Well, that was fun…

Or something like that.

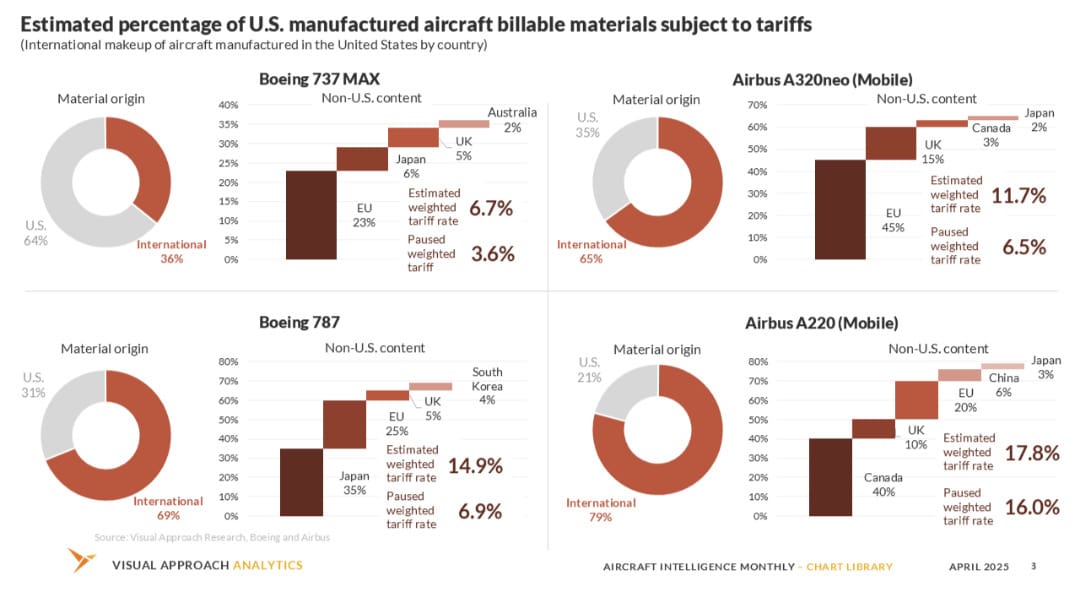

Looking back over the past 12 months reminded us of just how crazy commercial aviation was this year. Not COVID crazy, but a new type of slow-burning geopolitical uncertainty. It started with nobody concerned about tariffs, then everybody was, right before nobody was again. The expensive head-fake topped the concerns for the industry for the year, just for everything to go back (kind of) where it was.

Keeping up with the wild tariff swings was no easy task, either. The best part of it was that things changed so quickly and flippantly (sometimes by tweet) that it was difficult for anyone to know if we were wrong.

We were sometimes, but only for a brief period before it all changed again. But the bout with tariffs has certainly left long-lasting scars. The fall of globalization only accelerated throughout the year, building economic warning signs that have yet to play out.

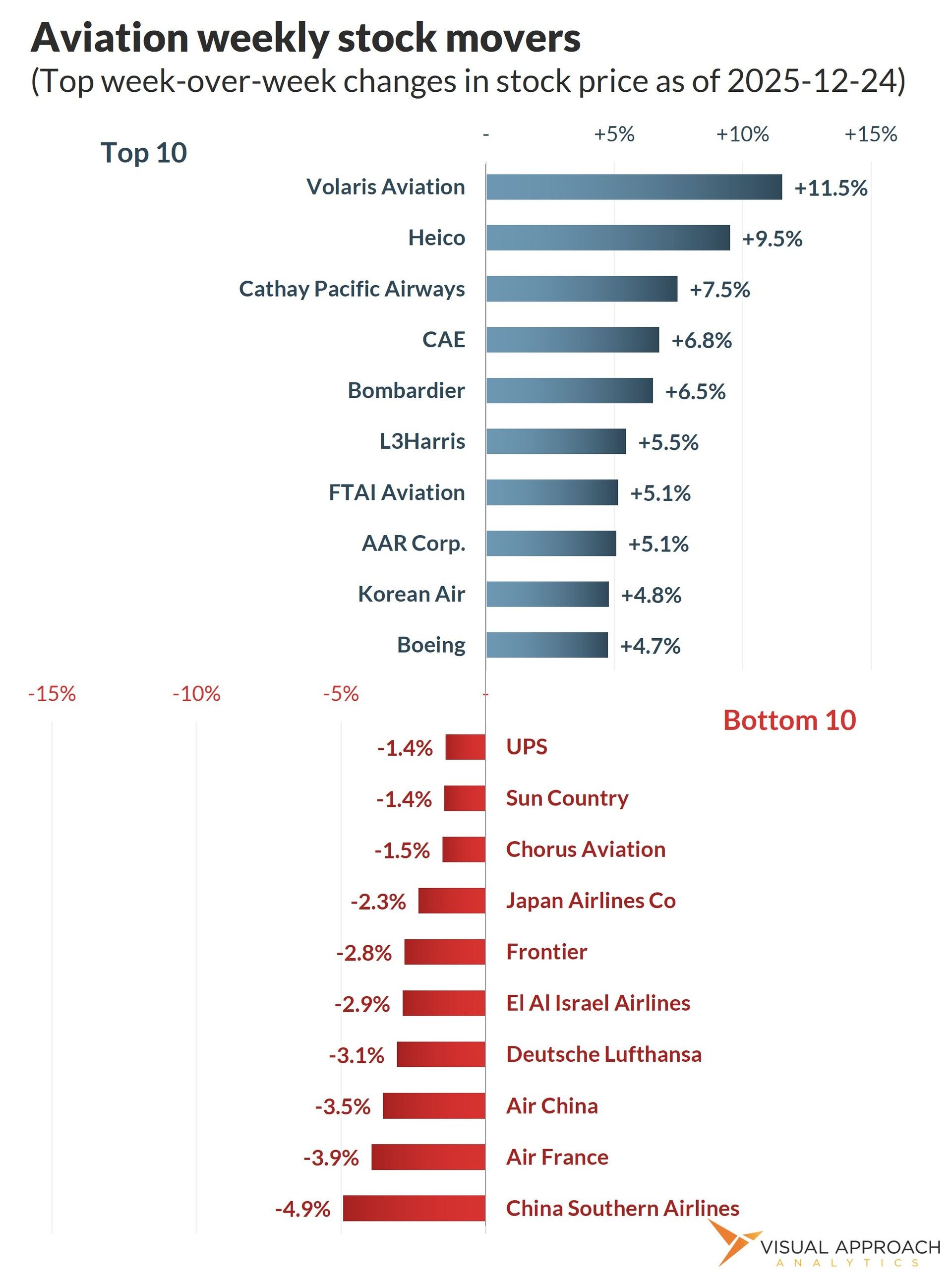

Speaking of economic warning signs: The K-shaped economy continued its K-ness through 2025. S&P up while consumer sentiment remains in the toilet. This chart from earlier this spring glosses over the scare the U.S. industry saw as part of the small bear market last spring. If you’ll remember, earnings guidance stopped during that period, and the airlines, so dependent upon the premium traveler, were suddenly very nervous. Then, the stock market recovered, and there was nothing to see here.

Only, there was a warning sign that flashed briefly during those few weeks. That warning sign was that many of the premium travelers were not sensitive to inflation and negative sentiment, like we are used to from prior cycles, but they were sensitive to the S&P taking a dip. We may end up looking back on this moment as a bit of a canary, even if it doesn’t sing again for a few years.

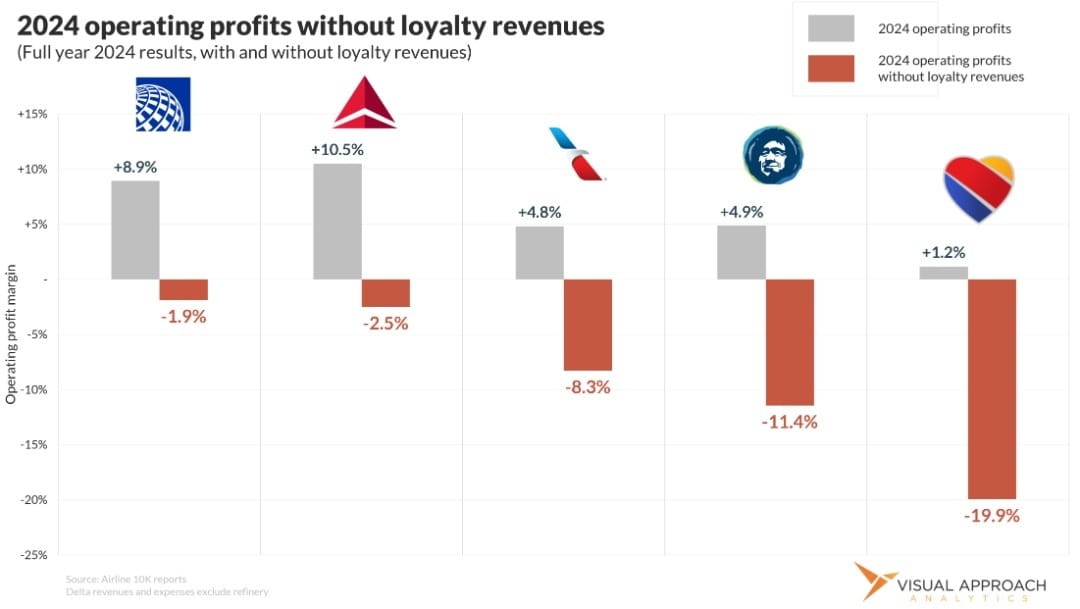

Another analysis looked back on the 2024 U.S. airline profitability (or lack thereof) sans revenue from credit card and loyalty programs. The trend is not new, but indeed squeezes some of those airlines without access to the lucrative alliance-wide networks of the big carriers. High credit card interchange fees in the U.S. enable this dynamic, which is not available in all parts of the world. This advantage is so complete that airlines can become profitable through the printing and spending (and inflating) of their own currencies, ultimately backed by interchange fees.

There is no sign of this dynamic changing in 2026 (or ever, probably).

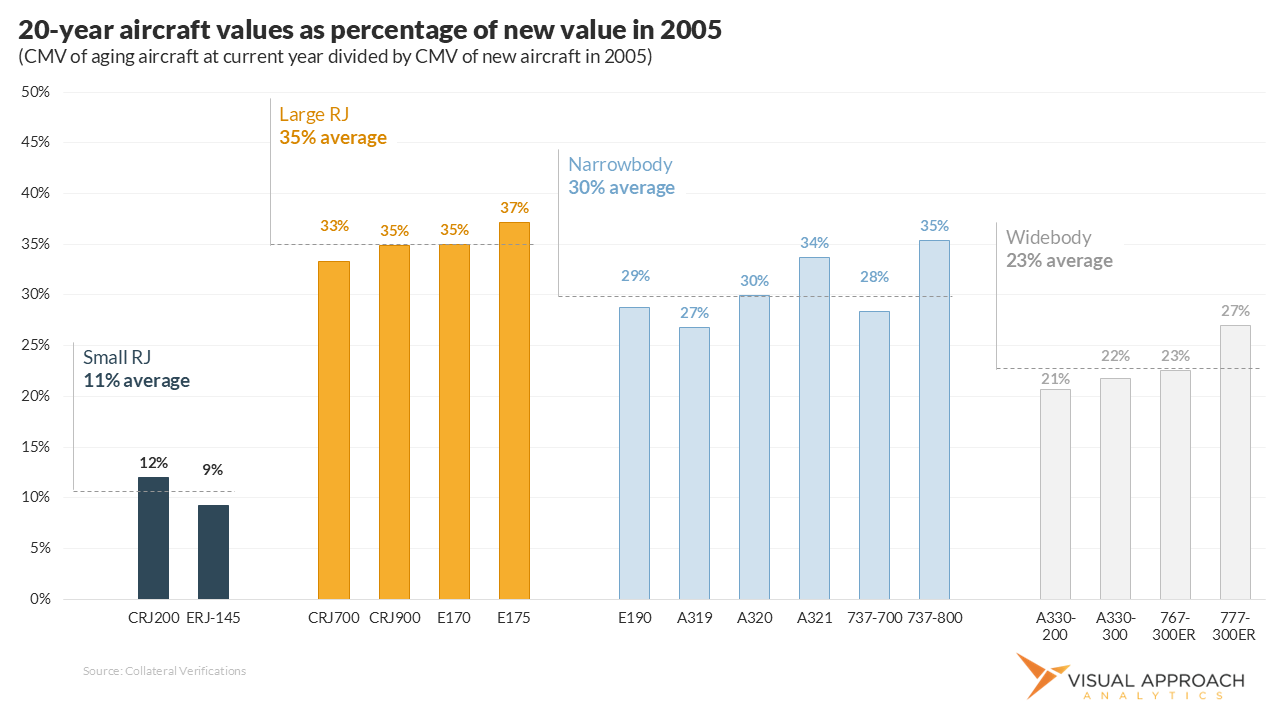

We partnered with Falko to publish several analyses throughout the year, focusing on the regional jet market. The myth that regional jets don’t hold value was quite simple to dispel. The key is in understanding the completely different dynamics of the large regional jets from the small, driven by a unique North American history. Long story short, the large narrowbody has retained its value better than any other class of aircraft, including the narrowbody.

Our “missing the forest from the solar breeze” moment goes to our recent analysis of the JetBlue A320 upset, originally blamed on solar flares that didn’t happen. While an entire industry of space enthusiasts saw a nail for which they finally had an excuse to use their hammer, the point was missed.

If you’ll remember, flight control software on the A320 family was updated earlier this fall. This new software update was susceptible to outside interference, which ultimately caused a JetBlue A320 to nose over at altitude, injuring 15 people. The answer to the problem was simply to reload the old software, which included age-old protection against this interference.

Meanwhile, the debate raged on the what type of particle or wave flipped a bit, while completely ignoring the fact that the interference wasn’t new - the software was.

We consider the debate over which type of interference exposed the software flaw as useful as debating which species of bird hit the Ethiopian 737 MAX angle-of-attack vane in 2019. It may have been interesting to an ornithologist, but the problem wasn’t the bird; it was the software that subsequently pointed the airplane toward the ground.

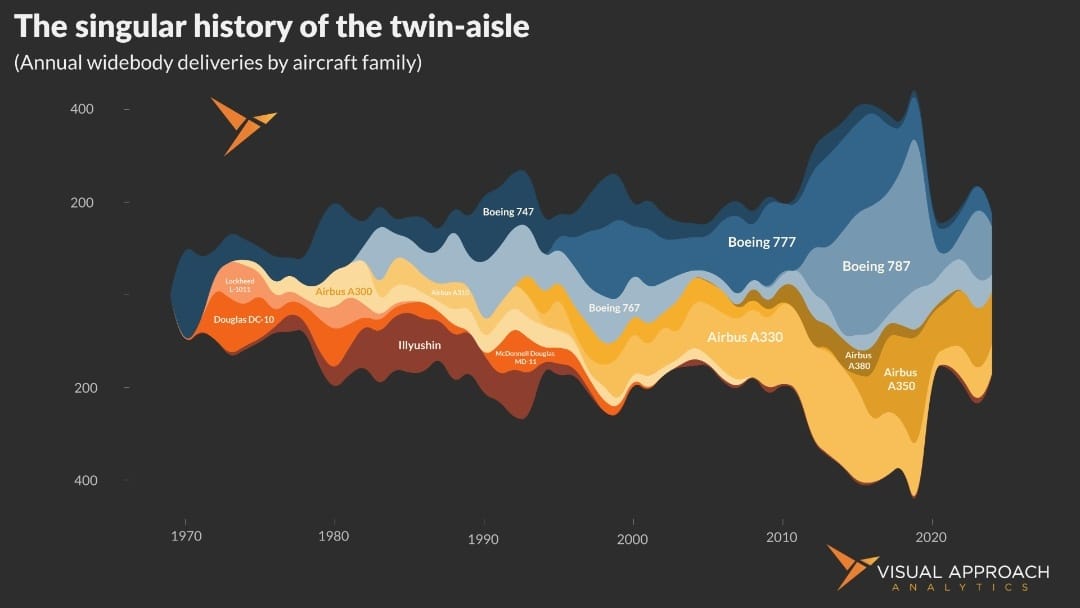

Finally, we end with the chart that took the longest time to complete - the animated history of the narrowbody.

This simple group of line charts was very programming-intensive. While most of our time is usually spent in Python, this lovely beast found us working in JavaScript - the mostest ugliest programming language ever, as voted by 100% of the authors of this newsletter.

You can watch the anything-but-effortless movement of the chart through 62 years of narrowbody jet production below:

So ends 2025, and our sixth year as Visual Approach Analytics. For some reason, we continue to be compensated for our research and contrarian data analysis, and for that, we are very thankful.

The year was completed with 52 newsletters sent, 12 Aircraft Intelligence Monthly reports showcasing 72 individual market analyses. We launched our slide library this year, allowing subscribers to search and access our full-page charts. And we conducted dozens of bespoke research decks for those of you who wanted a little secret sauce.

We handed out 13 network planning awards to North and Latin American airlines at the Cranky Network Awards. We launched the Cranky Confab for that Chatham House rule discussion with airlines before the awards were celebrated. Over 250 individual analyses and charts were created as part of Cranky Network Weekly this year, distributed to airlines and investors around the world.

Finally, this newsletter saw another 52 analyses published, all for the low-low price of nothing, and we kept our weekly streak alive. We finished the year with our favorite newsletter statistic: a 53% open rate.

You keep reading, we’ll keep creating.

At final tally, we built over 600 new charts and slides throughout 2025, including over 200 bespoke charts you don’t get to see. 2025 was a busy year.

Now, if you’ll excuse us, we have to get started on the next 600 for 2026.

Happy New Year

Time on Wing Podcast Guest - Aaron Prothero

Our latest podcast welcomes Aaron Prothero from Aerolease Aviation. We discuss a lot of things, including the A330, 757, and 777, and whether the market is currently frothy (spoiler alert: it is).

We always have some of the best conversations with Aaron. If you're looking for good marketing speak, for following messaging guidelines, and for avoiding strong opinions about the market, this podcast is not for you.

On the other hand...

If you're interested in a truly authentic conversation on how contrarians view the market, you're in for a treat.

If you don't know Aaron, you will. Just give it time.

In the meantime, finish 2025 strong with this latest Time on Wing podcast with Aaron Prothero:

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact