The world is rapidly running out of South American airlines that have not entered bankruptcy protection.

(Before you protest, North America doesn’t exactly have a spotless record, either.)

Azul Brazilian Airlines has flirted with bankruptcy for years. Inevitably reaching an out-of-court restructuring each time, the airline filed for Chapter 11 bankruptcy protection in New York on May 28, 2025.

While Azul takes the brunt of the bad press presently, it is the fourth large South American airline to transit bankruptcy in the last half-decade.

Avianca’s bankruptcy journey lasted from May 2020 through December 2021. LATAM entered the same month in 2020 and exited in November 2022. Gol entered in January of 2024 and is set to exit, well, tomorrow.

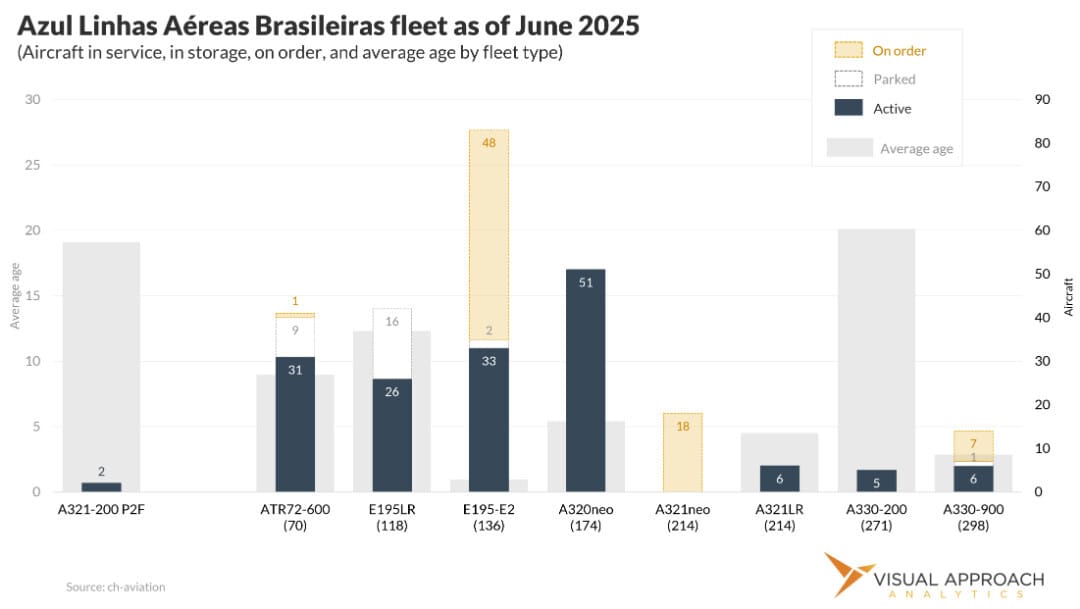

Azul started as an E-Jet-only fleet, expanding to turboprops with the acquisition of TRIP in 2014. Later growth added A330-200 widebodies to incorporate long-haul flights to North America, and ultimately Europe. Notably, the inception of widebody service also included an order for 5 A350 aircraft that no longer operate at the airline. The airline then added A320neo aircraft in 2016 before adding the A330neo in 2019.

Already, a list of early rejected leases was erroneously released, focusing primarily on stored aircraft. Nine E195 aircraft were rejected, along with two 737-400F cargo conversion aircraft that have since been replaced by the A321 P2F.

In Q4 last year, our research suggested a 65% likelihood Azul would enter bankruptcy protection over the next five years - an extraordinarily high probability. Today, that number is 35 points higher.

(If you are a subscriber to our research and would like to review the unpublished Q4 2024 competitive report on Azul, send us a note. If not, consider subscribing.)

Our latest research

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact