COVID wasn’t kind to Latin American aviation.

More accurately, Latin America wasn’t kind to Latin American aviation during COVID. COVID wasn’t kind to any sector of commercial aviation.

Governments financially supported airlines worldwide as COVID forced passengers to stop paying to travel. That didn’t happen in Latin America.

At least not to a level that could prevent a mass wave of airline bankruptcies.

Since COVID, Latin America has endured the bankruptcy reorganization process of Aeromexico, Avianca, LATAM, and now GOL. (This doesn’t consider the bankruptcy liquidation process undertaken by several other airlines, such as Interjet, TAME, Aeromar, Viva Air (the one in Colombia), Ultra Air, Calafia, and Amaszonas.)

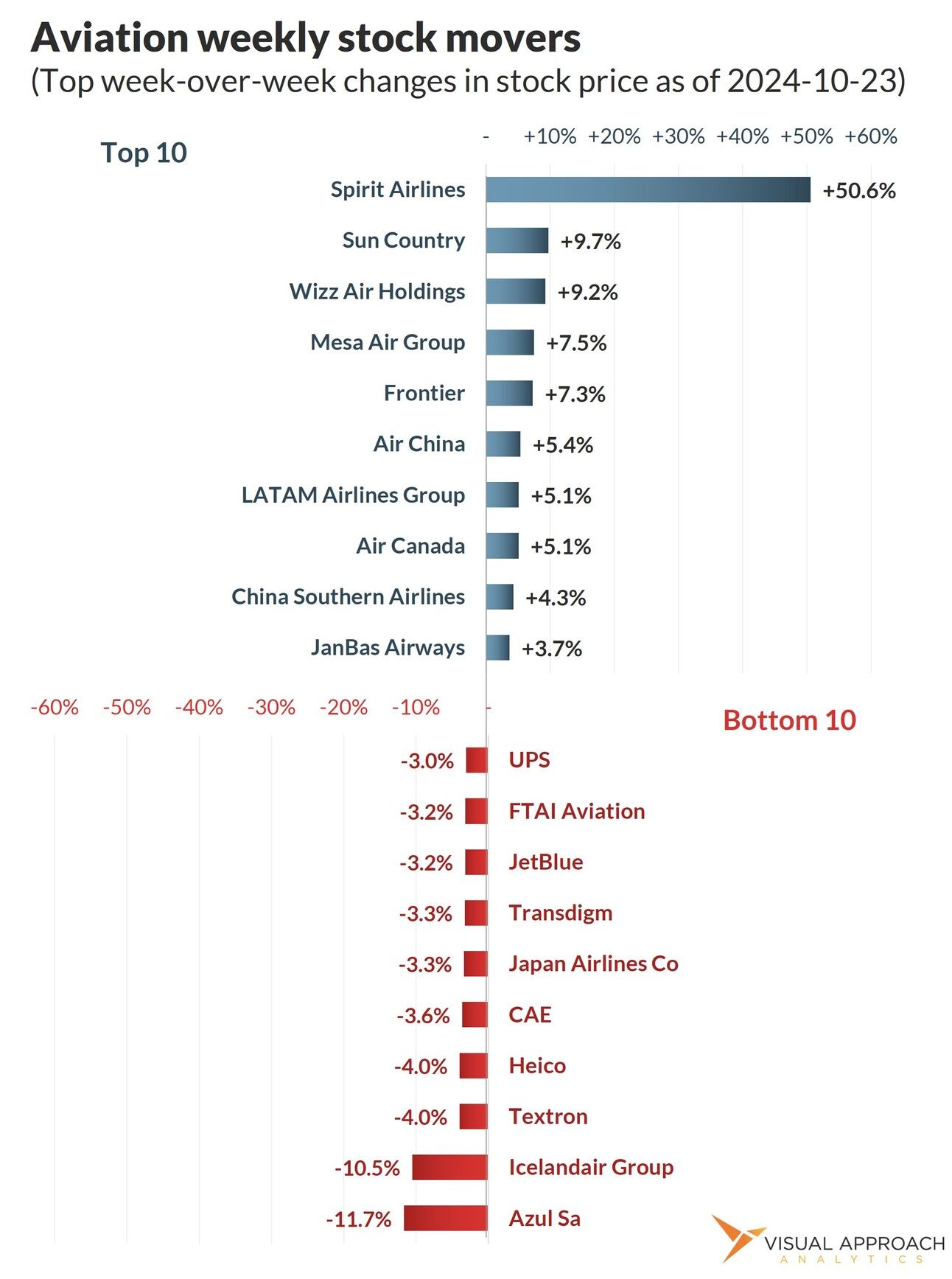

In Brazil, the last major airline that has not yet undergone the Chapter 11 process is Azul Linhas Aéreas. That streak may soon end.

Depending on how you count it, Azul is the largest airline in Brazil, or the second-largest, or the third-largest. Number of passengers, domestic flights, fleet size, markets served… it’s all close. Point is, it’s essentially a three-way tie.

Azul, GOL, and LATAM fight for Brazil. LATAM exited bankruptcy protection in 2022. GOL entered bankruptcy protection in January 2024, where it currently remains.

Azul has to compete with that.

Now, pile on a volatile currency exchange rate (airplanes and fuel are paid in U.S. dollars. Fares are paid in Brazilian Reis. The two aren’t exactly equal).

Then pile on historic flooding in the Porto Alegre area affecting 10% of Azul’s flying.

Things are not looking great for Azul.

After announcing a deal to refinance leases accepted by lessors representing 92% of its fleet, Azul later admitted the one piece on which the deal was contingent was proving difficult to achieve. The refinancing agreements required a new investor be found with a $400 million capital injection. That has proven difficult.

Eyes are on the end of the month to determine if Azul can find the required cash to continue without judicial intervention of the Chapter 11 variety.

But, bankruptcy deadlines are meant to be delayed. If not for the blue airline in Brazil, then for the yellow one in Florida. The point is, when it comes to individual negotiations, things can shift to the right.

The questions then become whether those delays matter and whether we’re about to see both a yellow and a blue bankruptcy in the near future.

Hate to type it, but probably.

Speaking of negotiations…

Boeing has now successfully negotiated agreements with the IAM that have been put to vote. Both agreements have been voted down by the membership.

The first vote failed, with over 90% of the membership declining the tentative agreement put forward by union leadership for a vote.

The second just failed, with 64% voting against it.

The sticking point remains focused around the reinstatement of a defined benefit pension plan, an issue long-called a “red line” by Boeing.

So, the strike continues.

Yet, while attention is focused on the failures at Boeing over recent years, we must also point out the discrepancies between the negotiations by IAM leadership and the desires of its membership. Two failed votes for negotiated agreements leave Boeing with yet more questions about their future: With whom are they negotiating, and how well do they represent the group that is keeping airplanes from being built?

im

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact