Spring has arrived, but the Canadian travelers have not. At least not all of them.

It should come as no surprise to anybody that leisure travel is being hit hardest by Canadians considering travel to the U.S. If you’ve been following our work, you’ll recognize the other word we use for leisure—discretionary.

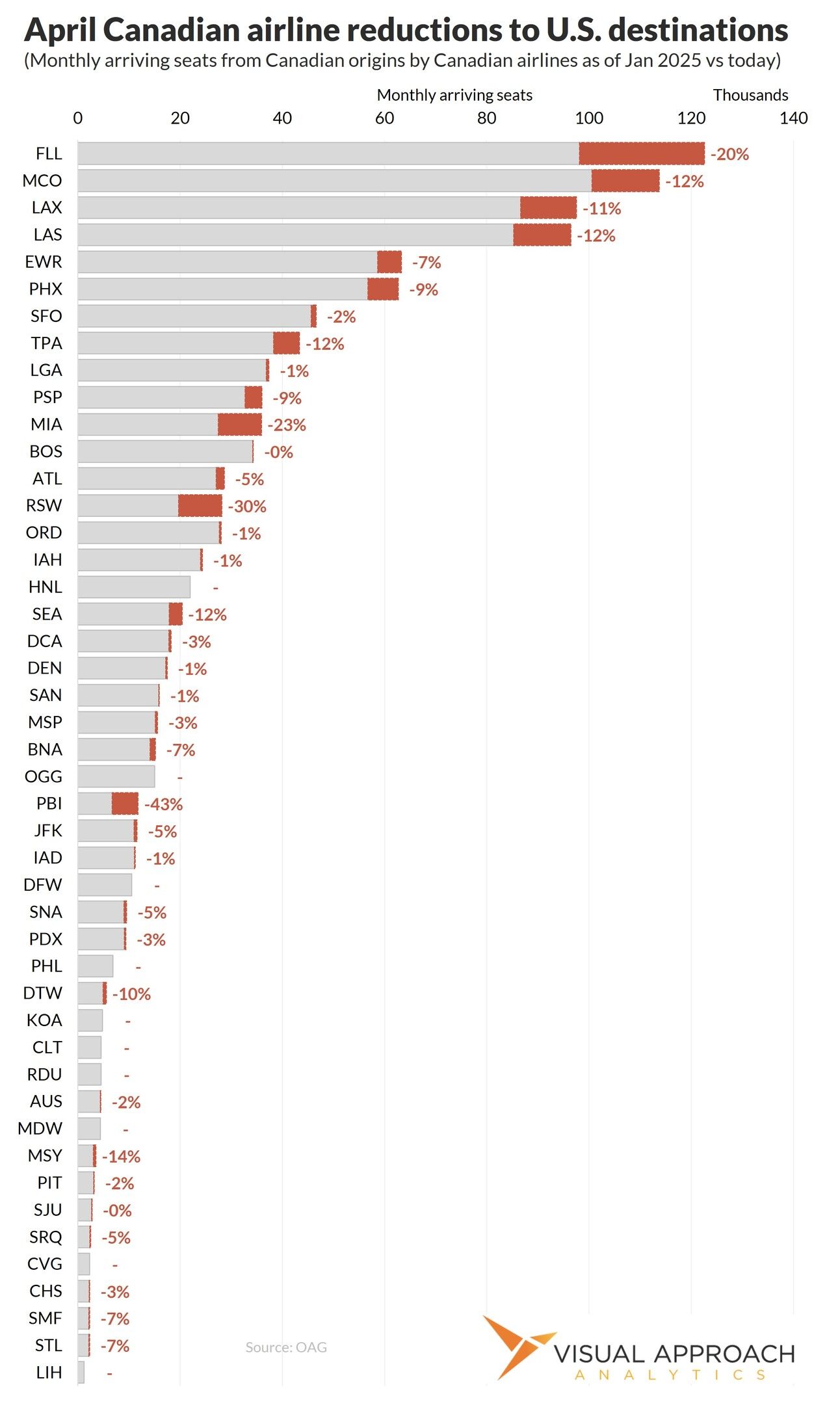

Our comparison this week comes suggested by a subscriber. It looks at April scheduled seats between Canada and the U.S. by the Canadian airlines and where the cuts are.

Florida. It’s Florida.

Indeed, it is the leisure destinations in the United States seeing the greatest reductions in capacity from Canadian airlines. Florida, in particular, is experiencing drastic cuts across the board. Fort Myers and Palm Beach are down 30% and 43%, respectively, compared to April schedules as they existed on January 1, 2025.

However, Hawaii offers an interesting contrast, with capacity not seeing any cuts to HNL, LIH, KOA, or OGG. While still a few departing seats from the start, the 50th state appears to be a bit too far for Canadians to consider changing spring travel plans at the last moment.

Similarly, hub and business markets have fared much better. While Newark is down 7%, San Francisco is only down 2%, and Boston is flat. Seattle and Detroit appear to be the only exceptions for partner hub airline reductions, both down by double digits.

But consider that airlines cutting seats to destination markets almost certainly means traffic is down even further. The effects of reduced travel by Canadians has impacts reaching far further than the airlines themselves - particularly for an industry such as Florida, where hotels, restaurants, and entertainment venues have long looked forward to those arrivals from the Great White North. Anecdotal reports from some of those institutions suggest the drop in leisure travel is closer to 30% than 10%.

Canadian travel to the U.S. is currently in its peak season, with Canadians more likely to choose domestic destinations or European destinations in the summer. Regardless of the results of any tariff deals this year, it will be 2026 before any concerted recovery can be made to the overall market.

Such is the sting of conflict between such large trading allies. The impacts are felt very quickly, but the recovery takes significantly longer. Especially for those considering the United States as a way to escape the cold, hard winter: It will take another cold, hard winter before we know how long lasting this could be.

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact