Remember this chart?

Back when we first identified the coming narrowbody shortage in 2021, it wasn’t exactly - how you say - a popular take. Yet, by the end of 2023, even the most vocal of naysayers have produced their own version of this chart.

This week, we look back through 2023 at our most… um… “shared” charts. We are pulling these from our premium collection, part of Visual Approach Research and the Aircraft Intelligence Monthly.

We start with the updated narrowbody shortage chart, showing the gap in production following COVID. As supply chains began to be ironed out in 2023, things were still pushed to the right, widening the shortage.

We find this chart referenced or recreated often, which is appropriate since this is the driving factor behind the narrowbody market and is expected to continue to be for some time. The massive shift from the demand-constrained world to the current supply-constrained one is very simply depicted. We don’t have enough airplanes.

Even though this was originally a part of our 2021 market outlook, the narrowbody shortage remains a key factor to the industry in 2023 and will again in 2024.

Originally published in our January 2023 publication, we noticed an imbalance between the benefits of new engine technologies and the additional costs. Namely, shorter shop visit intervals and higher parts costs drastically increased maintenance costs of GTF and LEAP engines, eclipsing the fuel burn benefits.

This can be translated into a monthly lease rate delta based on fuel prices. It’s a lot - about $70,000/mo of premium expected that was being chewed up by higher engine maintenance costs.

Since eclipsed by the fiasco of contaminated powdered metal, the issue of shorter shop visit intervals remains an issue on new-tech engines. The result has a similar effect on the market as the shortage - keeping prior-generation aircraft in service longer makes sense.

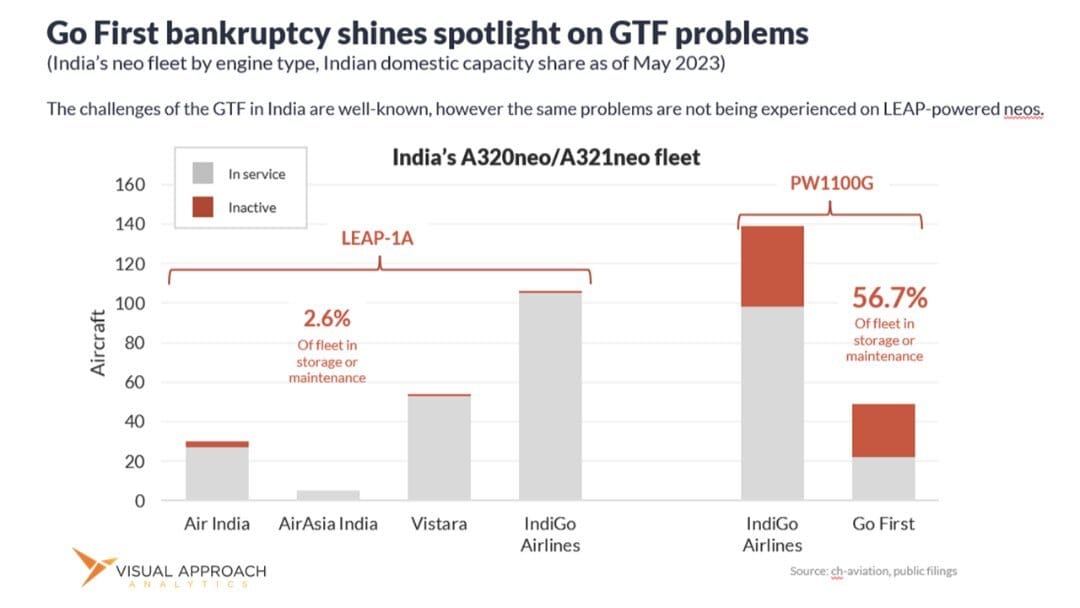

Speaking of engines…

Riddle: Given a highly competitive Indian market, which airline would you expect to go first?

The bankruptcy by Go First was the first volley lobbed at Pratt & Whitney regarding GTF issues. It turns out that Go First had a point. When looking at other airlines in the region, it was the GTF that was clearly underperforming while the LEAP continued flying. Then, things went from bad to worse for the GTF.

This analysis was published in May, but it was September before the full attention was brought to the challenges in GTF.

China’s open for business, just not to North America.

By May, the end of the Zero-COVID in China had been showing its effects on the returning travel market. But the transpacific capacity to China remained near flat-lined.

Little has changed by the end of 2023, with only marginal increases in flying by Chinese and American airlines. In the meantime, China has quickly shifted from an optimistic recovery story to a concerning economic one. We have identified China’s economic situation as a key risk to air travel stability looking forward in the Aircraft Intelligence Monthly.

Cargo yields went nuts after COVID. Early in 2022, we looked at the correlation between shipping rates and air cargo. Shipping rates plummeted and have continued to drop to 2019 levels. Air cargo rates have also dropped but have found a floor above 2019.

Still, the massive shifts in the cargo market have been able to make their full impact in 2023, causing distress in the space. The excitement for narrowbody cargo conversions has waned, just as demand for those aircraft to remain as passenger-carrying narrowbodies has picked up.

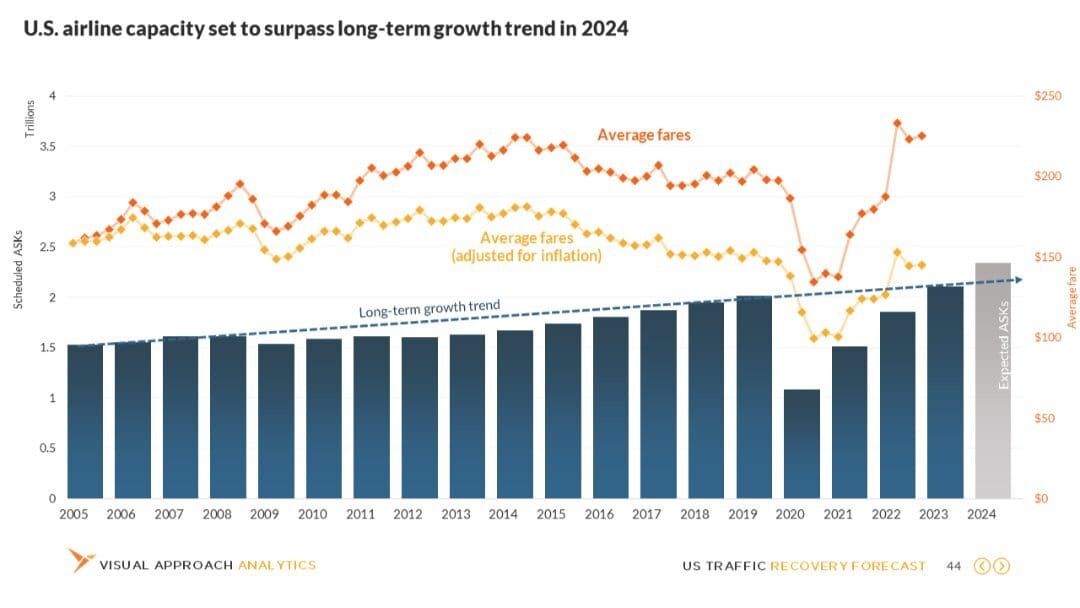

By July, we started noticing the risks of overcapacity in the U.S. market. That overcapacity arrived in a hurry by Q3 earnings, well ahead of what even we were expecting, but arrive it did.

Now that we know just how quickly things can turn on the airlines, it’s tough to remember just how impossible it was to talk of overcapacity in the summer of 2023. It was just one year prior the airlines saw a significant under-capacity, driving record fares and temporarily justifying the massive increases in pilot wages that would follow.

(“Temporarily justifying,” in case you missed that)

Now, the U.S. airlines are in a very different position. Capacity cuts are a thing again, and profitability isn’t.

But how can we have a shortage of aircraft and too many at the same time?

Not all regions are experiencing the same. New aircraft order books are full and mostly full of commitments by U.S. airlines. That means a global shortage is still in effect even as the U.S. overdoes it.

But it also means there are even greater shortfalls in other regions. Looking forward to aircraft demand over the next decade is our current project. We have developed a new way of forecasting in the post-COVID world that offers better visibility considering the new constraints that didn’t exist before.

Stay tuned for our new, detailed forecast to be published in early January for Visual Approach Research subscribers. Let us know if your organization is not yet a subscriber and would like to consider leading analyses like these well before they hit the mainstream.

You should do a chart on…

This week’s chart is a great example of a subscriber request.

“Hey,” offered said subscriber. “How about a look into the African market?”

So we did.

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact