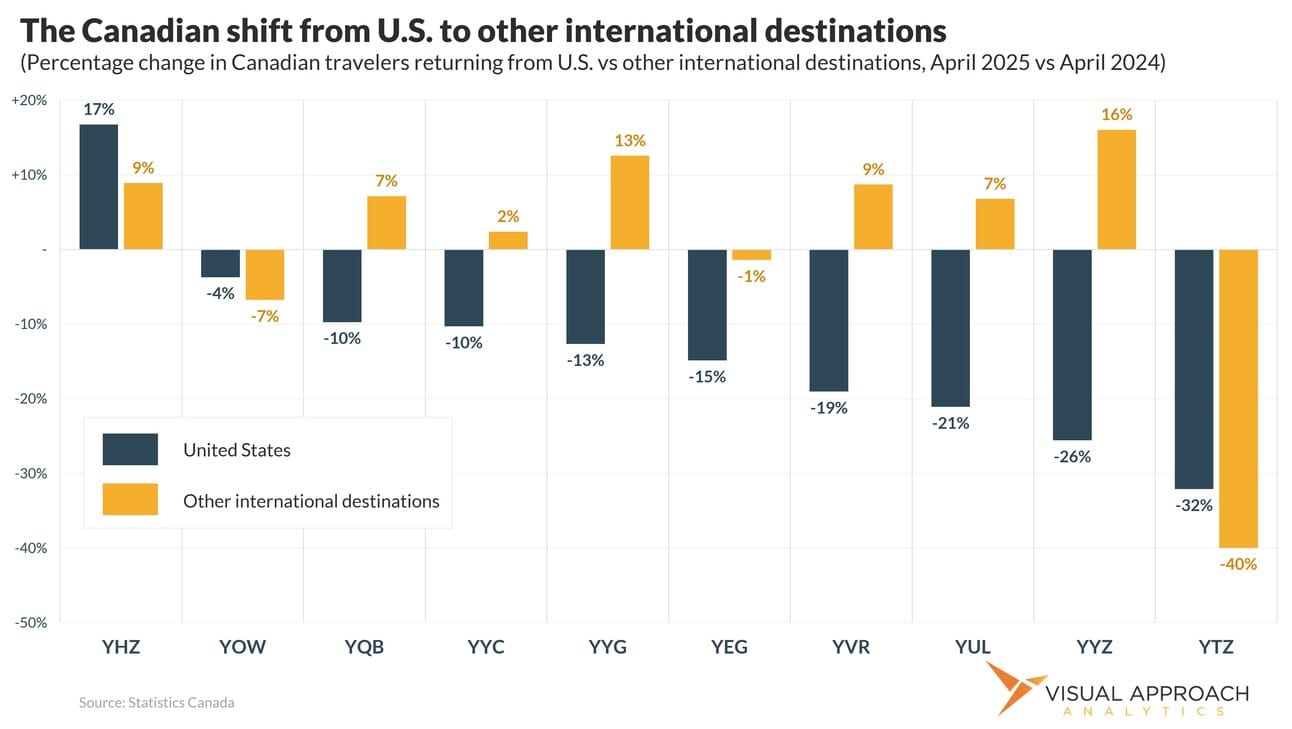

April numbers show that only four-fifths of the number of Canadian residents returning from the U.S. at Canadian airports in April 2024 are doing so in April 2025. Statistics Canada further breaks down the numbers to show where the drops have been.

Toronto has seen the greatest drop in both overall numbers of travelers to the U.S., as well as percentage drop. At the same time, the highest shift of passengers to international destinations also happened in Toronto.

The renewed shift away from travel to the U.S. in April has now officially wiped out the peak season. Little spring travel boost remains in May, leaving the remainder of the year as the lower half.

While the loss in peak travel has certainly frustrated Canadian airlines and U.S. tourism, the arrival of peak summer domestic travel comes as a welcome sign for the airlines. In a weird way, the silver lining of ending a peak season without a peak is knowing it will be another seven months before the damage to peak travel can be felt again.

Small wins.

But, even as Canadians avoid the U.S., they have shifted to other international destinations, particularly those in warm climates. Overall, international Canadian travelers were up 10%, on a higher base this spring.

But, back to the 20% is not 80% optimism. 20% is still bad. In fact, 20% would represent the greatest downturn in travel outside of COVID. While our perceptions have all been skewed by the last truly black swan of the pandemic, it’s important to maintain context for just how bad the situation is.

Keep in mind, also, that even though local tourism hotspots can replace the lost Canadian visitor by some measure, it is very likely at cheaper rates and lower overall revenues. In short, they must discount to replace the demand from Canadians now overflying to destinations beyond the U.S.

May number should be out early in June; however, they matter little through the remainder of the year. The peak season has been lost.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact